The next article is an op-ed by João Victor Alves Souza from Boletim Bitcoin.

Stablecoins have exploded in reputation in recent times together with the broader digital asset market. Notably, the stablecoin market is gaining prominence in rising economies, equivalent to Brazil and different Latin American nations.

Notably, Greenback Tether, USD Coin and different stablecoins are selling a form of silent dollarization within the Brazilian economic system. Statistics on the adoption of stablecoins within the area reveal a rising curiosity in dollar-backed tokens.

Brazil and hyperinflation

Brazil and Latin American nations on the whole have a protracted historical past of inflationary crises. The nation skilled a number of many years of excessive inflation and hyperinflation through the twentieth century.

Due to this, funding in actual property, gold and {dollars} grew to become widespread over time. Brazil’s financial scenario was stabilized by the Actual Plan, which was applied in 1994.

Nonetheless, the danger of hyperinflation has as soon as once more plagued the Brazilian economic system. In only one 12 months, the Brazilian actual fell by round 25% towards the US greenback.

Dollarization through stablecoins

Stablecoins are actually one of the helpful devices in the complete cryptocurrency market. No surprise the sector’s market worth now exceeds greater than US$200 billion.

Notably, greenback stables have been more and more sought out by Brazilians and Latin Individuals on the whole.

Knowledge from the Brazilian Federal Income Service confirmed that in July 2024, 4.1 million people registered transactions with digital belongings. Notably, Greenback Tether transactions symbolize greater than 90% of the quantity traded by Brazilians.

A Triple-A survey from Might 2024 discovered that 26 million Brazilians invested within the digital asset market. This determine represents round 7.8% of the nation’s inhabitants.

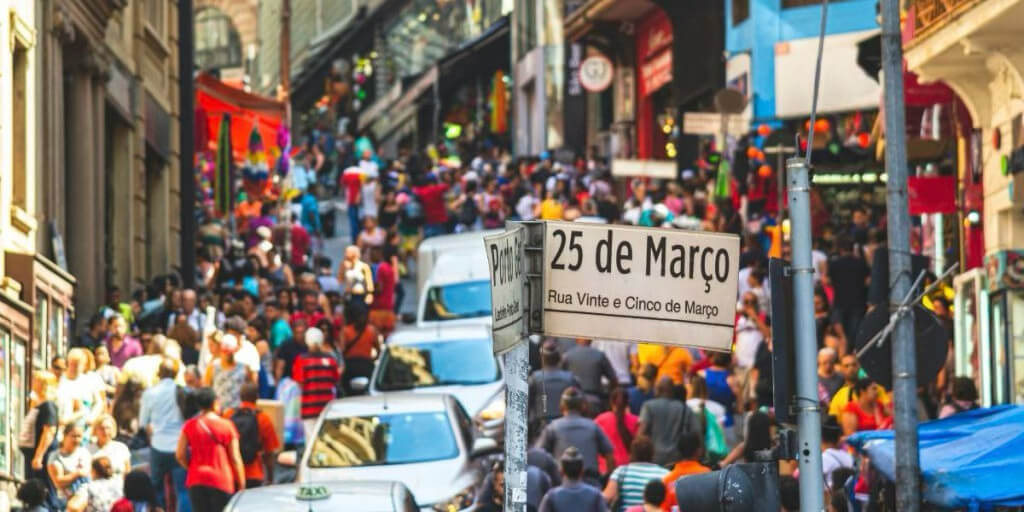

As well as, curious instances of adoption have emerged in recent times. A number of stories point out that greenback stablecoins have been used to commerce at 25 de Março, Brazil’s largest avenue mall, positioned in São Paulo.

This nice adoption of the Brazilian market has even been observed by Polo Ardoino, CEO of Tether Restricted:

“Within the first quarter of 2023, USDT dominated cryptocurrency and stablecoin transactions in Brazil, with a complete of 37.1 billion reais, which represents 81% of the full worth traded in cryptocurrencies and stablecoins via the primary quarter.”

“Whereas Brazilian banks are nonetheless trusted as protected havens for cash, there’s a rising market of residents utilizing USDT for fast and easy accessibility to the monetary system. That’s why partnerships like SmartPay’s with Tether, which permits USDT entry at greater than 24,000 ATMs throughout the nation, are so vital for residents preferring to make use of Tether tokens through Pix to pay their payments or items and providers.”

Notably, the adoption of stables in rising markets is very optimistic for the US economic system. It’s because greenback stables are predominantly backed by US authorities bonds. On this manner, they’re serving to to monetize US federal authorities debt.

On the identical time, the adoption of stables is contributing to the deterioration of the nationwide foreign money. It’s because many Brazilians proceed to alternate the native foreign money for digital {dollars}, which tends to affect the broader foreign exchange market.

This text was initially revealed by the Brazilian cryptocurrency firm Coinext.