This can be a phase from the 0xResearch e-newsletter. To learn full editions, subscribe.

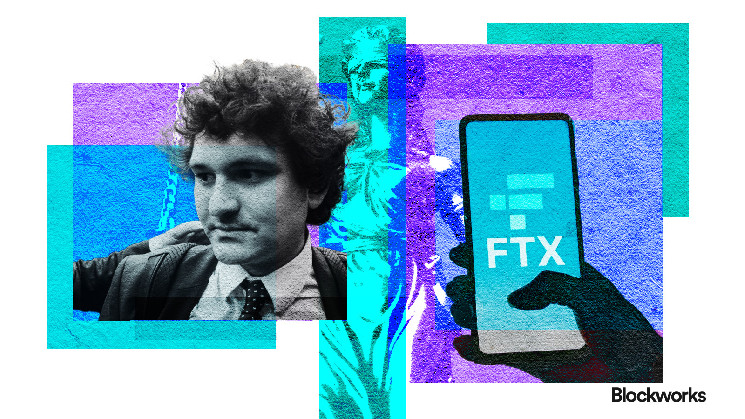

Immediately marks two years for the reason that eventful day FTX filed for chapter. Sam Bankman-Fried is in jail for 25 years, Ryan Salame likewise for 7.5 years, Caroline Ellison simply commenced a two-year jail time period and the FTX chapter property is making progress.

Although the story was extensively publicized throughout mainstream media as a colossal failure of crypto writ giant, that was by no means really true. The particular areas of failure within the FTX debacle had been in reality the sorts of centralized establishments that cryptocurrency was designed to upend.

Recall the commingling of funds — about $14.6 billion of FTX’s native FTT token — between FTX and its buying and selling arm, Alameda Analysis. When the worth of FTT plummeted, Alameda’s loans that had been borrowed towards FTT successfully fell underwater.

On the identical time, Alameda additionally held an impressive mortgage of 20 million MIM (the stablecoin of Abracadabra protocol) towards $5 million FTT.

Alameda totally paid that debt as FTT cratered on Nov. 9 — two days earlier than FTX filed chapter — to keep away from computerized good contract liquidations. In sum, DeFi labored.

Immediately, Abracadabra appears to be just about lifeless. Its MIM stablecoin nonetheless has a market cap of about $44 million, however hasn’t seen any development since FTX’s collapse.

Abracadabra’s founder, the notorious Daniele Sesta, has apparently moved on from his as soon as fashionable “Frog Nation” cult to…memecoins on the Sonic (beforehand Fantom) chain. The Abracadabra-affiliated challenge Wonderland, which at one level handed greater than $2 billion in TVL, was additionally stealth-rebranded right into a lending protocol, Volta, in late 2023. The transfer occurred after the challenge was scandalized with information that its pseudonymous treasury supervisor turned out to be Michael Patryn, the beforehand convicted co-founder of the failed Canadian crypto alternate QuadrigaCX.

Immediately, Abracadabra and Wonderland have turned out to be simply one other collection of ghost initiatives within the ethereal graveyard of crypto’s historical past.

When FTX collapsed, there have been issues that Binance would successfully monopolize the centralized crypto alternate market. At the moment, its BUSD stablecoin was the third largest, and BNB Chain was additionally the second largest L1 by TVL.

Immediately, Binance retains its place as the most important world cryptocurrency alternate, however fears of a “monopoly” haven’t come to move.

The BUSD stablecoin was deprecated after the New York Division of Monetary Providers (NYDFS) ordered its closure in February 2023. Binance then switched to a little bit recognized stablecoin, FDUSD, for stablecoin liquidity on its alternate, which has seen development from $350 million to about $2.3 billion immediately.

As for BNB Chain, it’s nonetheless fourth by TVL, overtaken solely by Solana’s meteoric rise previously yr.

Underneath FTX Ventures, SBF was additionally a significant investor in dozens of crypto initiatives. A few of these included LayerZero, Yuga Labs, Close to, in addition to MoveVM chains like Aptos and Sui — whose mainnets weren’t but launched — and naturally, Solana.

FTX’s giant token holdings forged a looming shadow over the way forward for these initiatives. Immediately, most of those initiatives appear to be doing simply fantastic.

Lastly, a post-FTX crypto trade shortly consolidated round the usual of “proof of reserves” at least safety customary for centralized crypto product choices, as seen in newer efforts like Coinbase’s cbBTC or Kraken’s annual audits.

The failure of FTX undoubtedly set the trade again. However two years out, it looks like crypto has a minimum of realized a couple of classes.