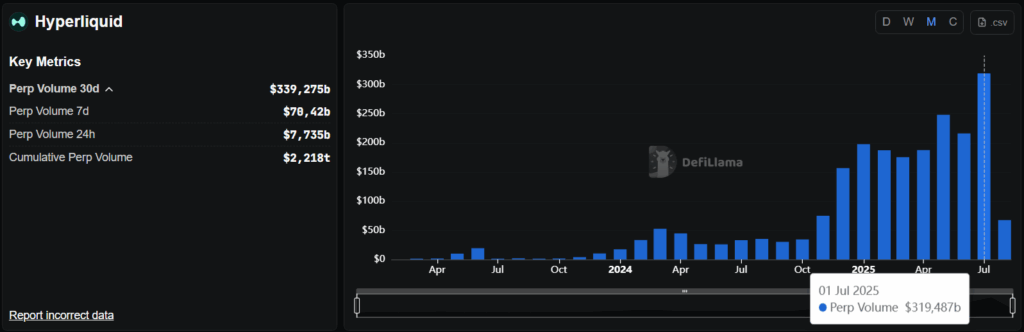

$319 billion in quantity traded in simply 31 days: that is the brand new file set by Hyperliquid in July 2025.

How did it break the Hyperliquid file in July 2024?

Hyperliquid, the DeFi platform specialised in perpetual futures, recorded a historic quantity excessive in July 2025, reaching $319 billion, in response to DefiLlama information. This determine represents absolutely the peak not solely amongst DEXs however in your complete world of DeFi for derivatives. The rising choice of customers in the direction of decentralized exchanges over conventional centralized platforms (CEX) is now evident.

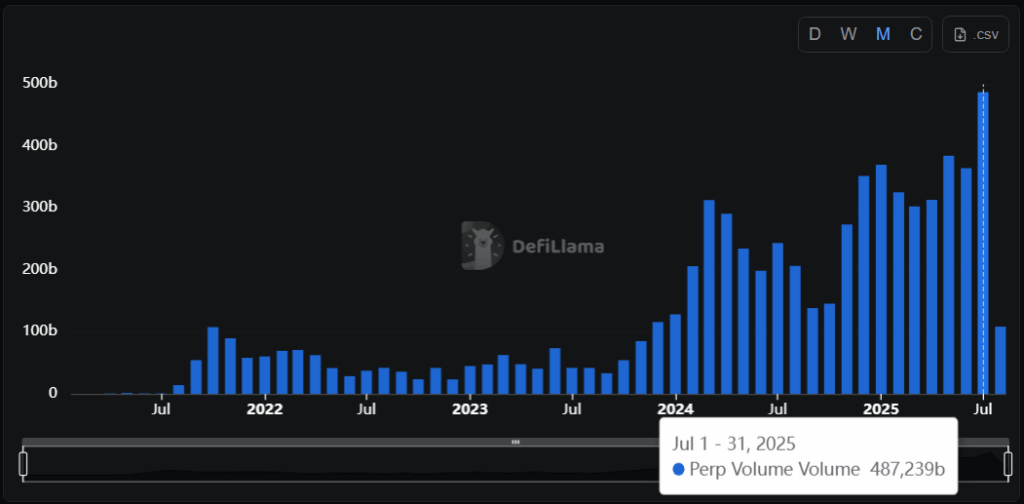

Based on the DefiLlama information, the full quantity on all DeFi platforms for perpetual futures rose to $487 billion within the month, a pointy enhance in comparison with $364 billion in June 2025.

What number of customers are energetic on Hyperliquid? Steady progress and neighborhood

Not solely volumes: the person base of Hyperliquid can also be rising at a sustained tempo. In July, the full customers exceeded 604,400, in comparison with the 488,000 recorded two months earlier. This information consolidates Hyperliquid because the seventh largest derivatives change on the planet each day, surpassing many historic platforms of world decentralized finance.

What differentiates Hyperliquid from different DEX?

The success of Hyperliquid was not born by likelihood. The platform has stood out since April 2024 with some essential selections: introduction of spot buying and selling, an aggressive itemizing technique able to attracting speculators on new cash, and a easy and accessible person interface.

Moreover, the neighborhood has acknowledged the platform as one of the fast in dealing with emergencies. On July 29, an interruption of about 37 minutes quickly blocked the merchants, however Hyperliquid promptly reimbursed $2 million to the affected customers. The transparency and timeliness in dealing with the difficulty have elevated belief within the protocol.

The rise of Hyperliquid displays the transformation of the crypto ecosystem: belief in decentralized programs is rising, whereas centralized platforms are shedding market share. In July, Hyperliquid captured 35% of the revenues of all blockchains, “snatching” worth from giants like Solana, Ethereum and BNB Chain in response to the month-to-month report by VanEck.

Different DeFi platforms for perpetual futures, similar to EdgeX (second with $21 billion in quantity in July) and MYX Finance (third with over $9 billion), stay distant from the brand new management of Hyperliquid.

What are the dangers and alternatives for merchants?

The exploit of Hyperliquid brings new life to the competitors amongst DEX, however not with out dangers. The rise in volumes and customers entails better infrastructural stress: the current interruption is proof of this. Nevertheless, the readiness in fast reimbursements (2 million {dollars} returned in lower than 24 hours) exhibits an aggressive and sensible repute technique.

For individuals who function on Hyperliquid or are contemplating coming into, it’s important to grasp that DeFi isn’t risk-free. Success attracts consideration, but additionally makes an attempt of assault, bugs, and system overload.

The way to take part and what to watch within the coming months?

The Hyperliquid platform has confirmed to be open and responsive in the direction of its neighborhood. Registering and beginning to commerce is easy, because of the intuitive interface launched in April 2024. The expansion development of customers suggests future upgrades of itemizing and functionalities, along with the more and more fierce competitors with different DEX and CEX.

Those that comply with tasks like MYX Finance, EdgeX or the classics Solana, Ethereum ought to monitor quantity information and reliability ranges: the DeFi market share can change quickly.

What to anticipate: future eventualities and indicators from the market

The exploit of July 2024 tasks Hyperliquid among the many benchmarks of DeFi. The platform has demonstrated elasticity, innovation, and efficient disaster administration, as evidenced by the fast compensation post-interruption. It stays to be seen how the opposite platforms will react: the conflict of volumes is simply starting.

With an increasing neighborhood, a file share of ricavi blockchain and more and more superior options, the way forward for decentralized finance may revolve round leaders like Hyperliquid. The problem between decentralization and centralization is extra “liquid” than ever. Comply with the neighborhood to maintain up with the subsequent strikes of the large DeFi.