This weekend sees the scheduled launch date of Bitcoin Core model 30 (v30) and an extremely contentious second in Bitcoin’s historical past.

Though studies of alleged plans for a tough fork have circulated within the run-up to this controversial software program launch, it’s technically potential — albeit extremely unlikely — that Bitcoin may expertise a blockchain break up.

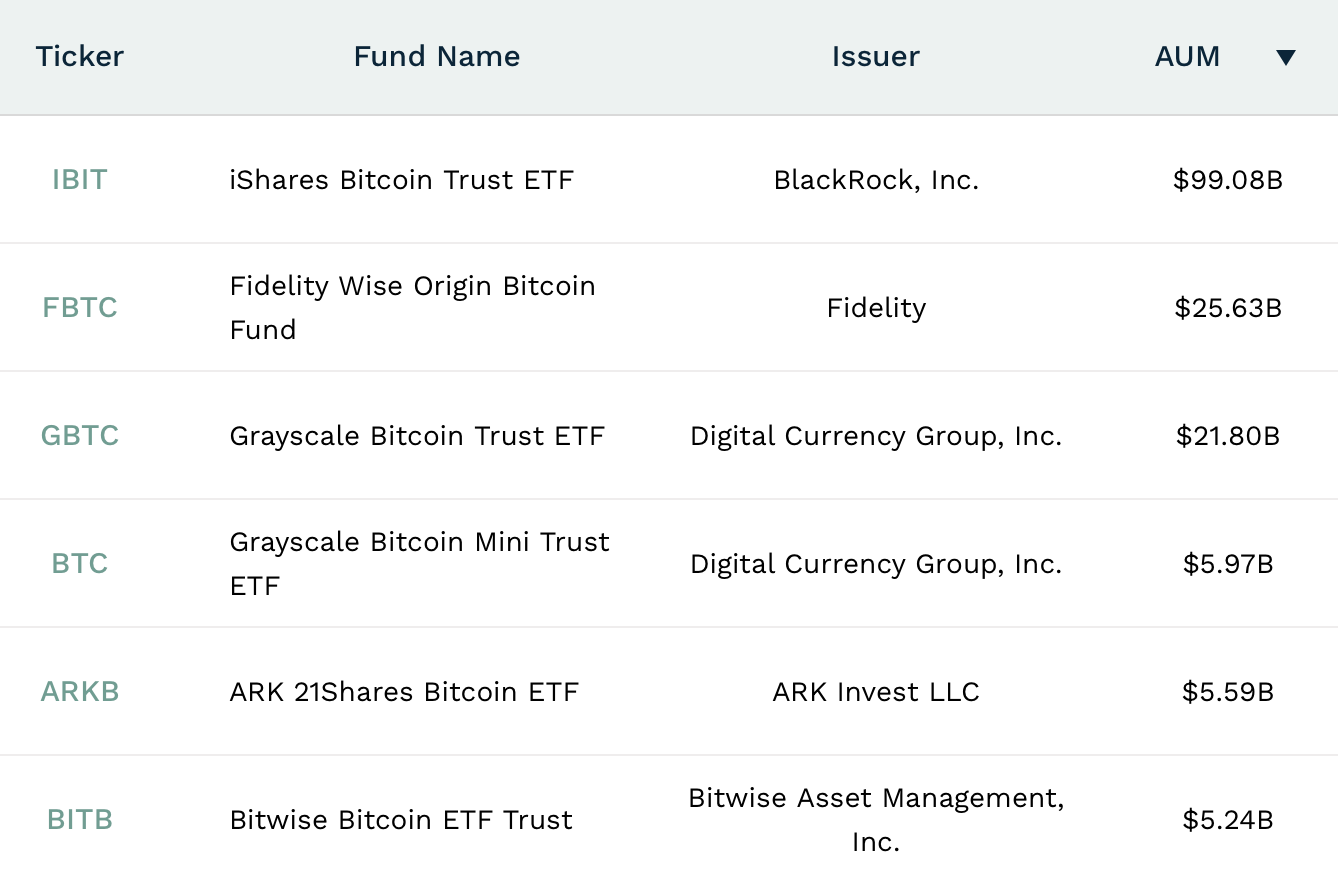

Within the occasion of a shock chain fork, the function of spot trade traded fund (ETF) sponsors in judging which chain will retain the bitcoin title and its BTC ticker image is underreported and poorly understood.

Regulatory filings for US-based BTC spot ETFs reveal that their sponsors have the discretion to decide on which Bitcoin fork they regard because the legitimate one within the occasion of a tough fork.

This upends the standard apply of letting miners or node operators resolve, which normally select the fork with probably the most processing energy because the legitimate Bitcoin chain.

The ability to decide on which bitcoin is bitcoin

BlackRock’s $87 billion IBIT prospectus states unambiguously, “Within the occasion of a tough fork of the Bitcoin Blockchain, the Sponsor shall decide which community shall represent the Bitcoin community and which asset shall represent bitcoin in accordance with the Belief Settlement.”

Elsewhere, Blackrock admits that it won’t even select the most important BTC as the true BTC. “There isn’t any assure that the Sponsor will select the community that’s the most precious fork,” its legal professionals disclaim.

Bitwise’s spot bitcoin ETF prospectus contains comparable language. “The sponsor will promptly make religion willpower as to which digital asset community is regarded by the neighborhood because the Bitcoin community and which is the ‘forked’ community.”

“Except an announcement is made informing traders {that a} fork will likely be supported, a newly-forked asset must be thought of ineligible for inclusion within the Belief,” disclaims ARK Funding Administration.

Along with the discretion to decide on which blockchain is the true Bitcoin, some spot ETF sponsors additionally reserve the fitting to ignore the worth of a tough forked blockchain completely for the needs of the ETF holdings.

“With respect to any fork, airdrop or comparable occasion, the sponsor will trigger the belief to irrevocably abandon the incidental rights,” disclaim each ARK Funding Administration and Grayscale.

“The one digital asset to be held by the belief will likely be BTC” because the ETF sponsor defines BTC.

Learn extra: Crypto reacts to SEC’s dramatic spot bitcoin ETF approvals

Intraday shopping for energy for the BTC they select

Within the case of ETFs, sponsors actively purchase and promote belongings on an trade all through every buying and selling day.

With a view to purchase and promote BTC, the sponsors should agree which asset is BTC. Highly effective, multi-billion greenback ETF sponsors will select, on a real-time foundation and with untold liquidity, which asset to buy for his or her ETFs throughout any chain fork state of affairs.

Any sharp observer with the persistence to learn regulatory filings has observed the discomforting actuality that spot ETF sponsors select with human discretion — not by mining hash energy or node depend — which fork of BTC is their actual BTC.

Spot ETF sponsors are a brand new echelon of energy, alongside BTC miners, with the privilege of figuring out which digital asset preserves the BTC ticker image and their huge funding flows.

As a comparatively new set of entities with this energy — launched solely because the Securities and Change Fee’s approval of spot ETFs in January 2024 — monetary establishments like Blackrock and Constancy maintain extraordinary energy over funding flows into the BTC that they choose as the true BTC.

Might Bitcoin Core v30 really trigger a series break up?

Core v30, if builders launch it on-time, will introduce three adjustments to the habits of Bitcoin nodes queueing up transactions for upcoming blocks.

For the primary time in over a decade, nodes will settle for BTC transactions into their mempool with a number of OP_RETURN outputs.

Second, the info dimension of those outputs could attain 100 kilobytes — 120,000% greater than their earlier 83 byte restrict.

Third, v30 software program will nerf the “datacarriersize=” operation of node operators who wish to filter out these giant chunks of information.

Importantly, none of those adjustments have an effect on the Nakamoto Consensus guidelines of nodes accepting validly mined transactions.

Core v30 will solely create variations between the mempools of pending transactions — not chain ideas — of node operators utilizing alternate software program shoppers like Knots, BTCD, or Core v29 and prior.

Because of this, the Bitcoin blockchain will virtually actually not fork this weekend. Sarcastic jokes in regards to the dying of BTC in the present day are incomes laughter throughout social media.

Nonetheless, the approaching launch of v30 is a useful reminder in regards to the energy of ETF sponsors if Bitcoin ever have been to arduous fork.