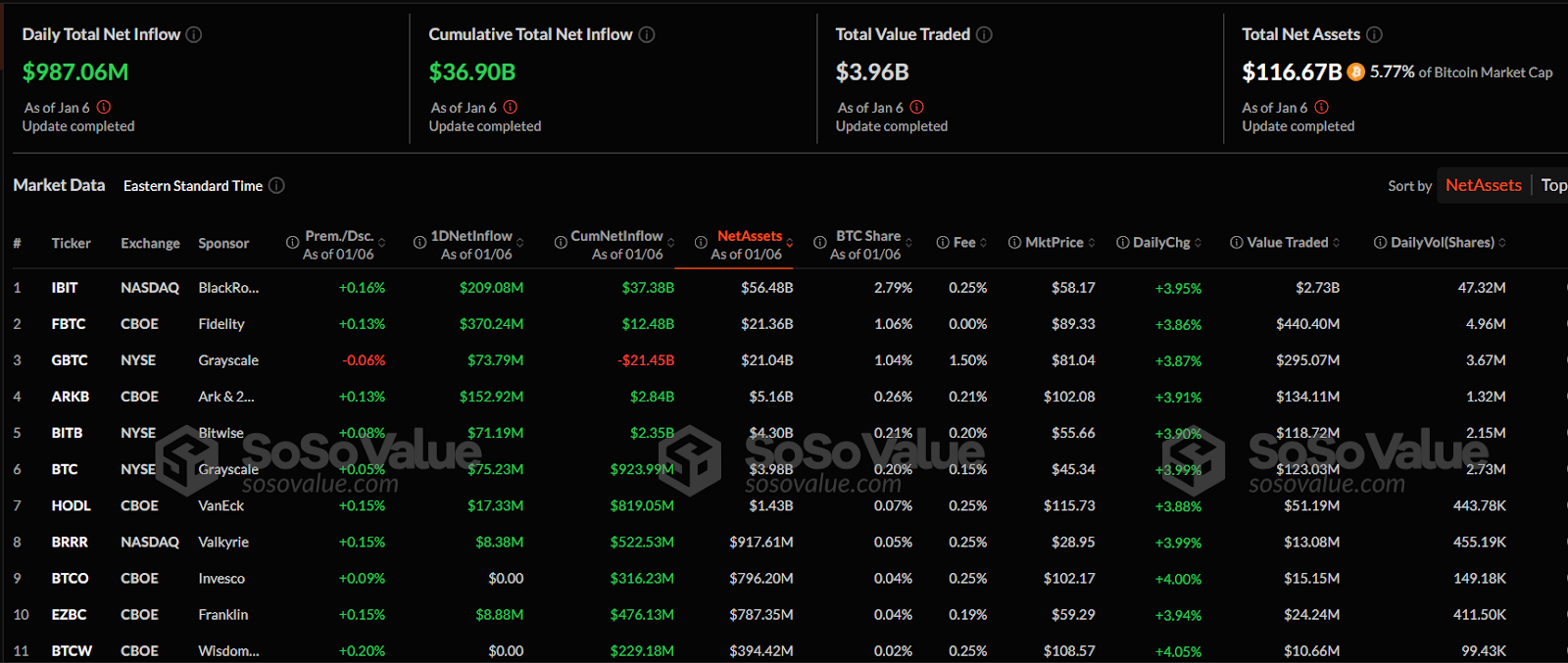

As of January 6, SoSoValue’s latest information replace signifies that the day by day web influx for Bitcoin ETFs reached $987.06 million, whereas the cumulative complete web influx was $36.90 billion. The overall worth traded stood at $3.96 billion, as the overall web belongings for ETFs amounted to $116.67 billion, representing 5.77% of BTC’s market cap.

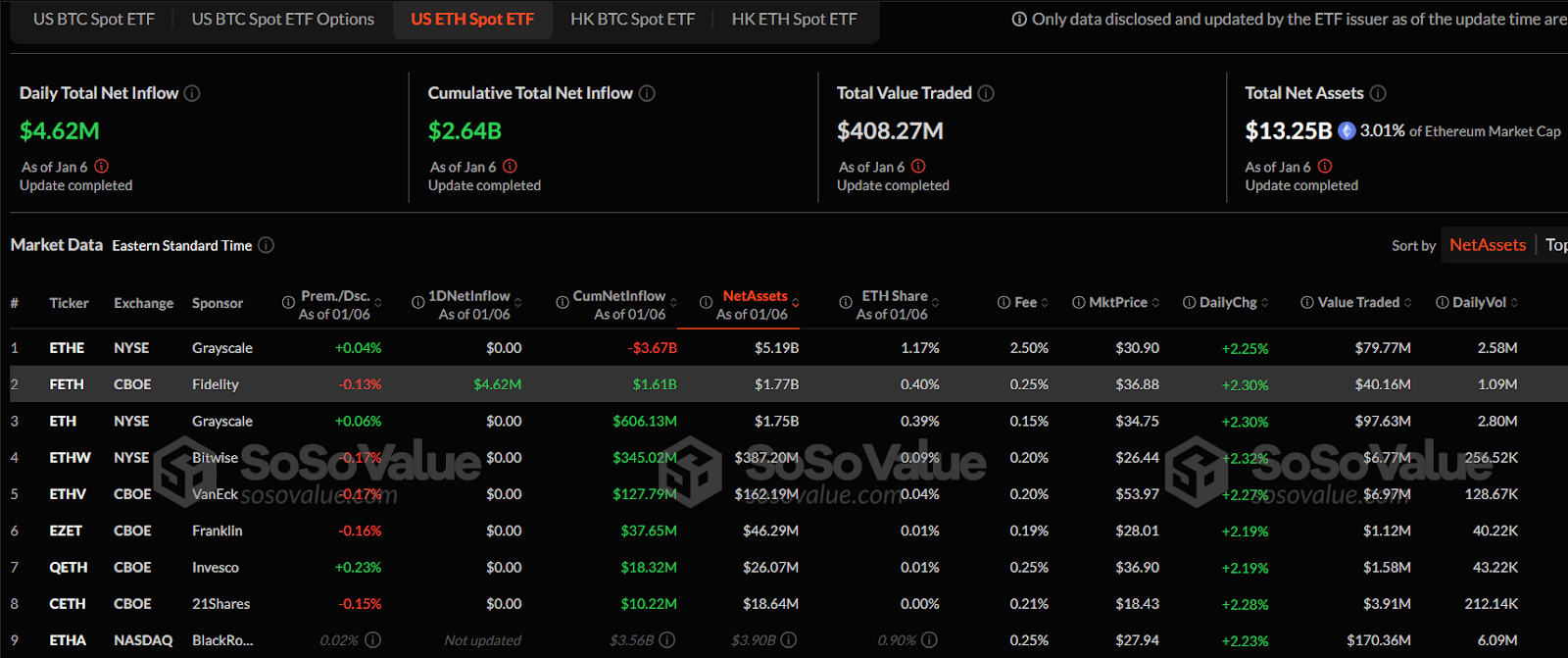

Alternatively, US Ethereum Spot ETF’s complete day by day web influx was recorded at $4.62 million. The cumulative complete web influx amounted to $2.64 billion, whereas the overall web belongings reached $13.25 billion. This accounts for 3.01% of Ethereum’s market capitalization, whereas the overall worth traded was $408.27 million.

FBTC ETF Hits $21.36B, Main with $370M Each day Influx

In an in depth view, the IBIT ETF listed on NASDAQ, sponsored by BlackRock, gained $56.48 billion in web belongings. The fund recorded a day by day web influx of $209.08 million and a cumulative web influx of $37.38 billion. Its market worth registered a day by day improve of +3.95%, buying and selling at $58.17 with low cost fee of +0.16%.

Supply: SoSoValue

FBTC ETF, sponsored by Constancy and listed on the CBOE change, recorded web belongings of $21.36 billion. It skilled a day by day web influx of $370.24 million, contributing to a cumulative web influx of $12.48 billion. The fund’s market worth rose by +3.86% to $89.33, with a reduction fee of +0.13%. Its day by day buying and selling quantity was 4.96 million shares, translating to a traded worth of $440.40 million.

Whereas GBTC ETF reported $21.04B in belongings, a +3.87% worth rise, and a $73.79M day by day influx regardless of -$21.45B cumulative inflows, ARKB ETF achieved $5.16B in belongings with a $152.92M day by day influx. BITB ETF recorded $4.30B in belongings, a $71.19M day by day influx, and a $2.35B cumulative influx.

BTC ETF, additionally sponsored by Grayscale, confirmed web belongings totaling $3.98 billion with a cumulative influx of $223.99 million. It recorded a day by day influx of $75.23 million and a worth change of +3.99%. Its market worth was $45.34, with a premium/low cost fee of +0.05%. The day by day quantity for BTC ETF was 2.73 million shares, and its traded worth stood at $123.03 million.

BRRR, BTCO, EZBC, and BTCW ETFs Report Sturdy Worth Features As much as 4.05%

The BRRR ETF, listed on NASDAQ and sponsored by Valkyrie, achieved web belongings of $917.61 million. It recorded a day by day influx of $8.38 million, with a cumulative influx of $522.53 million. BRRR’s market worth elevated by +3.99%. Alternatively, the BTCO ETF, listed on CBOE and sponsored by Invesco, reported web belongings of $796.20 million, attaining a day by day influx of $316.23 million, with a cumulative influx of $796.20 million.

EZBC ETF, sponsored by Franklin, registered $787.35 million in web belongings and a cumulative influx of $476.13 million. It recorded zero day by day inflows however displayed a worth change of +3.94%, buying and selling at $59.29. BTCW ETF, funded by WisdomTree and listed on CBOE, recorded $394.42 million in web belongings. It earned a cumulative influx of $229.18 million with no day by day inflows. BTCW’s market worth elevated by +4.05% to $108.57, with a premium fee of 0.00%.

Ethereum ETFs Shine Brilliant: Can They Outpace BTC Development?

Ethereum-sponsored ETFs weren’t left behind, as SoSoValue notes that ETHE ETF, listed on NYSE and sponsored by Grayscale, reported $5.19 billion in web belongings. The fund registered no day by day inflows, with a cumulative web influx of -$3.67 billion. Its market worth rose by +2.25%, buying and selling at $30.90 with a reduction fee of +0.04%. The day by day buying and selling quantity reached 2.58 million shares, with a worth traded of $79.77 million.

Supply: SoSoValue

A deeper evaluation signifies that FETH ETF, listed on CBOE and sponsored by Constancy, recorded web belongings of $1.77 billion. It reported a day by day web influx of $4.62 million, contributing to a cumulative web influx of $1.61 billion. Its market worth elevated by +2.30%, reaching $36.88, with a premium/low cost fee of −0.13%. The day by day buying and selling quantity was 1.09 million shares, translating to a traded worth of $40.16 million.

Ethereum ETFs Blended Development: Rising Costs, No Each day Inflows

The ETH ETF, additionally sponsored by Grayscale and listed on the NYSE, had web belongings of $1.75 billion. It recorded no day by day inflows, with a cumulative web influx of $606.13 million. Its market worth elevated by +2.30%, buying and selling at $34.75 with a premium/low cost fee of +0.06%. The day by day buying and selling quantity was 2.80 million shares, with a worth traded of $97.63 million.

The ETHW ETF, sponsored by Bitwise, reported $387.20M in belongings and a +2.32% worth rise, buying and selling at $26.44. The ETHV ETF by VanEck recorded $162.19M in belongings and a +2.27% worth improve to $53.97. Each ETFs had no day by day inflows, with buying and selling volumes of 256.52K and 128.67K shares, respectively.

The EZET ETF, sponsored by Franklin and listed on CBOE, had web belongings of $46.29 million. It recorded no day by day inflows, with a cumulative web influx of $37.65 million. Its market worth elevated by +2.19% to $28.01, with a premium fee of −0.16%. The day by day buying and selling quantity stood at 40.22K shares, valued at $1.12 million.

The QETH ETF, sponsored by Invesco and listed on CBOE, reported $26.07 million in web belongings. It recorded no day by day inflows, with a cumulative web influx of $18.32 million. Its market worth elevated by +2.26% to $28.01, with a premium fee of +0.23%.

ETHA ETF, sponsored by BlackRock, reported $18.64 million in web belongings. It recorded no day by day inflows, with a cumulative web influx of $10.22 million. Its market worth rose by +2.23%, buying and selling at $27.94 with a premium/low cost fee of 0.02%. The day by day buying and selling quantity reached 212.14K shares, with a worth traded of $3.91 million.