- The L1 undertaking burns over 6.7M tokens in its first group buyback.

- The initiative goals to reward lively community contributors.

- One other buyback is slated for November, strengthening Injective’s deflationary mechanism.

Injective has taken it to X to substantiate the completion of its first community-led token buyback, which began on October 23, marking a key step within the L1’s deflationary mannequin.

The crew revealed that the occasion burned 6.78 million INJ cash, price roughly $32.28 million.

The primary $INJ Group BuyBack is now formally full!

Injective is the one chain the place token buybacks immediately reward the group.

1. INJ is burned eternally

2. The group earns from a reward pool for his or her contributionsKeep tuned for the subsequent burn in November 🔥 pic.twitter.com/5KUiMDiyaI

— Injective 🥷 (@injective) October 29, 2025

The strategic initiative units Injective aside from most blockchain initiatives, making asset buybacks a community-driven occasion.

Quite than the inspiration or crew repurchasing tokens and burning them privately, Injective prioritizes consumer participation.

The layer 1 community creates a system that merges deflation with group incentives.

Such an strategy ensures that lively community contributors profit from Injective’s ecosystem growth, aligning rewards between INJ holders, merchants, and builders.

The announcement learn:

Injective is the one chain the place token buybacks immediately reward the group.

Notably, Injective opened the primary group buyback occasion for the general public on October 23, with the precise repurchase and token burn occurring after every week, on October 27.

Injective’s distinctive buyback technique

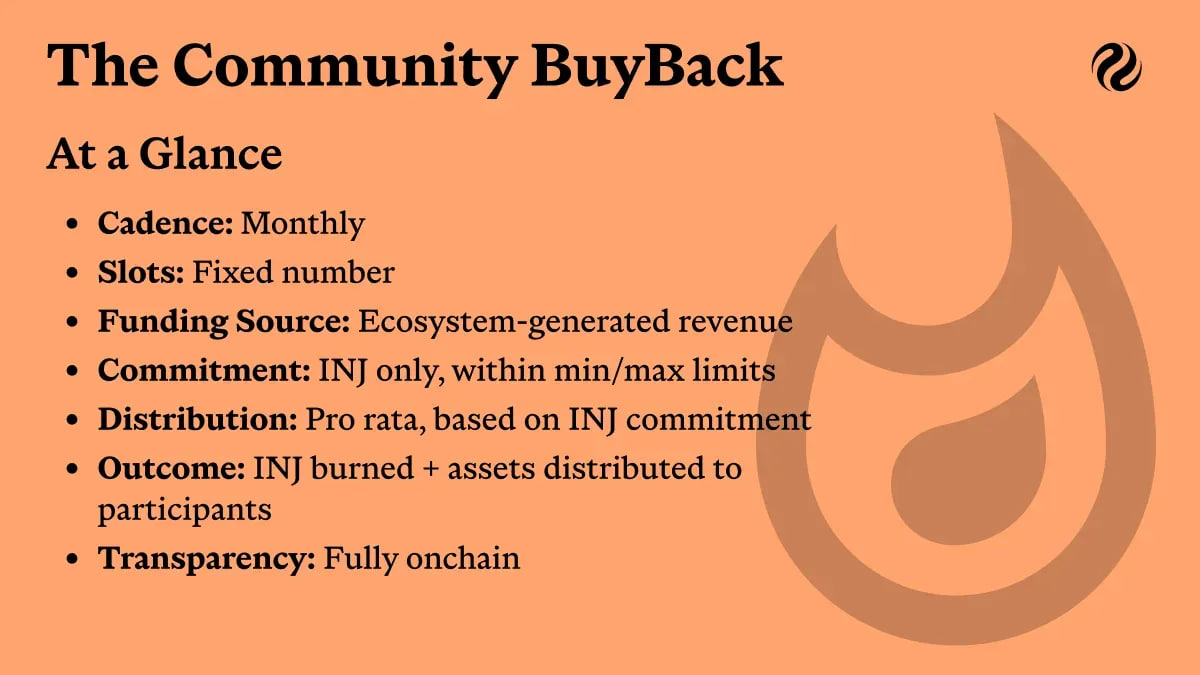

Injective’s group buyback mechanism adopts two highly effective but easy methods.

At first, the platform completely burns native tokens to scale back the general provide.

Secondly, it distributes a few of the worth to reward customers who contribute to the INJ’s ecosystem.

Based on the official weblog:

The Group BuyBack is a month-to-month on-chain occasion that enables anybody to participate in Injective’s deflationary mechanism. Members commit INJ, and in return obtain a professional rata share of the income generated throughout the Injective ecosystem. The INJ exchanged is then completely burned, lowering the whole provide of INJ.

Notably, the Group BuyBack basket contains numerous tokens, together with USDT and INJ, valued at 10,000 Injective tokens.

That design introduces a strong deflationary mannequin, whereas incentivizing loyal customers.

Injective maintains transparency, with all buyback data obtainable on the dashboard.

Adopting a deflationary financial system with a twist

Injective’s newest announcement is a part of its broader mission to construct a community-centered, sustainable token financial system.

By burning native tokens each month, the undertaking goals to scale back INJ inflation whereas encouraging long-term holding.

Most initiatives throughout the decentralized finance sector are embracing such mechanisms.

Nonetheless, Injective has added a big twist, involving its customers within the course of.

Apart from strengthening belief, such an strategy retains INJ holders engaged within the ecosystem’s progress.

Additionally, holders will profit from shortage as each buyback reduces the circulating asset provide completely.

The subsequent burn will occur subsequent month, in November.

INJ worth outlook

The native token remained comparatively muted over the previous 24 hours, as bears moved the broader market.

INJ is buying and selling at $8.66. It has consolidated between $9 and $8 over the earlier week, gaining over 3% in that timeframe.

Its day by day buying and selling quantity has elevated by 17%, signaling renewed optimism, seemingly following the buyback announcement.

Nonetheless, broad market sentiments will affect the altcoin’s worth trajectory within the coming classes.