In response to Sean Invoice, chief funding officer at BSTR, just a few corporations will in the end stand out within the bitcoin treasury area—and he’s putting his guess on Bitcoin Commonplace Treasury Firm (BSTR) to be considered one of them.

BSTR’s Aggressive Bitcoin Accumulation and Dormant Reserve Technique

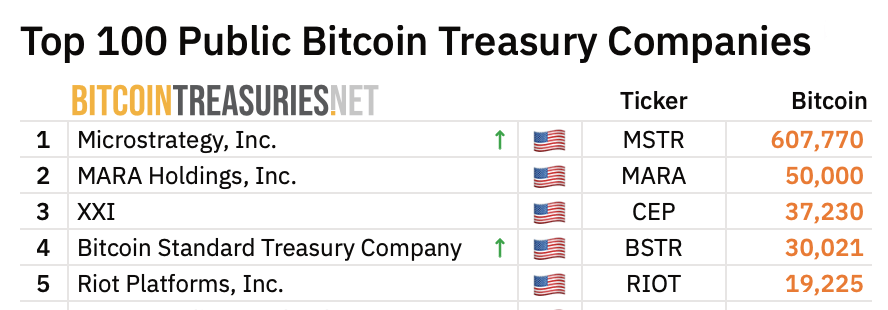

Simply final week, BSTR kicked issues off with a stash of greater than 30,000 bitcoins. Knowledge from bitcointreasuries.internet exhibits BSTR now ranks because the fourth-largest holder of BTC amongst public company treasuries. On Tuesday, Sean Invoice shared insights into the corporate’s method on the Bloomberg Crypto present and defined what units their recreation plan aside.

Supply: bitcointreasuries.internet

Invoice argues that bitcoin goes far past being a mere guess on value—it has real-world utility. One instance, he says, is producing yield by utilizing bitcoin in monetary instruments like bitcoin revolvers, particularly with big-name establishments like Blackrock. He additionally highlights a more moderen use case: placing bitcoin up as collateral in insurance coverage markets.

Whereas this isn’t but widespread amongst conventional insurers, he factors to the Caribbean insurance coverage sector as an early adopter, the place bitcoin is already supporting coverage underwriting—a nook of the market he views as brimming with prospects.

Invoice additionally defined to the Bloomberg hosts that some monetary corporations have already begun accepting bitcoin as collateral for mortgages. Debtors can pledge their bitcoin, obtain upfront money, and safe the mortgage utilizing each the digital asset and the property—sometimes at a 50% loan-to-value ratio. Conventional finance (TradFi) establishments, he says, are nonetheless behind in adapting to this development.

When requested “Why does the market want extra bitcoin treasury corporations? Invoice mentioned, “I’d agree that just a few will in the end win right here. However we imagine BSTR will probably be considered one of them. We’re exhibiting up with a bulldozer and a allow to clear-cut bitcoin. We’re opening within the fourth spot, however we predict we’ll rapidly slingshot into quantity two. That’s our mission,” the BSTR CIO remarked.

The BSTR govt added:

“We will concern debt at 1%, purchase bitcoin, and as bitcoin appreciates, it naturally de-leverages our steadiness sheet. That’s a novel functionality accessible to bitcoin treasuries that the majority corporations don’t have.”

BSTR goals to be the best choice for corporations needing bitcoin liquidity or credit score. “Over time, we purpose to develop into the popular counterparty for monetary establishments. If a financial institution or finance agency wants a bitcoin revolver, we would like BSTR to be their first name,” he mentioned.

Towards the tip of the interview, Invoice highlights that a number of the earliest and most influential figures in Bitcoin’s historical past are backing their firm—together with Adam Again, whose Hashcash invention was immediately cited by Satoshi Nakamoto within the authentic Bitcoin white paper. He describes Again as “affected person zero” of the Bitcoin ecosystem, underscoring the depth of the agency’s connections.

He provides that these relationships give the corporate a strategic benefit in accessing important quantities of dormant bitcoin—holdings that aren’t presently on exchanges. With the precise community and method, Invoice mentioned he believes they will unlock this untapped provide.