The intersection of synthetic intelligence and blockchain expertise has emerged as a defining narrative within the present cryptocurrency bull market. Among the many varied initiatives combining these revolutionary applied sciences, IO.NET stands out as a distinguished pressure. This complete overview explores IO.NET’s infrastructure, IO tokenomics, and its potential as a long-term funding alternative.

IO.NET’s web site homepage shares its imaginative and prescient for an “Web of GPUs”

What’s IO.NET and How Does it Work?

IO.NET, launched in 2024 however based in 2022 by Ahmad Shadid, represents a groundbreaking strategy to decentralized computing. Now led by CEO Tory Inexperienced, the platform operates as a decentralized computing community that aggregates GPU assets from varied sources, successfully making a decentralized bodily infrastructure community (DePIN).

The platform addresses a number of important challenges in conventional AI growth:

- Restricted {Hardware} Availability: Conventional cloud companies usually have weeks-long ready intervals

- Restricted {Hardware} Choices: Customers face restricted selections concerning GPU specs and places

- Prohibitive Prices: Conventional AI computing assets can value lots of of hundreds of {dollars} month-to-month

Core Elements

IO.NET’s ecosystem revolves round two main parts:

IO Employee

This interface permits GPU house owners to contribute their computing energy to the community. By a user-friendly net utility, suppliers can simply monetize their idle GPU assets and earn IO tokens as rewards.

IO Cloud

Constructed on the Ray framework—the identical expertise powering OpenAI’s GPT-3 and GPT-4 coaching—IO Cloud offers customers entry to distributed computing assets. The platform options self-healing, totally meshed GPU techniques that guarantee excessive availability and fault tolerance, making it preferrred for Python-based machine studying workloads.

Enterprise Capital Backing and Funding Rounds

IO.NET has attracted important consideration from distinguished buyers within the blockchain house. In March 2024, the mission accomplished a $30 million Sequence A funding spherical led by Hack VC, with participation from:

- sixth Man Ventures

- Multicoin

- MH Ventures

- ArkStream

- Solana Labs

- Aptos Labs

- Foresight Ventures

Notable angel buyers included Solana founder Anatoly Yakovenko and Aptos founders Mo Shaikh and Avery Ching. This follows an earlier $10 million seed spherical, demonstrating sturdy institutional confidence within the mission.

Understanding the IO Token

The IO token serves as the first utility token inside the IO.NET ecosystem, constructed on the Solana blockchain. With a present market capitalization of roughly $245 million and a totally diluted valuation of $1.45 billion, the token performs a number of essential roles:

Token Utility

- Fee for GPU computing companies

- Rewards for computing energy suppliers

- Staking alternatives for community safety

- Decreased charges in comparison with USDC funds (0% vs 2%)

Tokenomics Overview

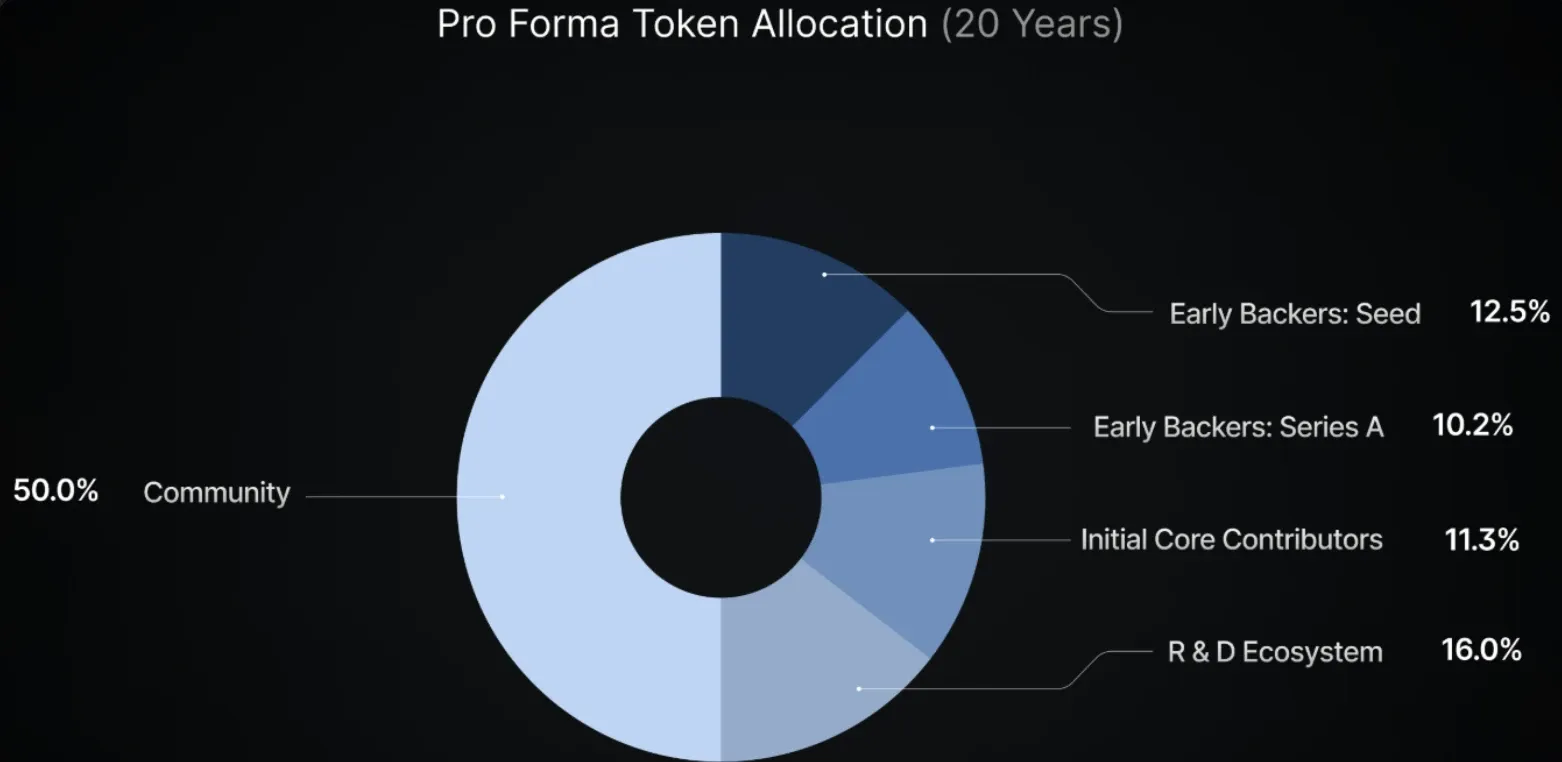

The IO token includes a most provide cap of 800 million tokens, with the next distribution:

- Seed Buyers: 12.5%

- Sequence A Buyers: 10.2%

- Core Contributors: 11.3%

- Analysis & Growth: 16%

- Ecosystem and Neighborhood: 50%

Particulars of IO’s allocations based on the mission’s docs

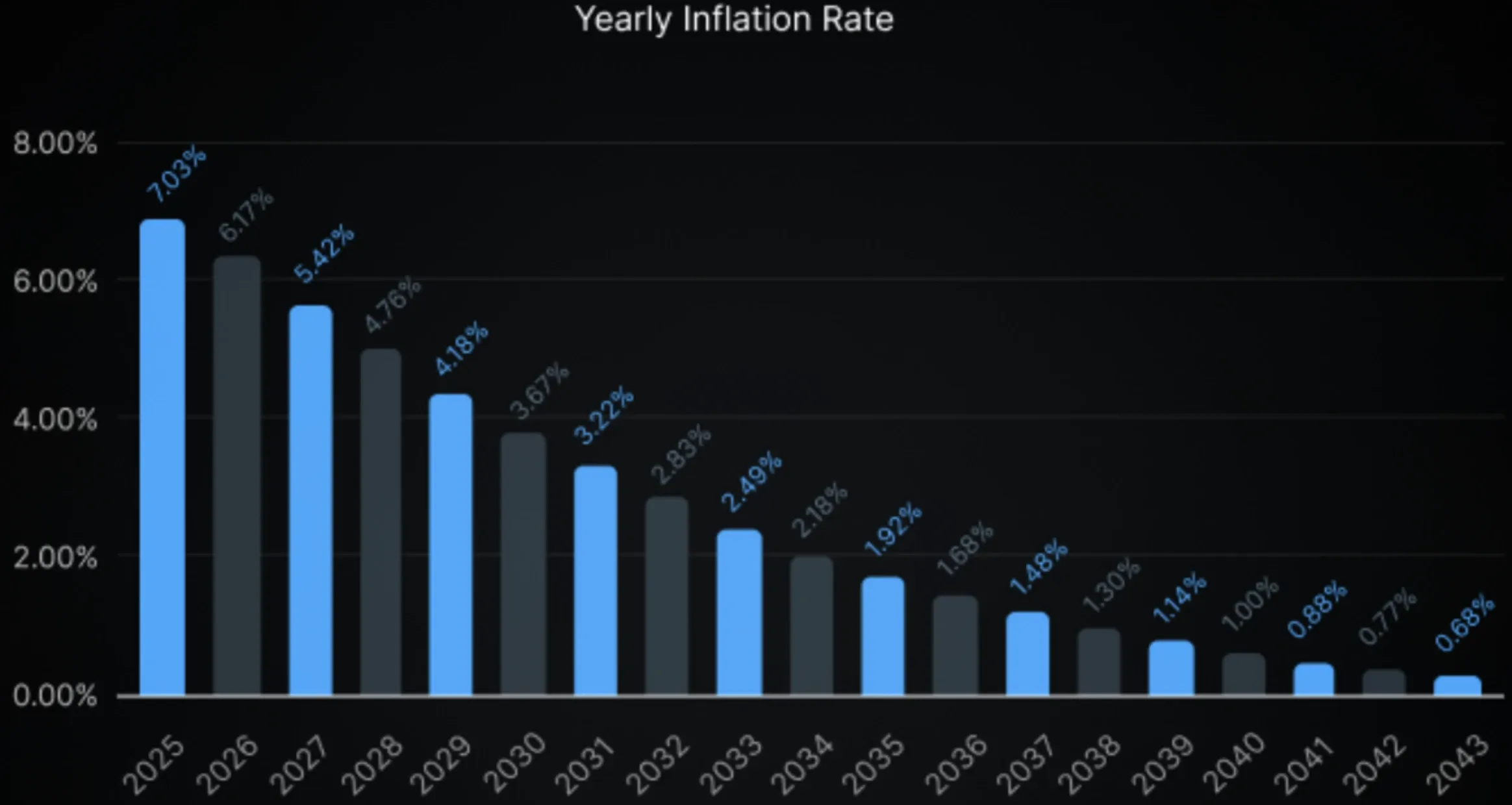

Token distribution follows a disinflationary mannequin over 20 years, with rewards distributed hourly to suppliers and stakers. A deflationary mechanism makes use of community revenues to buy and burn IO tokens, creating extra worth for holders.

Particulars of IO’s inflation price based on the mission’s docs

Latest Developments and Partnerships

IO.NET has demonstrated important progress in 2024, attaining a number of key milestones, based on its official report:

- Generated $18.4 million in annual community earnings

- Improved platform reliability to over 99% cluster stability

- Decreased cluster creation time to below 1.5 minutes

-

Secured partnerships with:

- Leonardo.ai and KREA for picture technology

- Zerebro within the AI agent sector

- Creator.Bid on Coinbase’s Base community

The platform has additionally proven sturdy group engagement, with 46 million social media impressions in October 2024 alone. The IO.NET partnership practice continues, nevertheless, just lately saying collaboration with the likes of Alpha Community and Nexus.

Lengthy-term Prospects: Alternatives and Dangers

Constructive Components

- Strategic positioning in high-growth sectors (AI, DePIN, and Solana ecosystem)

- Sturdy institutional backing and monetary assets

- Established market presence with progress potential

- Sturdy group assist

- Sustainable tokenomics with each deflationary and long-term distribution mechanisms

- Steady partnership and community growth

Danger Issues

- Potential market overvaluation within the Crypto AI sector

- Vital insider token allocations from VC funding

- Intense competitors within the decentralized AI computing house

- Dependence on sustained product adoption

- Inherent cryptocurrency market volatility

Closing Evaluation

IO.NET presents a compelling worth proposition within the rising decentralized AI computing sector. The mission’s sturdy institutional backing, technical infrastructure, and strategic positioning in high-growth markets counsel potential for long-term success. Nevertheless, buyers ought to fastidiously think about the related dangers, together with market volatility and competitors inside the sector.

As with every cryptocurrency funding, thorough due diligence is crucial, and buyers ought to solely commit capital they’ll afford to lose. Whereas IO.NET reveals promise, its final success will depend upon sustaining sustainable progress and attaining widespread adoption of its decentralized computing options.