Amid anti-government protests, Iran’s near-total web blackout in the present day has raised a quiet however necessary query for Bitcoin mining.

The blackout just isn’t a systemic risk to Bitcoin. But it surely does expose a fragile intersection between geopolitics, vitality coverage, and hashpower focus that buyers typically overlook.

Iran’s Bitcoin Mining Trade Faces Huge Risk

Authorities in Iran sharply restricted web entry as nationwide protests escalated. Monitoring teams reported near-total outages, particularly on cell networks.

At first look, this seems to be like a political story. Nevertheless, Iran can be a significant—although not dominant—Bitcoin mining hub. That hyperlink makes the blackout related past Iran’s borders.

You possibly can mine 1 Bitcoin in Iran for $1,300 and promote it for $108,000.

Is Iran good this time of 12 months? 🤔 pic.twitter.com/u8vYuUjeZU

— Bitcoin Archive (@BitcoinArchive) October 19, 2025

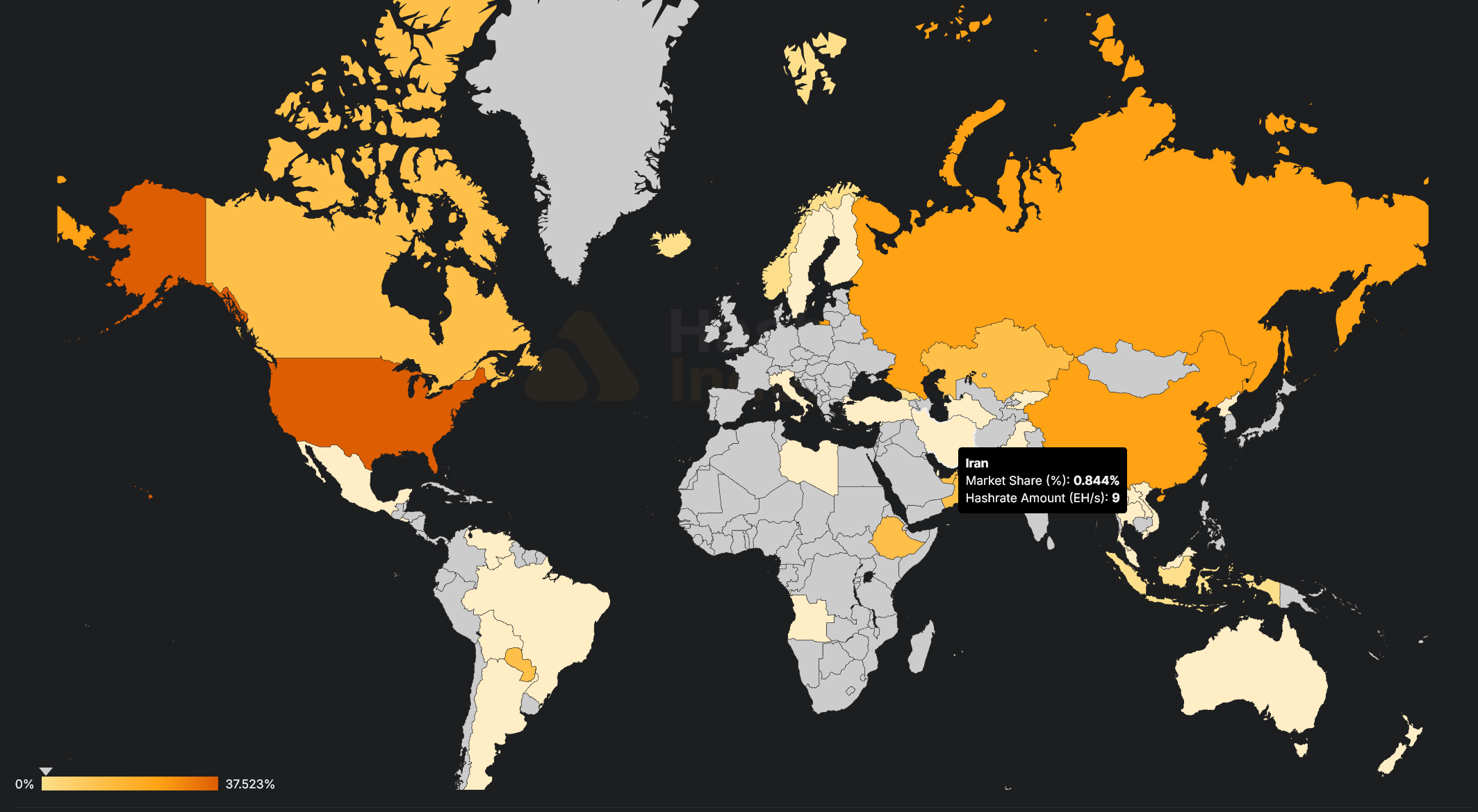

Iran contributes an estimated low-single-digit share of worldwide Bitcoin hashrate. That is down sharply from its 2021 peak however nonetheless massive sufficient to matter on the margins.

Low cost, backed vitality made Iran engaging for mining. Sanctions pushed components of the business underground. Repeated crackdowns compelled many operations to stay casual or semi-legal.

Importantly, Iran is not essential infrastructure for Bitcoin. The community not depends upon any single nation. However Iran stays a non-trivial contributor.

World Bitcoin Mining Hashrate Map. Supply: Hashrate Index

Does an Web Blackout Cease Bitcoin Mining?

Not instantly. Most industrial mining farms depend on steady energy and intermittent connectivity, not fixed high-bandwidth web.

Blocks propagate globally each ten minutes, and miners can stay operational even with restricted entry.

Nevertheless, extended or unstable connectivity creates friction:

- Pool coordination turns into more durable

- Firmware updates and payouts could also be delayed

- Smaller or illicit miners face increased downtime danger

Briefly, the blackout raises operational prices somewhat than shutting mining down in a single day.

Even a full Iranian outage would seemingly take away lower than 5% of worldwide hashrate. Bitcoin problem adjusts mechanically. The community absorbs the shock.

Nevertheless, if unrest spreads and vitality rationing resumes, Iran-based miners may face sustained shutdowns. This could modestly tighten hashpower however not destabilize the chain.

Essential to notice that Bitcoin survived China’s 2021 mining ban, which eliminated over 40% of hashrate. Iran’s scenario is orders of magnitude smaller.

Venezuela isn’t about oil. It’s about essential minerals and territory the place China, Iran and Russia function concurrently.

One other signal the post-1971 fiat system is lifeless.

The world is shifting again to actual issues with actual constraints. We’ll all want actual cash. Purchase bitcoin. pic.twitter.com/h7d9K22M3j

— Jack Mallers (@jackmallers) January 7, 2026

May Iran’s Disaster Harm or Assist Bitcoin?

The results reduce each methods.

On one hand, geopolitical instability reinforces Bitcoin’s decentralization narrative. No state can “flip off” the community. Hashpower migrates. The system adapts.

However, repeated crises spotlight an actual danger. Hashpower nonetheless follows low-cost vitality, typically in politically fragile areas. That creates volatility on the edges.

For markets, Iran’s blackout is extra symbolic than structural. It underscores resilience, not fragility.

The true story just isn’t Iran alone. It’s the ongoing redistribution of worldwide mining.

As politically dangerous areas cycle out and in of mining, hashpower continues shifting towards regulated, energy-rich jurisdictions. Iran’s position is shrinking, not rising.

This blackout could disrupt native miners. It doesn’t threaten Bitcoin. Nevertheless, it does remind buyers that the actual long-term dangers lie in vitality coverage, geopolitics, and the way shortly miners can adapt.