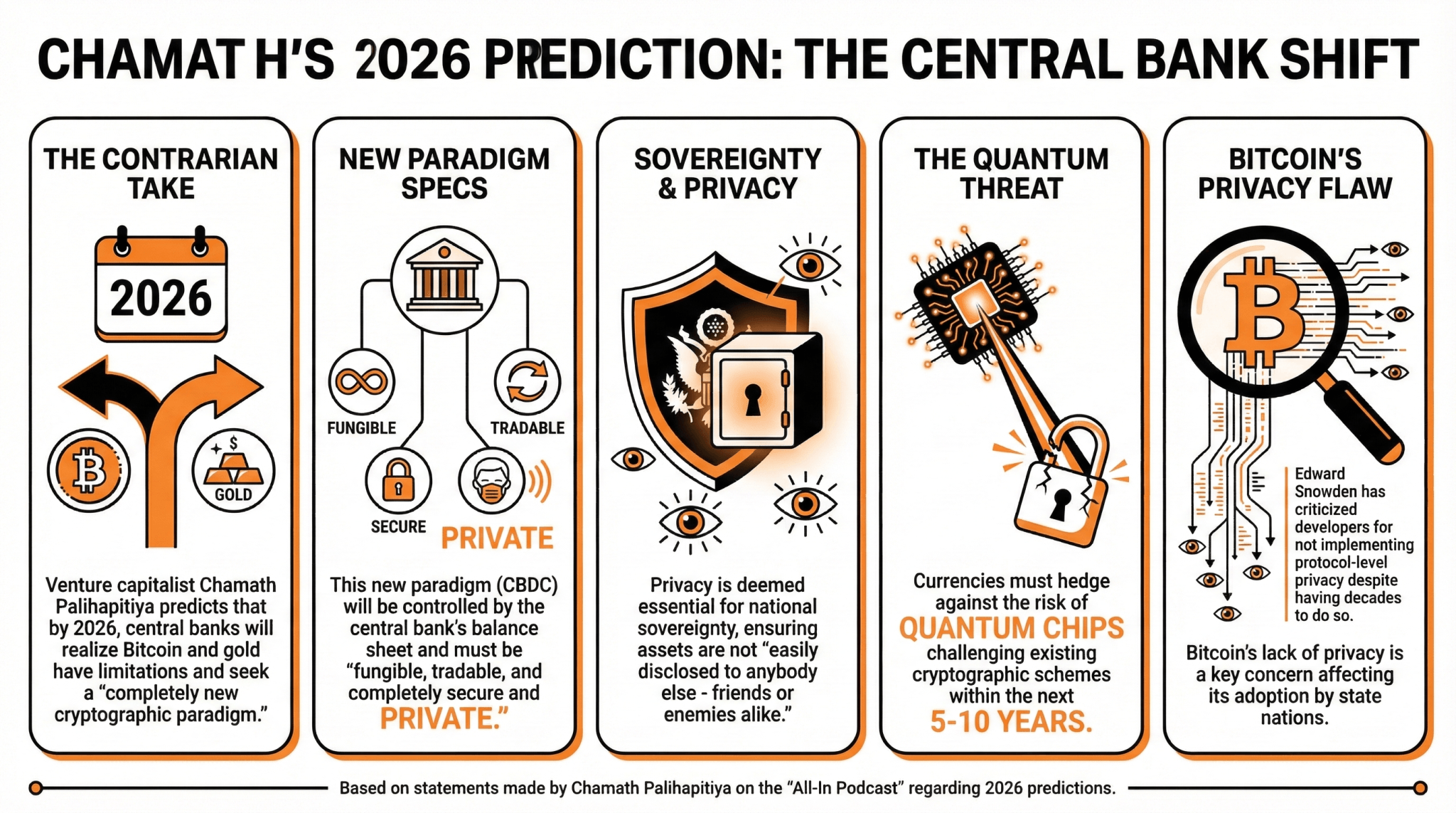

Enterprise capitalist Chamath Palihapitiya believes a brand new cryptographic paradigm will emerge to beat the privateness limitations inherent to bitcoin and gold. He emphasised that that is wanted to create belongings which might be “not simply disclosed.”

Chamath Palihapitiya Raises the Drawback of Bitcoin’s Lack of Privateness

The difficulty of bitcoin’s lack of privateness has been raised as a key concern which will have an effect on its adoption as a central financial institution digital foreign money by state nations.

Within the newest episode of the “All-In Podcast,” enterprise capitalist Chamath Palihapitiya offered his contrarian take for 2026, stating that central banks will notice each gold and bitcoin have limitations, and can search out a “fully new cryptographic paradigm.”

This new paradigm might be managed by the central financial institution’s stability sheet and might be “fungible, tradable, and fully safe and personal.”

Explaining the motivations for this shift, he declared:

I feel the explanation why that privateness must exist is that, for the sovereignty of a rustic, you should be ready the place you could have belongings that aren’t simply disclosed to anyone else – pals or enemies alike.

As well as, he additionally defined that quantum superiority posed dangers to Bitcoin, stating that this new paradigm must be able to face this upcoming menace. “If you happen to’re going to personal a foreign money, you should hedge towards the eventual danger within the subsequent 5 to 10 years that there’s a quantum chip that may problem the prevailing cryptographic schemes which might be used,” he concluded.

The difficulty of privateness -or lack thereof- in Bitcoin has been raised many occasions earlier than. NSA whistleblower Edward Snowden has been calling for a strong implementation of privateness at a protocol stage, criticizing that builders had years to implement this function with out developments.

“That is the ultimate warning. The clock is ticking,” stated Snowden in 2024, warning that bitcoin transactions could possibly be simply traced again to people and establishments with at present’s know-how.

Learn extra: Snowden Points ‘Remaining Warning’ to Bitcoin Builders on Privateness Enhancements

FAQ

-

What considerations about Bitcoin are affecting its potential adoption as a central financial institution digital foreign money?

The lack of privateness in Bitcoin transactions has raised considerations which will hinder its acceptance by state nations. -

What does enterprise capitalist Chamath Palihapitiya counsel for the way forward for foreign money?

Palihapitiya argues that central banks will search a new cryptographic paradigm that’s fungible, tradable, and ensures privateness and safety. -

Why does Palihapitiya emphasize the necessity for privateness in a foreign money?

He claims that for a rustic’s sovereignty, there have to be belongings that can not be simply disclosed to anybody, together with pals and adversaries. -

What warning did Edward Snowden give relating to Bitcoin’s privateness?

Snowden cautioned that with out strong implementation of privateness options, Bitcoin transactions could possibly be traced again to people, stating it was “the ultimate warning” as know-how advances.