Ethereum’s most up-to-date worth motion displays a short lived slowdown in momentum. After the aggressive decline towards the decrease demand area, the market has entered a fluctuation part, with minor bullish retracements trying to stabilize the construction. The worth is at the moment compressing inside key technical boundaries, suggesting {that a} decisive transfer is approaching.

Ethereum Value Evaluation: The Day by day Chart

On the each day timeframe, $ETH is transferring in a consolidation part following its sharp drop into the $1,800–$1,850 demand zone. The latest candles present minor bullish retracements, however these strikes lack robust impulsive traits and seem corrective in nature.

Technically, the asset is confined between the $1.8K static help and the descending channel’s center boundary, which is performing as dynamic resistance across the $2,500–$2,600 area. So long as Ethereum stays trapped between these two ranges, the market construction displays a fluctuation state moderately than a confirmed development reversal.

A sound breakout above the channel’s midline resistance could be required to shift short-term momentum in favor of consumers. Conversely, a breakdown beneath the $1,800 help would expose decrease demand zones and certain reintroduce robust promoting strain.

$ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the worth motion reveals the formation of a tightening triangle sample after the rebound from the $1,800 low. The construction exhibits converging trendlines, reflecting reducing volatility and a stability between consumers and sellers.

Ethereum is now buying and selling close to the apex of this slender vary, indicating {that a} breakout is imminent. A bullish breakout above the higher boundary of the triangle may set off a push towards the $2,300–$2,400 area as the following short-term resistance. However, a bearish breakdown beneath the ascending help of the triangle would doubtless result in a renewed take a look at of the $1,800 demand zone.

Total, the market is in compression mode on the decrease timeframe, and the following impulsive transfer will doubtless decide the short-term route.

Sentiment Evaluation

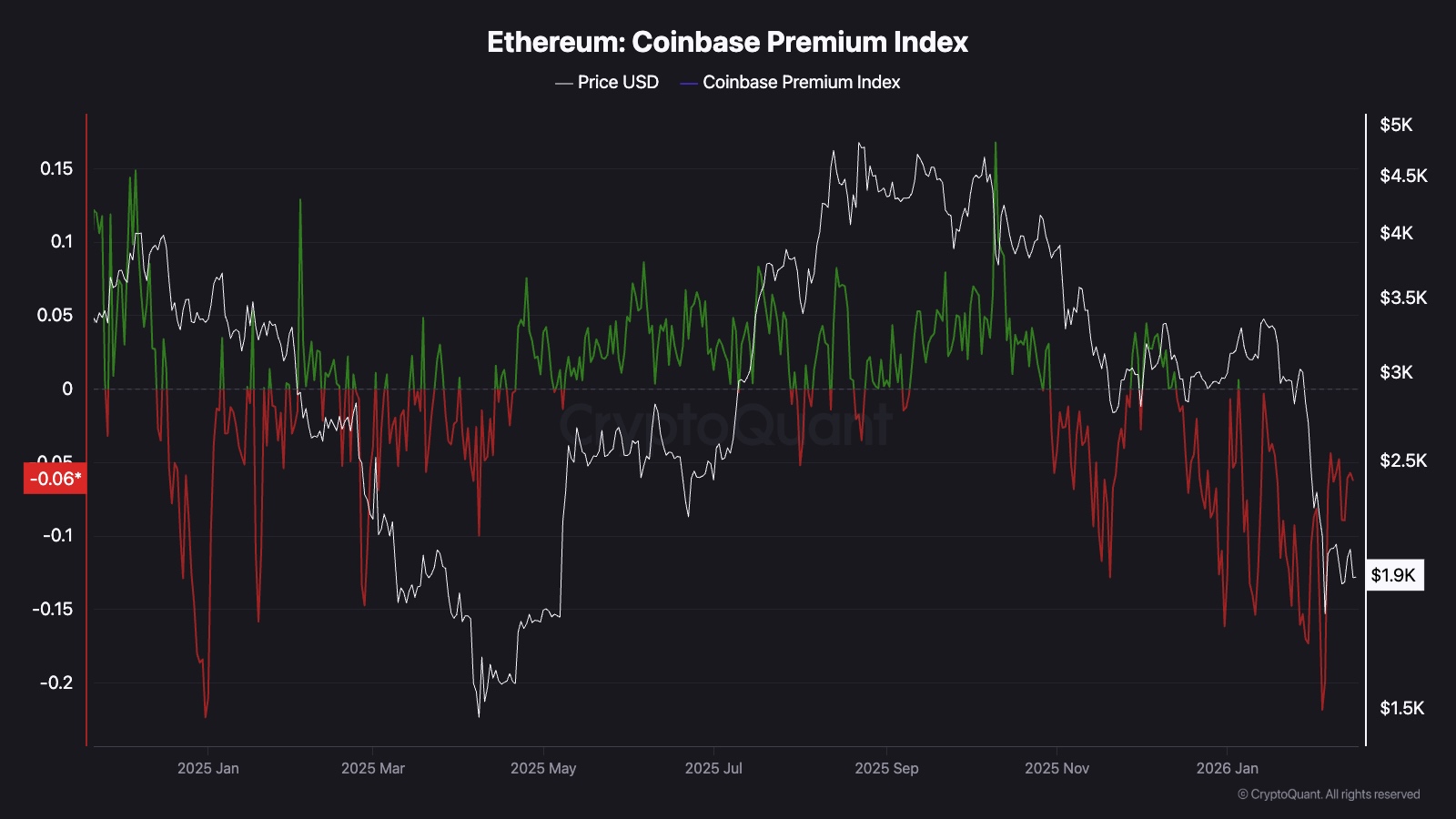

From an on-chain perspective, the Coinbase Premium Index has remained predominantly adverse, indicating comparatively weak demand from US-based traders and a scarcity of aggressive spot shopping for on Coinbase in comparison with different exchanges. This persistent adverse studying aligns with the broader corrective construction noticed on the charts.

Nevertheless, the index has just lately skilled a noticeable upward surge. Though it’s nonetheless beneath the impartial threshold, the depth of the rebound means that promoting strain from US individuals could also be easing. If this upward momentum continues and the index crosses into constructive territory, turning inexperienced, it will sign renewed spot demand from US traders.

Such a shift may act as a catalyst for a bullish rebound, significantly if it coincides with a technical breakout from the present triangle formation. In that state of affairs, each technical construction and on-chain demand would align in favor of a stronger restoration part.