Bitcoin has been consolidating above the essential $80K assist degree, going by means of substantial uncertainty. Nevertheless, this vary is predicted to carry, probably resulting in a bullish reversal.

Technical Evaluation

By Shayan

The Day by day Chart

Bitcoin has been transferring sideways above the $80K key assist zone, which incorporates the 0.5-0.618 Fibonacci retracement ranges and the ascending channel’s decrease boundary. This space is a vital psychological and technical assist, seemingly stuffed with shopping for curiosity.

Nevertheless, if sellers acquire management and push the worth under, a wave of lengthy liquidations may set off substantial declines. The subsequent main pattern will depend upon Bitcoin’s value motion across the $80K zone.

The 4-Hour Chart

On the decrease timeframe, Bitcoin confronted promoting stress on the higher boundary of its descending channel, leading to a pointy rejection. The value is now testing short-term assist at $83K, aligning with a earlier swing low. Whereas some shopping for curiosity might emerge, total market momentum stays weak, with sellers nonetheless in management.

If patrons fail to defend this degree, a drop towards the channel’s mid-boundary at $79K will grow to be seemingly. Conversely, a breakout above the descending channel’s higher trendline may set off a rally towards $93K.

On-chain Evaluation

By Shayan

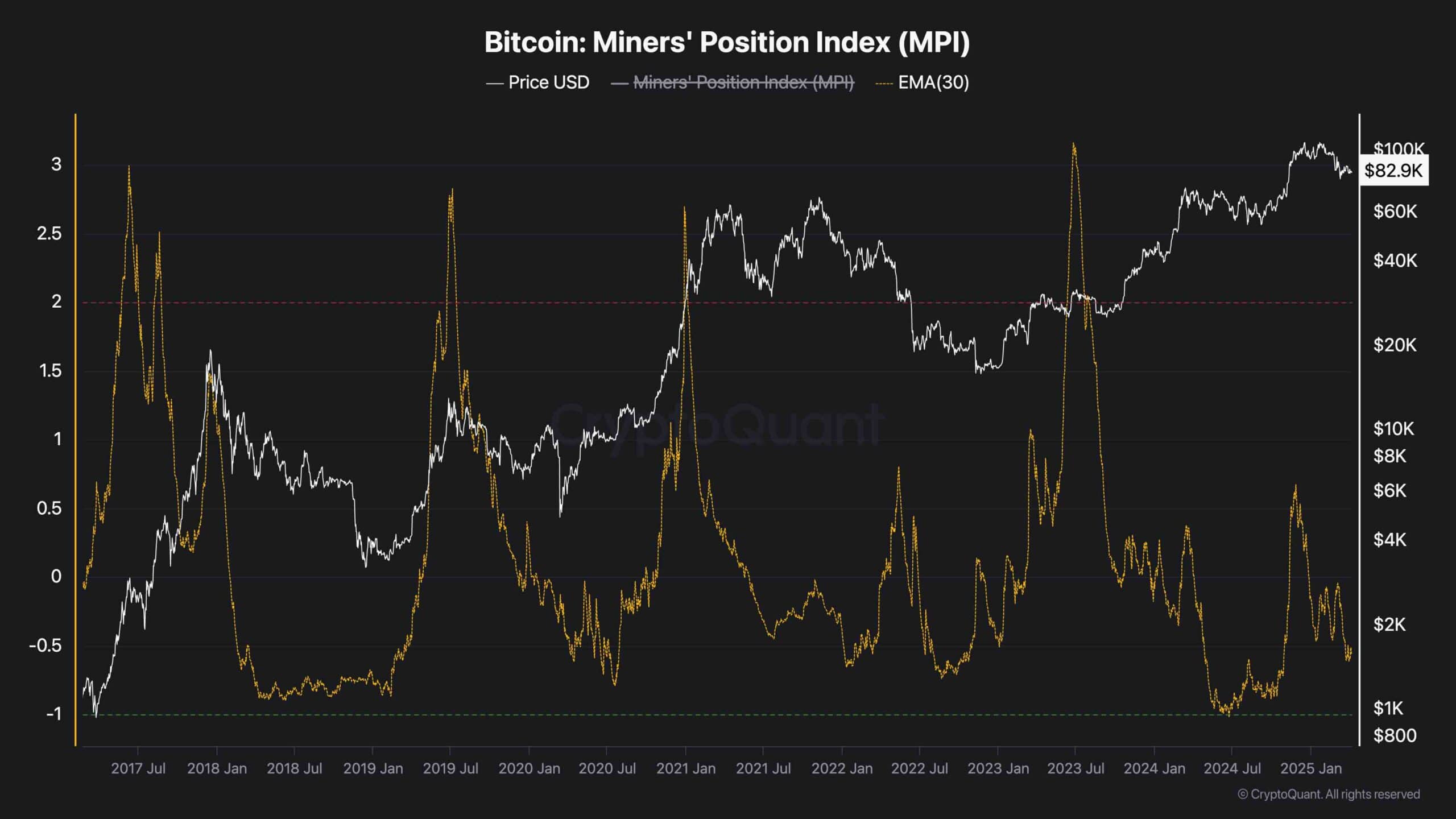

This chart illustrates the Miners’ Place Index (MPI), a key metric that measures the ratio of whole miner outflow to its one-year transferring common. Elevated MPI values point out heightened promoting stress from miners, which may sign potential value declines.

Presently, the MPI stays under zero, suggesting no vital miner-driven promoting stress. Though the overall variety of Bitcoins held by miners continues to say no step by step, the USD worth of their holdings has been trending steadily upward.

This pattern implies that miners stay assured of their operations. Whereas their BTC reserves are shrinking, their USD-denominated worth is growing, decreasing the motivation for mass liquidations even amid market downturns. This conduct means that the continued correction is extra seemingly a deep consolidation part moderately than the beginning of a bear market.