Bitcoin’s worth is teasing buyers, as it’s experiencing a pullback earlier than reaching the $100K mark. But, as issues stand, there’s a substantial chance that it’s going to hit the milestone quickly.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Every day Chart

Beginning with technical evaluation, the every day timeframe reveals huge bullish momentum for BTC. But, the market has been correcting for the previous couple of days after failing to achieve the $100K stage.

The $90K mark remains to be intact and will forestall the market from dropping any additional. That is very true as a result of the RSI is now not exhibiting an overbought sign.

The 4-Hour Chart

Because the 4-hour chart depicts, the latest Bitcoin worth motion reveals the formation of an ascending channel damaged to the draw back yesterday. That is usually a transparent reversal sample.

But, as the general market construction stays bullish, the value can climb again into the sample quickly, making it fail and paving the best way for an additional push towards $100K.

However, whereas unlikely, a breakdown of the $90K stage may end in a a lot deeper correction towards the $80K zone.

On-Chain Evaluation

By Edris Derakhshi (TradingRage)

Lengthy-Time period Holder SOPR

On-chain evaluation can all the time current a special perspective from that of technical evaluation, as it could possibly display the availability and demand dynamics because of the transparency offered by the Bitcoin community.

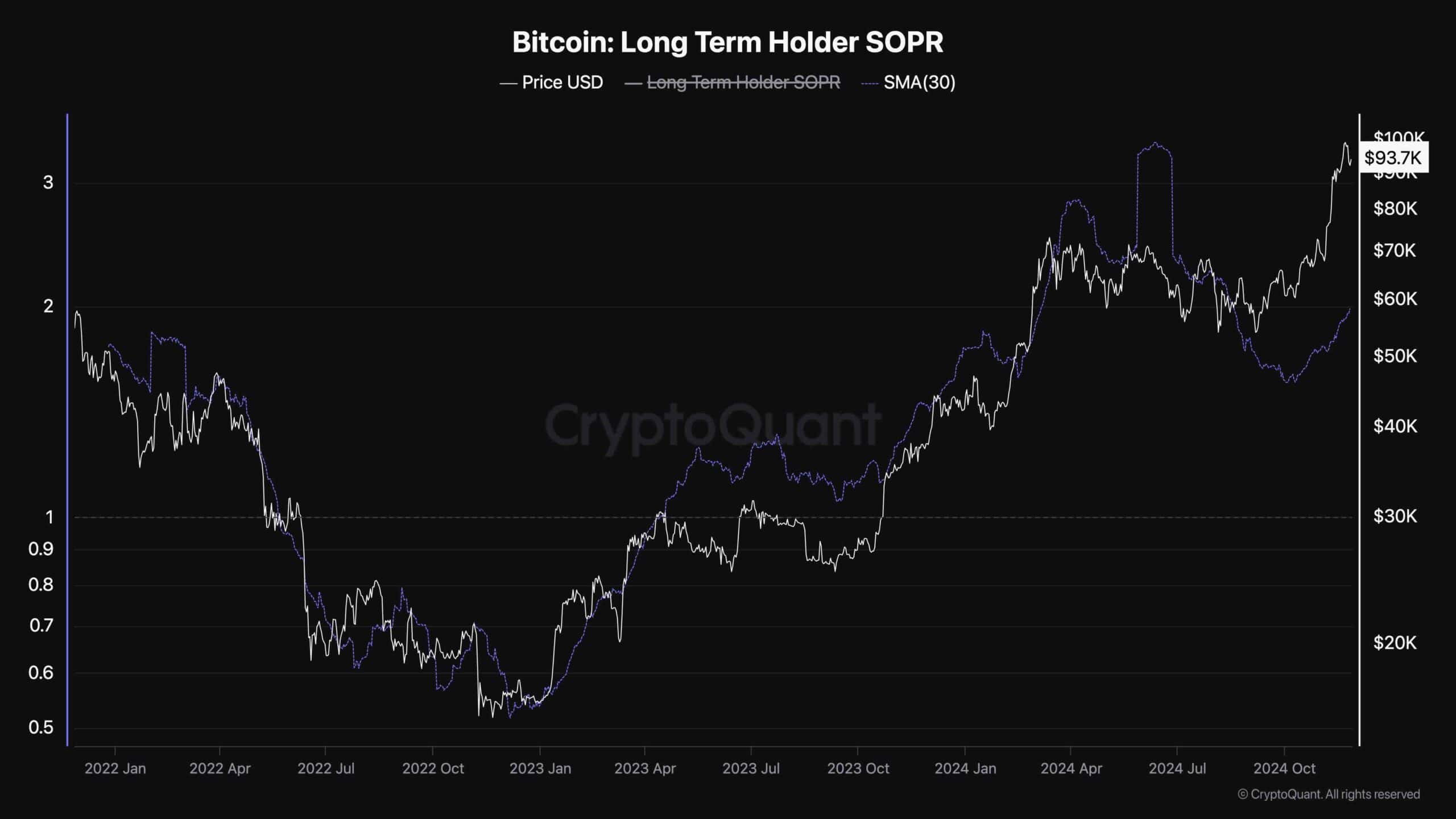

This chart shows the long-term holder SOPR metric, which measures the ratio of realized earnings to losses for long-term buyers. The 30-day shifting common of the LTH SOPR is trending larger and has been above one for some time, indicating that the cohort is realizing earnings because the market rallies.

When you can take into account this a bearish signal, as revenue realization can overwhelm the market with provide, this may not be the case.

LTH SOPR is far decrease than over the past all-time excessive vary earlier this 12 months. Subsequently, it may be concluded that the value can nonetheless go larger earlier than a large profit-taking occasion takes place by long-term buyers.