One other slip in Ethereum worth warns of the native help trendline crackdown. Will the altcoin survive?

The Ethereum worth presently trades at $2,418, with a 24-hour drop of two.85%. Prior to now seven days, it has dropped by 8.56% and misplaced the $300 billion market cap threshold. Ethereum’s valuation now stands at $291 billion, with a 24-hour buying and selling quantity of $16.11 trillion.

Can Ethereum keep its place above $2,400 as promoting strain resurfaces amid elevated market volatility? Let’s study the important thing help ranges and potential worth tendencies.

Ethereum Value Evaluation

The each day chart signifies a bigger falling channel sample, signaling an ongoing downtrend. Moreover, the bullish momentum inside the bearish channel is struggling to realize traction as a result of important provide on the 50-day EMA.

Following the latest market correction, ETH’s worth has decreased from a 14-day excessive of $2,729 to its present degree, representing an 11.52% drop. Nonetheless, bullish sentiment stays intact so long as the value stays above the essential help degree of $2,350.

On the 4-hour chart, there may be an rising probability of a breakdown rally.

The bullish resistance on this timeframe has led to a different pullback. With rising promoting strain, the ETH worth is approaching the native help trendline close to the $2,350 mark.

Furthermore, the MACD indicator on the 4-hour chart exhibits a bearish crossover. The 50, 100, and 200 EMA have additionally given bearish crossovers, aligning with a downward pattern.

Consequently, technical indicators on the 4-hour chart sign a promote alternative. If a bearish breakdown happens, the subsequent important help ranges for ETH are $2,150, the psychological $2,000 mark, and the $1,900 help degree.

Analyst Highlights Essential On-chain Assist at $2,300

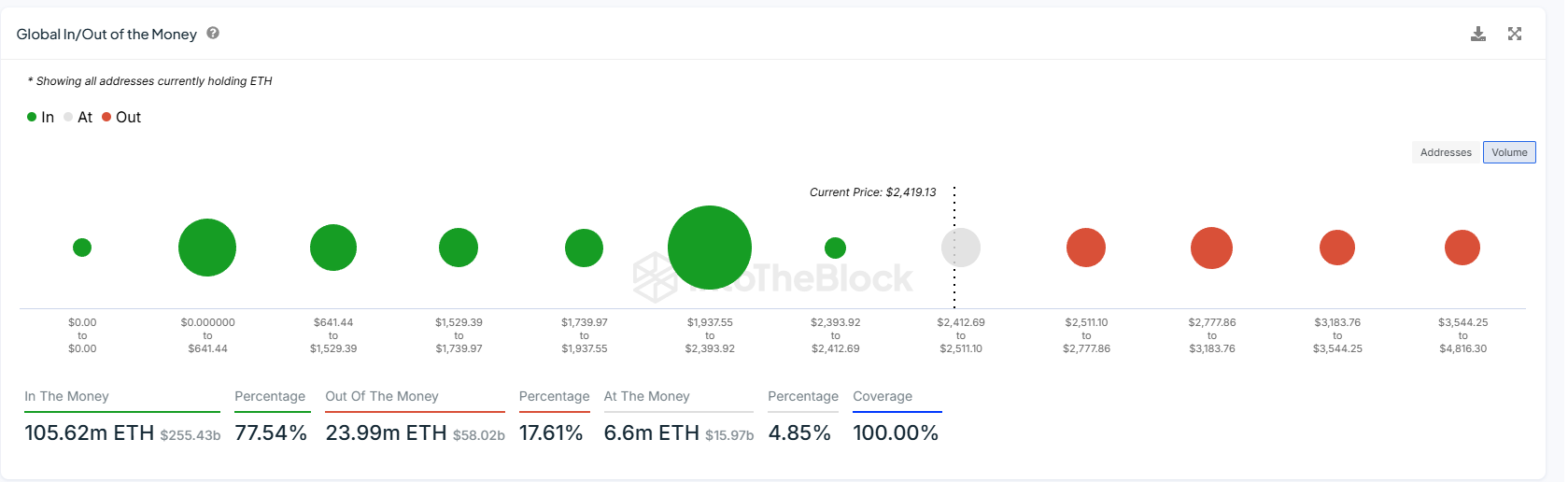

In keeping with the World In and Out of Cash Indicator from IntoTheBlock, 77.54% of Ethereum’s present provide is “within the cash,” amounting to roughly 105.62 million ETH tokens, valued at $255.43 billion.

Ethereum IntotheBlock

The “On the Cash” vary presently spans from $2,412 to $2,511, encompassing 6.66 million ETH, or 4.85% of the present provide, valued at $15.97 billion. In the meantime, 23.99 million ETH tokens, price $58.02 billion, are labeled as “out of the cash,” accounting for 17.61% of the overall provide.

Analyst Ali Martinez famous the significance of this profitability indicator, emphasizing that Ethereum’s essential help degree is roughly $2,300, as almost 2.77 million addresses maintain 52.65 million ETH tokens.

Ethereum Choice Open Curiosity Exceeds $5B

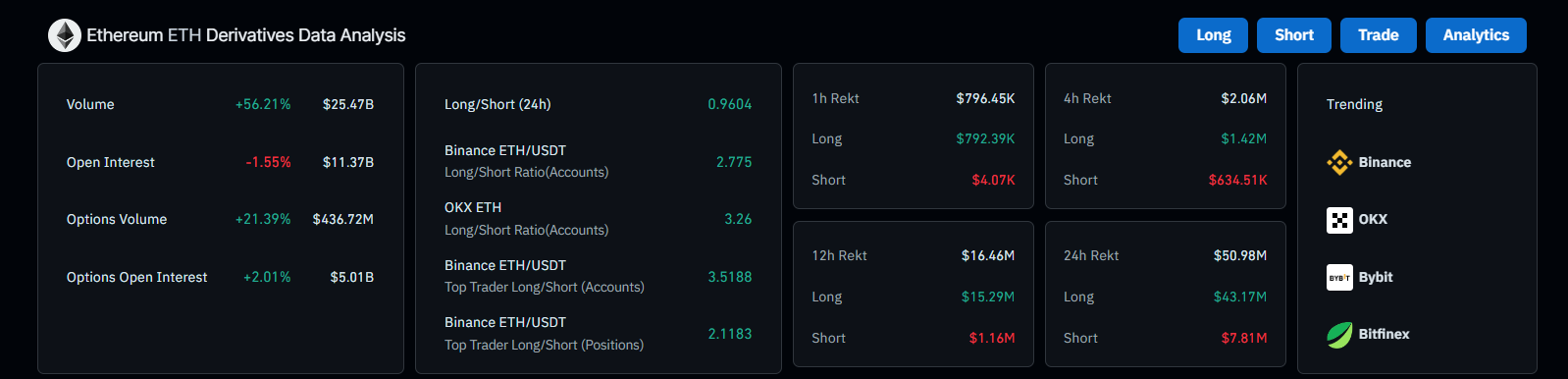

As Ethereum’s worth approaches the $2,400 threshold, the open curiosity in Ethereum has dropped by 1.02%, now standing at $11.44 billion. The choices market displays volatility, highlighted by a 28.50% surge in choices quantity, amounting to $46.465 million.

Information from CoinGlass signifies that open curiosity in Ethereum choices has elevated by 2.44%, reaching $5.07 billion.

ETH derivatives knowledge

The long-to-short ratio over the previous 24 hours is at 0.96, indicating a mildly bearish sentiment. Nonetheless, prime merchants on Binance present robust bullish expectations for Ethereum, with a long-to-short account ratio of three.48 and a place ratio of two.12.

Prior to now 24 hours, the market has liquidated $51.23 million in Ethereum positions, with $43.17 million of lengthy positions liquidated in comparison with $8.05 million in brief positions.

With over 5 occasions extra lengthy positions liquidated than quick positions, the general sentiment for Ethereum’s worth pattern stays bearish. On this setting, Ethereum is more likely to take a look at essential help ranges round $2,350, $2,300, or $2,150 if broader market sell-offs proceed.