A month into 2025, Ethereum faces rising uncertainty regardless of its established dominance within the good contract house. Whereas ETH registered notable good points in 2024, it lagged behind main rivals like Solana, XRP, and SUI, elevating issues about its skill to take care of market management.

The Ethereum Basis additionally had a difficult yr, coping with transparency points, management shifts, and growing skepticism from the group. With consultants divided on Ethereum’s future, the query stays: Does it nonetheless supply sturdy funding potential, or are different ecosystems changing into extra enticing?

Ethereum is Lagging Behind Main Opponents

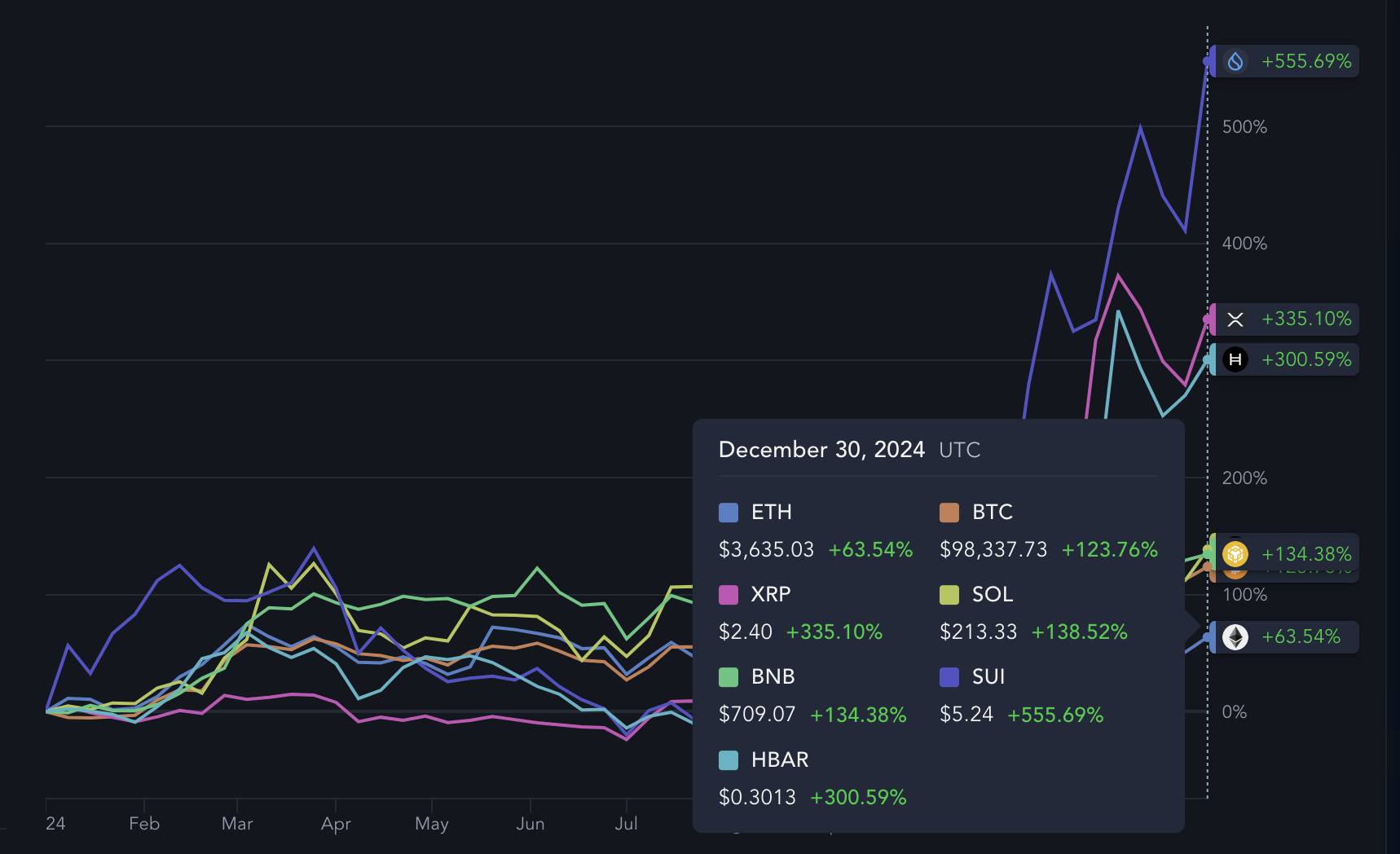

In 2024, Ethereum ended the yr with a 63% achieve, however this was far under its main rivals. Bitcoin rose 123%, BNB climbed 134%, and Solana surged 138%.

Smaller gamers like Hedera (300%), XRP (335%), and SUI (555%) outperformed considerably, suggesting that capital flowed into different ecosystems with greater returns.

Worth Change for Ethereum and a few of its main rivals between January 1, 2024, and December 30, 2024. Supply: Messari.

Ethereum and Hedera have been additionally the one belongings on this group that failed to succeed in a brand new all-time excessive. Ethereum’s peak in 2024 barely exceeded $4,000, nonetheless properly under its 2021 file of $4,864.

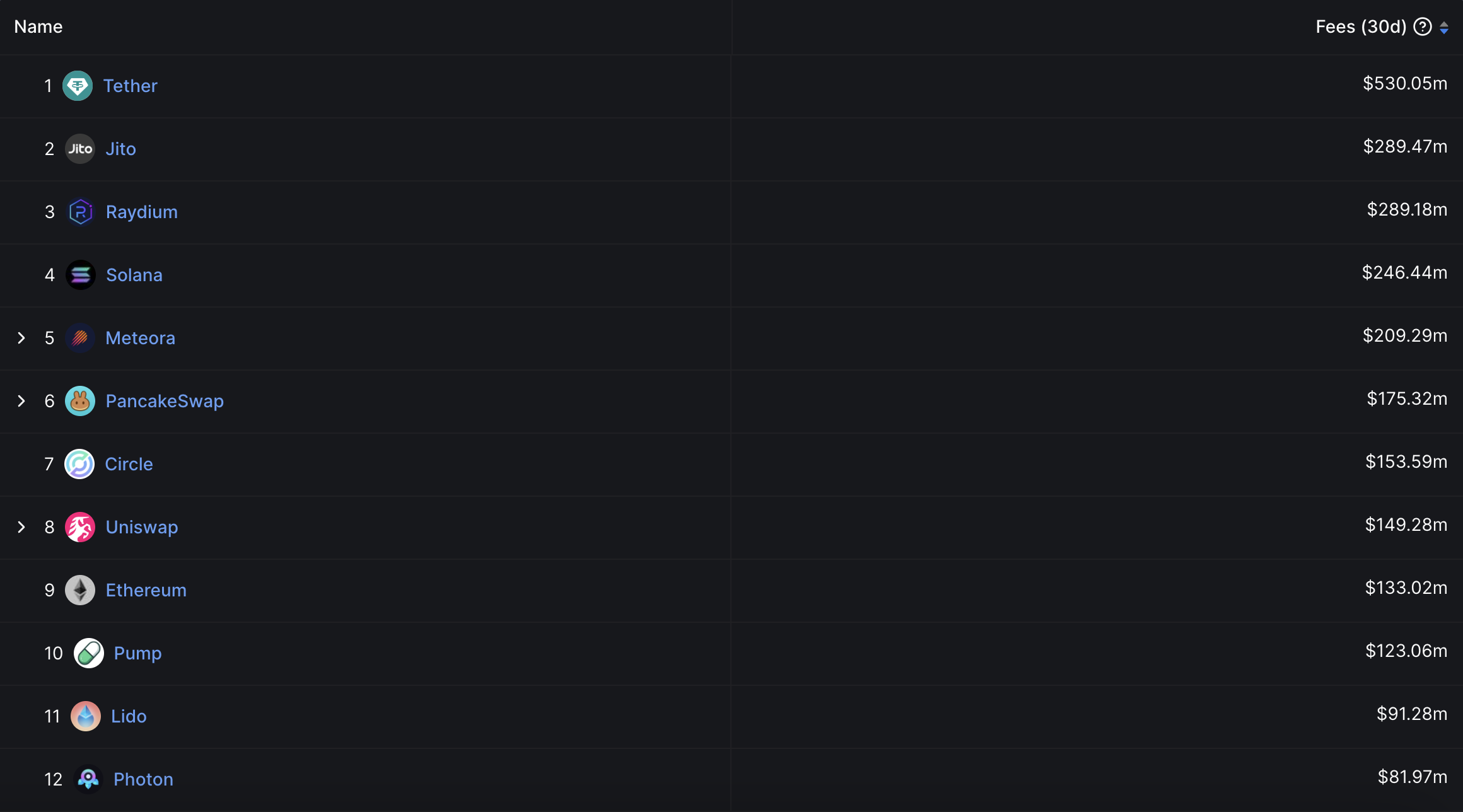

Charges Within the Final 30 Days for Totally different Chains, Protocols, and Purposes. Supply: DeFiLlama.

When analyzing charges generated within the final 30 days, Ethereum is on the verge of leaving the highest 10, with $133 million in charges, simply forward of Pumpfun ($123 million).

Notably, 5 of the highest 10 are Solana-based, together with Jito, Raydium, Meteora, and Pump, which, together with Solana itself, have all generated extra charges than ETH.

Ethereum Basis Suffered a Lot of Criticism Final Yr

Final yr was powerful for the Ethereum Basis, going through heavy criticism on a number of fronts. Points started when key members took advisory roles at EigenLayer, considered one of Ethereum’s most hyped tasks. The muse was additionally known as out for a scarcity of transparency after a $100 million switch to Kraken.

Additional controversy arose when studies steered that the muse was promoting ETH each 11 days, prompting Vitalik to defend its neutrality and reject staking ETH.

“We’re certainly at the moment within the course of of enormous modifications to EF management construction, which has been ongoing for near a yr. A few of this has already been executed on and made public, and a few remains to be in progress,” Buterin posted on X (previously Twitter) again in January.

Just lately, Vitalik hinted that the muse may rethink ETH staking to cowl bills. On January 18, he introduced “massive modifications” to the management construction, aiming for stronger technical experience and higher communication with builders, customers, and Layer 2 tasks. Regardless of this, the group stays skeptical, with ETH down 17.5% since his assertion.

With ongoing management modifications, monetary issues, and transparency points, some in the neighborhood see the Ethereum Basis as directionless.

Confidence in its long-term imaginative and prescient seems shaky, and uncertainty round Ethereum’s subsequent improvement phases may very well be weighing on sentiment.

Consultants Present Combined Sentiment In regards to the Way forward for Ethereum

On X, opinions on Ethereum are divided. Max Resnick, Lead Economist at Anza, suggests Uniswap might have missed a possibility by not launching on Solana.

He highlights that Raydium, a Solana-exclusive DEX, is now producing extra quantity and charges than Uniswap, regardless of Uniswap working throughout a number of chains.

“In all probability one of the best recommendation you may’ve given uniswap 6-12 months in the past would have been to launch on Solana as quickly as attainable. Influential folks, a few of whom I believe are very good and respect advised them to launch the a thousandth Ethereum L2. That is the outcome,” Resnick wrote.

Anton Bukov, co-founder of 1Inch, takes a special stance, praising Ethereum and its Layer 2 options for his or her simplicity and developer-friendly setting.

“Regardless of market uncertainty about main good contract platforms, I’m fairly positive it’s nonetheless clearly the preferred and easy platform for builders – Ethereum and its L2s,” Bukov wrote.

Crypto investor Ted Pillows stays optimistic, pointing to potential catalysts for Ethereum, akin to a Trump administration and the potential of an Ethereum Staking ETF.

Then again, Crypto Information knowledgeable Kofi argues that the Ethereum Basis shouldn’t be seen because the face of Ethereum, reinforcing the concept the community’s energy lies in its decentralized nature.

The EF does plenty of essential work. Folks don’t realise it as a result of the EF: – Don’t aggressively promote their work – Enable the groups they assist to take full credit score for wins That is intentional. The EF shouldn’t be meant to be the face of Ethereum. The EF is meant to steward the infinite backyard, supporting an more and more various community of contributors from the background. Till, at some point, it’s now not wanted,” wrote Kofi.

To Sum It Up: Is ETH Price Investing?

Ethereum’s struggles in 2024 sign a troubling development for its future as rivals like Solana, XRP, and SUI proceed to seize market share with greater returns, decrease charges, and higher scalability.

The Ethereum Basis’s ongoing transparency points, management turmoil, and lack of clear route solely add to the uncertainty, making it much less enticing for buyers searching for stability.

With Solana-based functions now outpacing Ethereum in payment technology and innovation shifting elsewhere, Ethereum’s relevance because the main good contract platform is now not assured.

Until it addresses these challenges shortly, ETH might now not be one of the best funding selection in 2025.