Coinbase, the US-listed cryptocurrency alternate large, has acquired the Cyprus unit of BUX (previously Stryk) and renamed the entity Coinbase Monetary Providers Europe, Finance Magnates has realized.

Is Coinbase Exploring CFDs?

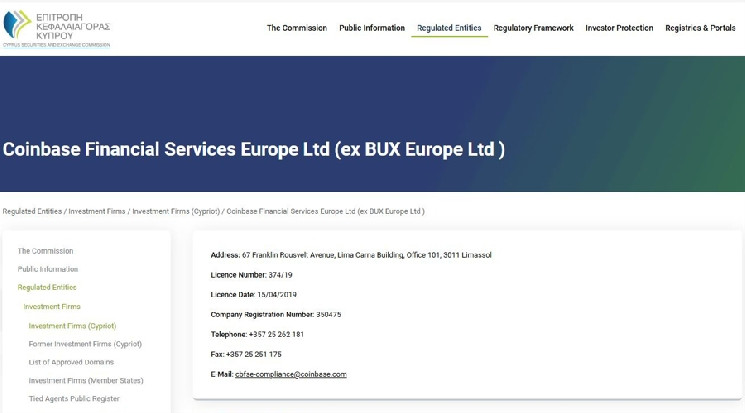

With this acquisition, Coinbase now holds a Cyprus Funding Agency (CIF) license, which authorises it to supply contracts for variations (CFDs) merchandise. Moreover, the crypto alternate can passport this Cyprus license to offer monetary companies throughout different European Financial Space (EEA) member states.

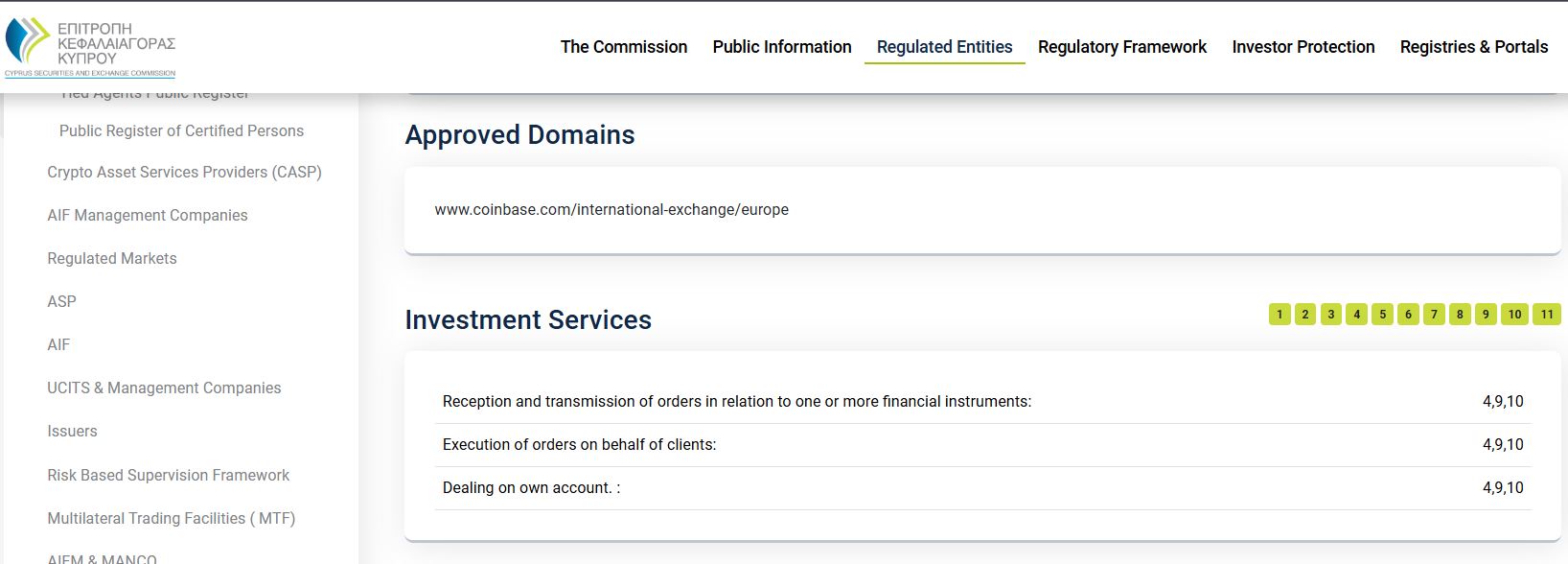

The Cyprus Securities and Trade Fee (CySEC) registry confirms that the area “coinbase.com/international-exchange/europe” has been authorised by the regulator, though it isn’t but operational. Whereas there is no such thing as a official affirmation, Coinbase seems to be concentrating on skilled and institutional purchasers with its choices underneath the Cyprus license.

A screenshot of the license particulars of Coinbase’s CY entity on CySEC’s registry

Coinbase’s curiosity in BUX’s Cyprus entity appears to centre on buying the license and operational infrastructure slightly than the earlier shopper base. In line with earlier experiences by Finance Magnates, BUX migrated its Cyprus-based purchasers to AvaTrade, one other CFD dealer.

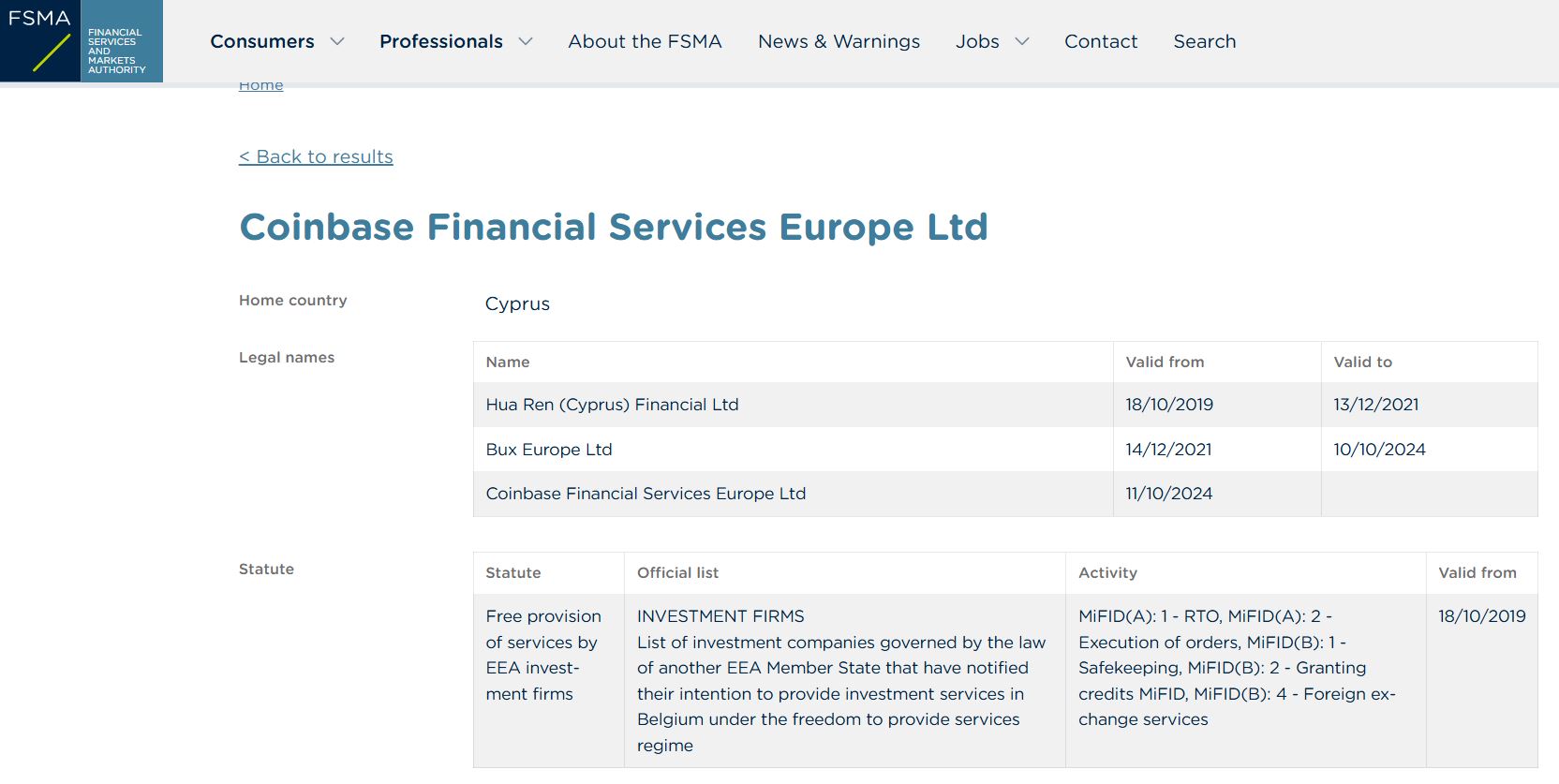

The deal seems to have been finalised final October, because the registry of Belgium’s Monetary Providers and Markets Authority (FSMA) signifies that the entity’s title was modified from Bux Europe Ltd to Coinbase Monetary Providers Europe Ltd on 11 October 2024.

Particulars about Coinbase Monetary Providers Europe on FSMA registry

Finance Magnates reached out to BUX and Coinbase for additional particulars on the acquisition however had not acquired a response by press time.

Coinbase is just not the primary cryptocurrency alternate to indicate potential curiosity in CFDs. In November, Crypto.com confirmed its acquisition of Fintek Securities, an Australian-licensed CFDs dealer. Equally, Bybit holds an energetic Mauritius license, enabling it to supply foreign exchange and CFDs devices.

BUX’s Divestment Full

Headquartered within the Netherlands, BUX offers funding companies to European retail purchasers. Its major enterprise was acquired by Dutch financial institution ABN AMRO final yr, with assurances that BUX would proceed working independently.

BUX’s UK unit, which additionally supplied CFDs, was offered to UAE-based APM Capital. The FCA-regulated entity has since been rebranded as APM Markets however has but to relaunch its companies. Finance Magnates beforehand reported that Joshua Owen was appointed because the CEO of the UK entity.