It is a section from the Ahead Steerage publication. To learn full editions, subscribe.

One thing very attention-grabbing confirmed up within the FOMC November assembly minutes this week that had nothing to do with fee lower expectations.

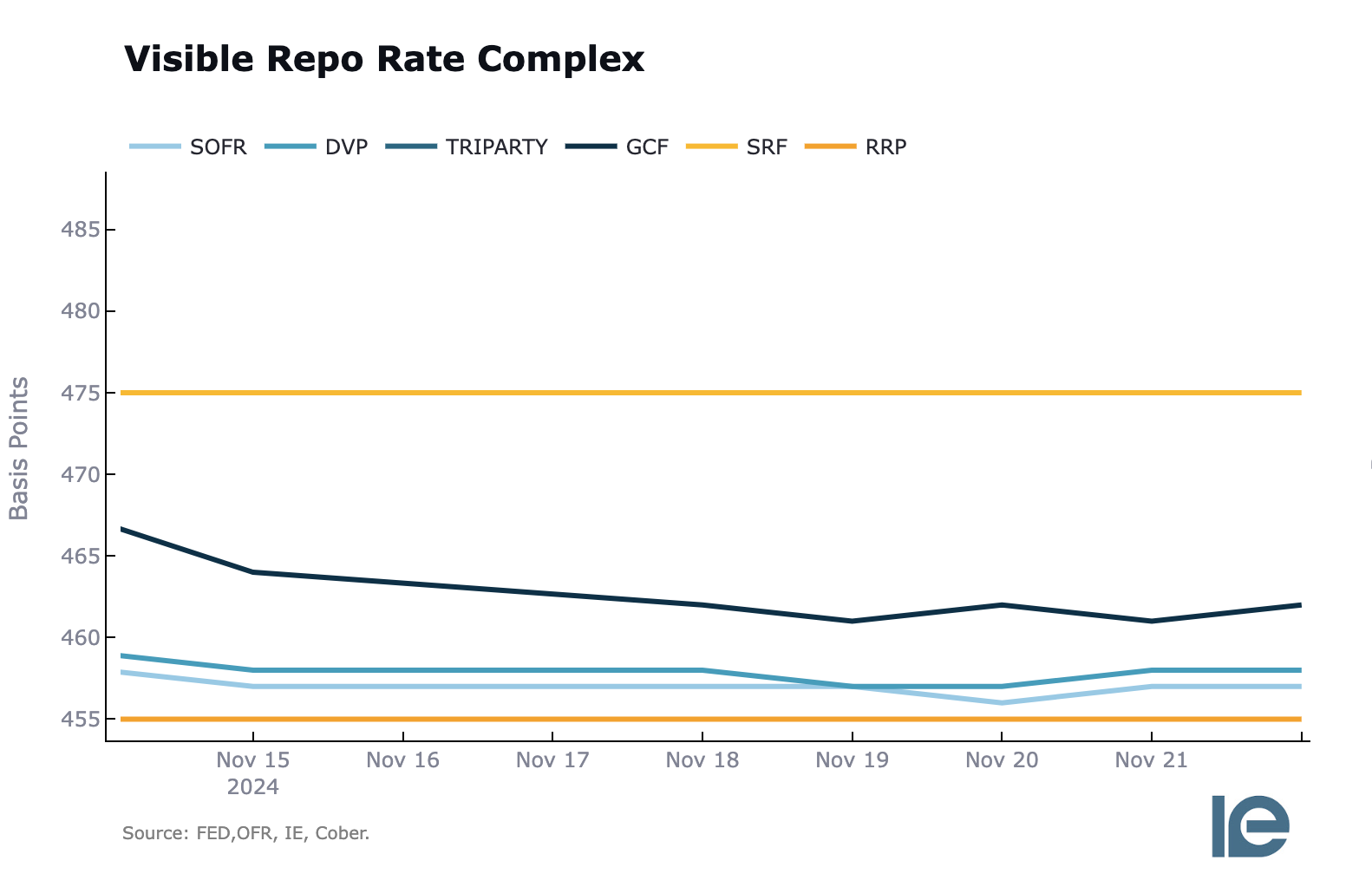

Hidden deep within the minutes was the next excerpt:

Basically, the Fed is contemplating reducing the award fee on Reverse Repo Facility belongings by 5-basis factors, which might decrease the underside of the goal vary of the federal funds fee band.

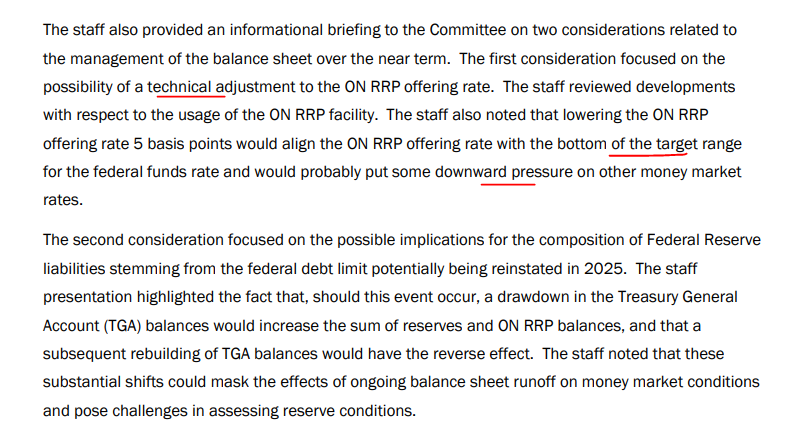

Here’s what that advanced appears like visually:

One can solely speculate as to why the FOMC needs to decrease this fee, however there’s a convincing concept:

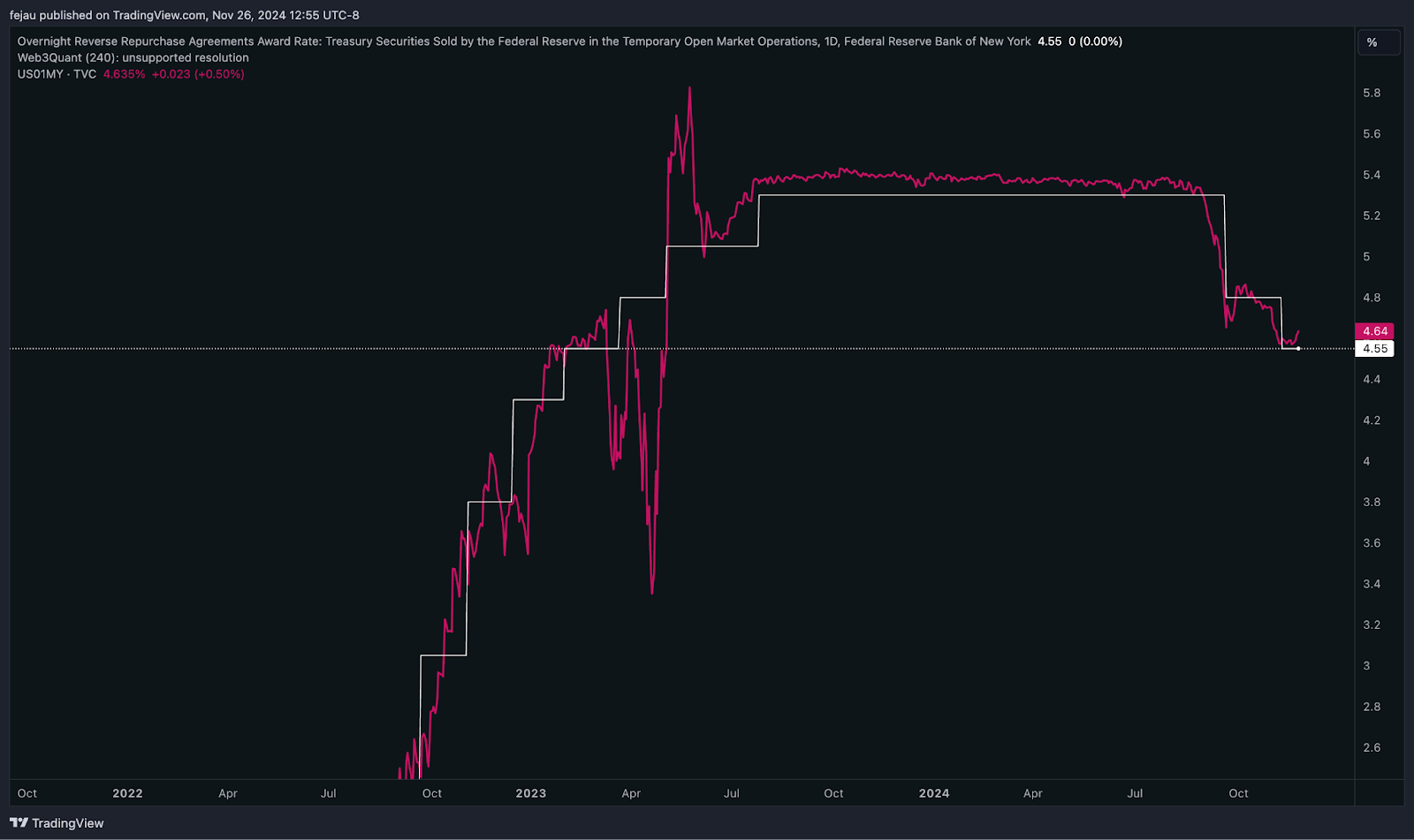

Given the current uptake within the Standing Repo Facility that occurred on the finish of the earlier quarter, paired with FOMC members acknowledging that the clock is ticking on how for much longer QT can proceed with out potential pressure exhibiting up within the financial plumbing system, the FOMC could be attempting to get forward of this by encouraging outflows from the RRP and growing financial institution reserves to supply ample liquidity.

As proven on this chart evaluating the $1 million T-bill with the RRP award fee, cash market funds are usually alternating between proudly owning the 2, relying on which has the upper yield on the time. By reducing the award fee, T-bills are made extra enticing:

As we will see within the present steadiness of the RRP, there’s nonetheless $186 billion of money that’s “caught” within the RRP. By reducing the award fee, it seems the FOMC is attempting to get this cash into the broad monetary system to make sure liquidity stays ample. This comes within the face of ongoing QT that’s getting nearer to a possible goal that would pressure financial institution reserve ranges:

We might want to wait till the following FOMC assembly in December to verify if this can certainly be the case. The actual fact is, although, that by even acknowledging this potential dynamic, the FOMC is signaling that they’re turning into more and more involved about financial institution reserve liquidity ranges.