The NFT and crypto house has been a rollercoaster of highs and lows, however latest tweets and discussions counsel that the market could also be dealing with one in all its most difficult durations but. From failed initiatives to plummeting token values, the sentiment is overwhelmingly damaging. Let’s dive into the main points and analyze whether or not it is a short-term setback or an indication of a bigger collapse.

What’s Going Unsuitable with NFT Initiatives?

The tweets paint a grim image of the present state of NFT and crypto initiatives. Right here’s a breakdown of the important thing points:

Summary’s Spectacular Failure

The tweet from @charcoonchain highlights the catastrophic failure of Summary, a venture that reportedly left many traders out of pocket. This raises questions in regards to the viability of comparable initiatives and the due diligence being carried out by traders.

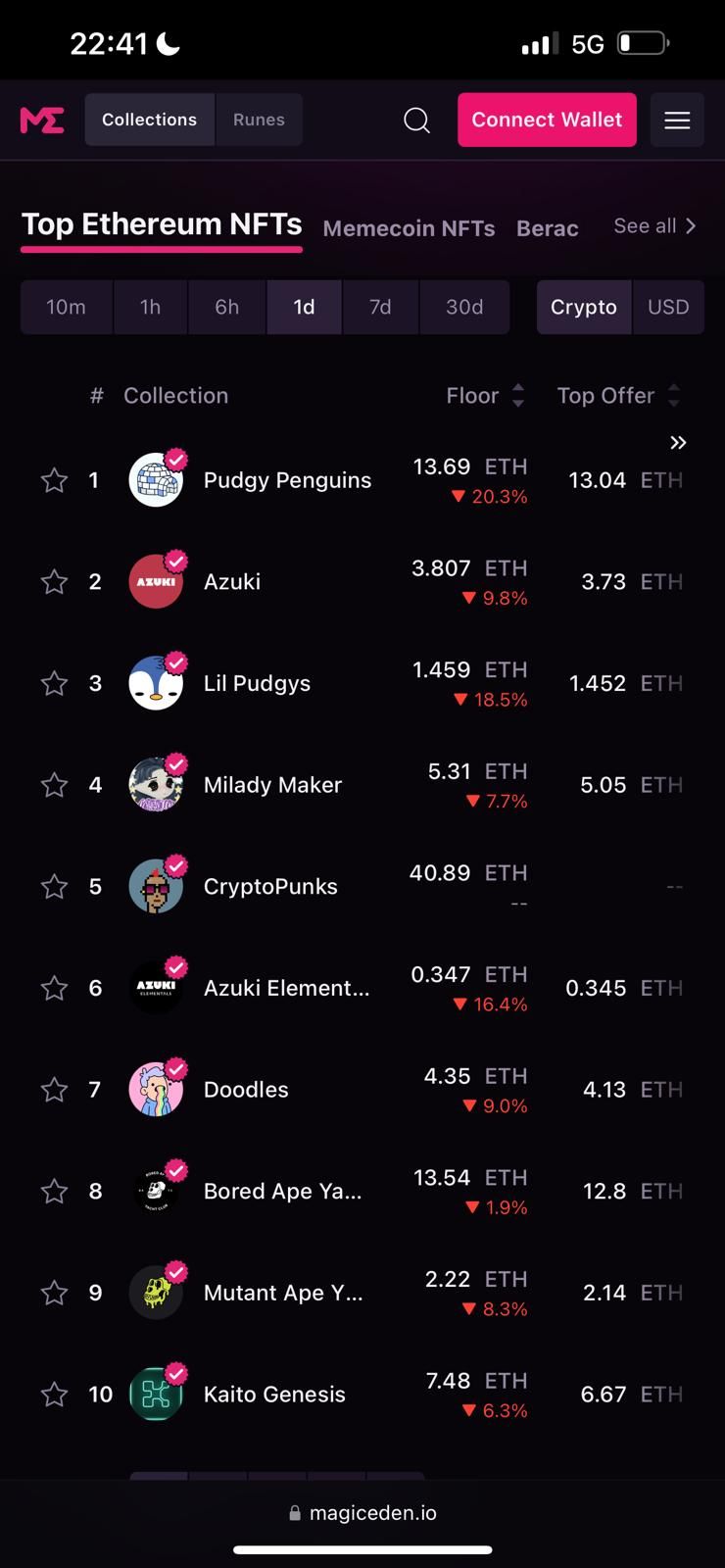

Pudgy’s Downward Spiral

One other tweet from @carl_m101 means that Pudgy, a once-promising venture, is “instantly on the best way to zero.The Pudgy Recreation hit laborious signifies that even initiatives with gaming components, which had been seen as a possible savior for NFTs, are struggling. Is that this an indication that the NFT gaming area of interest is shedding its attraction?

Yuga Labs Beneath Fireplace

Criticism of Yuga Labs, the creators of the Bored Ape Yacht Membership (BAYC), can be mounting. A tweet from @kodama_eth factors that even the giants of the NFT world are usually not resistant to backlash. What does this imply for the way forward for blue-chip NFT initiatives?

ApeChain’s Demise

The identical tweet from @kodama_eth mentions that with practically all launched tokens hitting all-time low. Moreover, the return of AIP cash as a consequence of “a lot damaging vibes” is a transparent indicator of investor dissatisfaction. Are these initiatives failing due to poor execution, or is there a deeper problem with the NFT mannequin itself?

Founder Backlash Towards KOL Advertising and marketing

Garga, the founding father of Apes, is reportedly “hating in opposition to KOL advertising.” Key Opinion Leaders (KOLs) have been instrumental in selling NFT initiatives, however this criticism suggests a rising disillusionment with influencer-driven advertising. Is that this an indication that the NFT house is transferring away from hype and towards extra substantive worth propositions?

Why Are Buyers Shedding Religion?

The recurring theme in these tweets is loss—lack of cash, lack of belief, and lack of momentum. Listed below are some attainable causes for this downward development:

Overhyped Initiatives: Many NFT initiatives rely closely on hype and advertising moderately than delivering tangible utility or worth. When the hype fades, so does investor curiosity.

Lack of Regulation: The absence of clear laws within the crypto house makes it a breeding floor for scams and poorly managed initiatives.

Market Saturation: With numerous NFT initiatives launching on daily basis, the market is changing into oversaturated, making it tougher for any single venture to face out.

Financial Elements: Broader financial situations, resembling inflation and rising rates of interest, could also be inflicting traders to drag again from high-risk belongings like NFTs and crypto.

What Can Buyers Do to Defend Themselves?

Given the present state of the market, it’s essential for traders to train warning. Listed below are some steps to think about:

Do Your Analysis: Earlier than investing in any venture, completely analysis its workforce, roadmap, and neighborhood sentiment. Keep away from initiatives that rely solely on hype.

Diversify Your Portfolio: Don’t put all of your eggs in a single basket. Unfold your investments throughout totally different asset lessons to mitigate threat.

Keep Knowledgeable: Sustain with the newest information and tendencies within the NFT and crypto house. Be part of communities and boards to remain forward of potential pink flags.

Be Skeptical of Hype: If a venture appears too good to be true, it in all probability is. Be cautious of initiatives that promise unrealistic returns or rely closely on influencer endorsements.

Is This the Finish of NFTs and Crypto?

Whereas the present state of affairs is undeniably regarding, it’s essential to keep in mind that the NFT and crypto house continues to be in its infancy. Market corrections and failures are a part of the pure evolution of any rising business. Nonetheless, the latest spate of failures and criticisms ought to function a wake-up name for each traders and venture creators.

The important thing query is: Will the NFT and crypto house study from these errors and evolve, or will it proceed down a path of decline? Solely time will inform, however one factor is evident—traders should tread fastidiously in these turbulent waters.