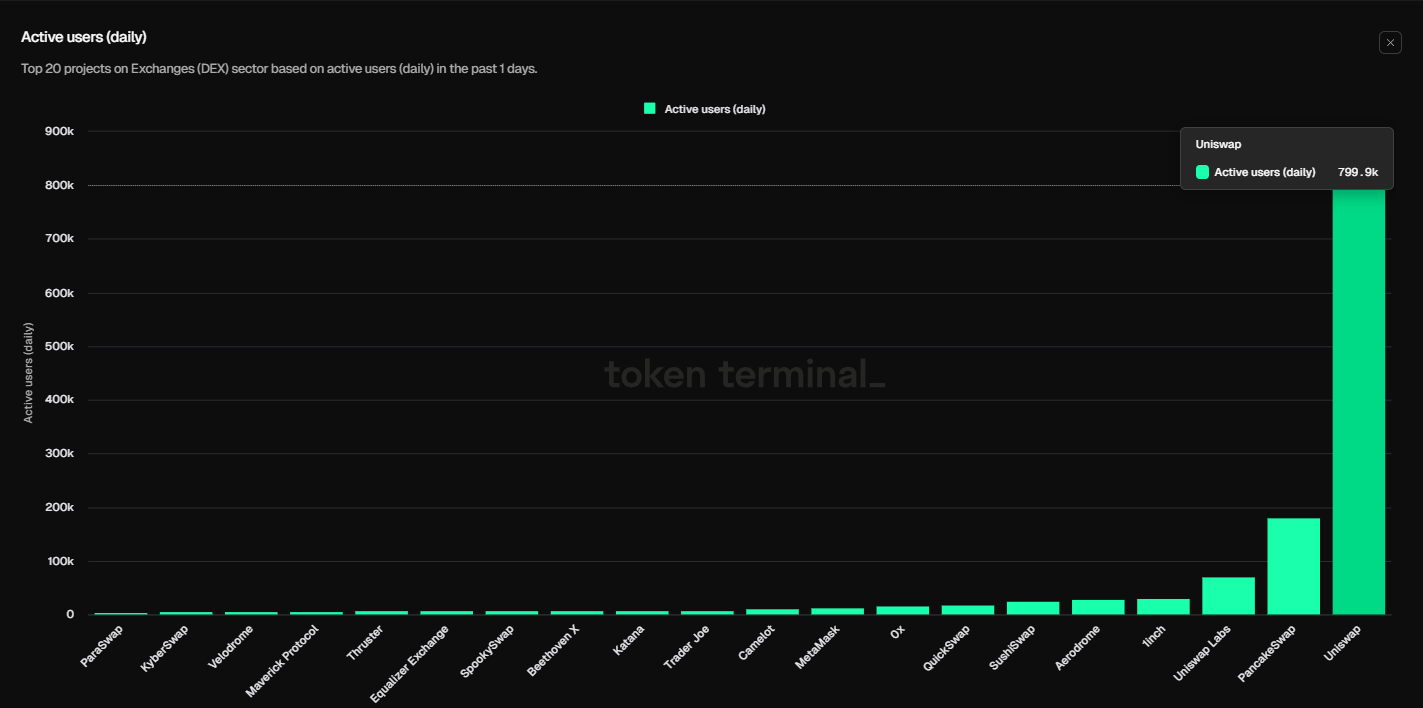

- Uniswap each day lively customers are the very best than different DEX exchanges.

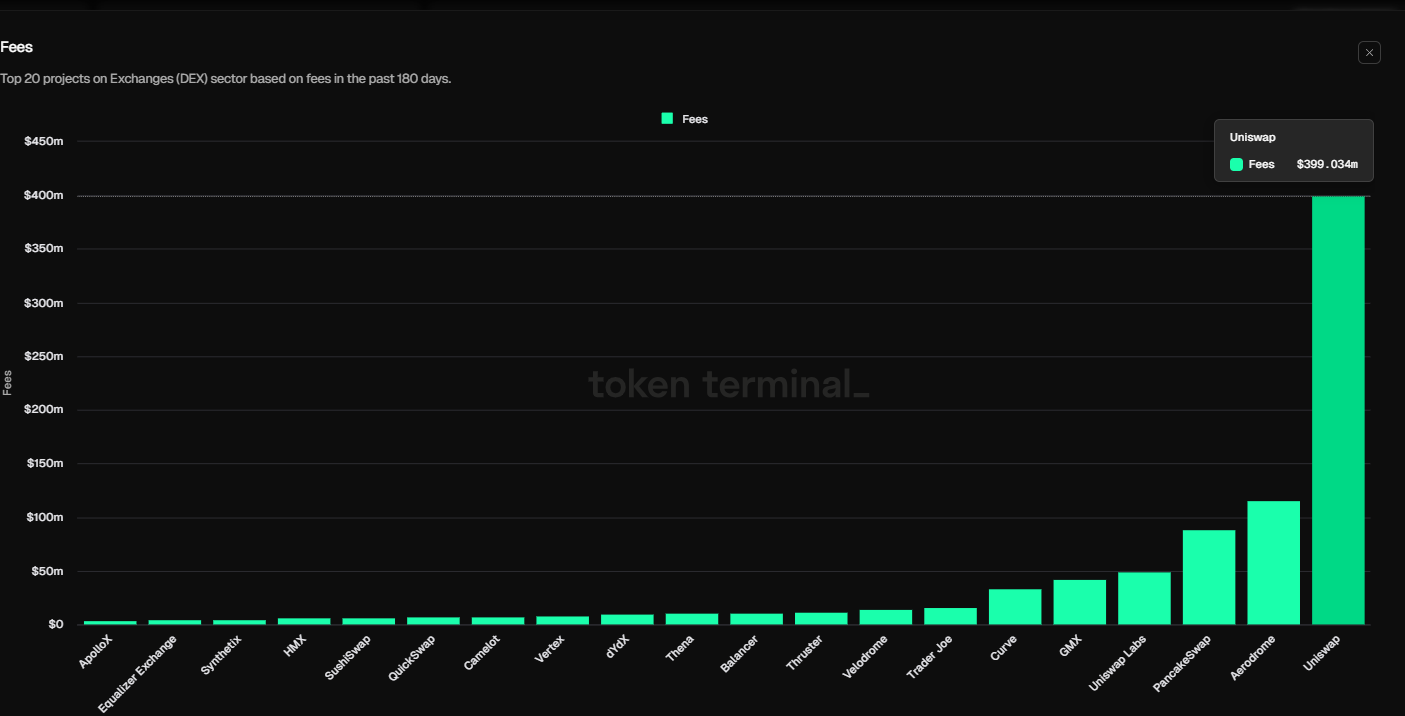

- Token Terminal knowledge present UNI has collected $399 million in charges previously three months.

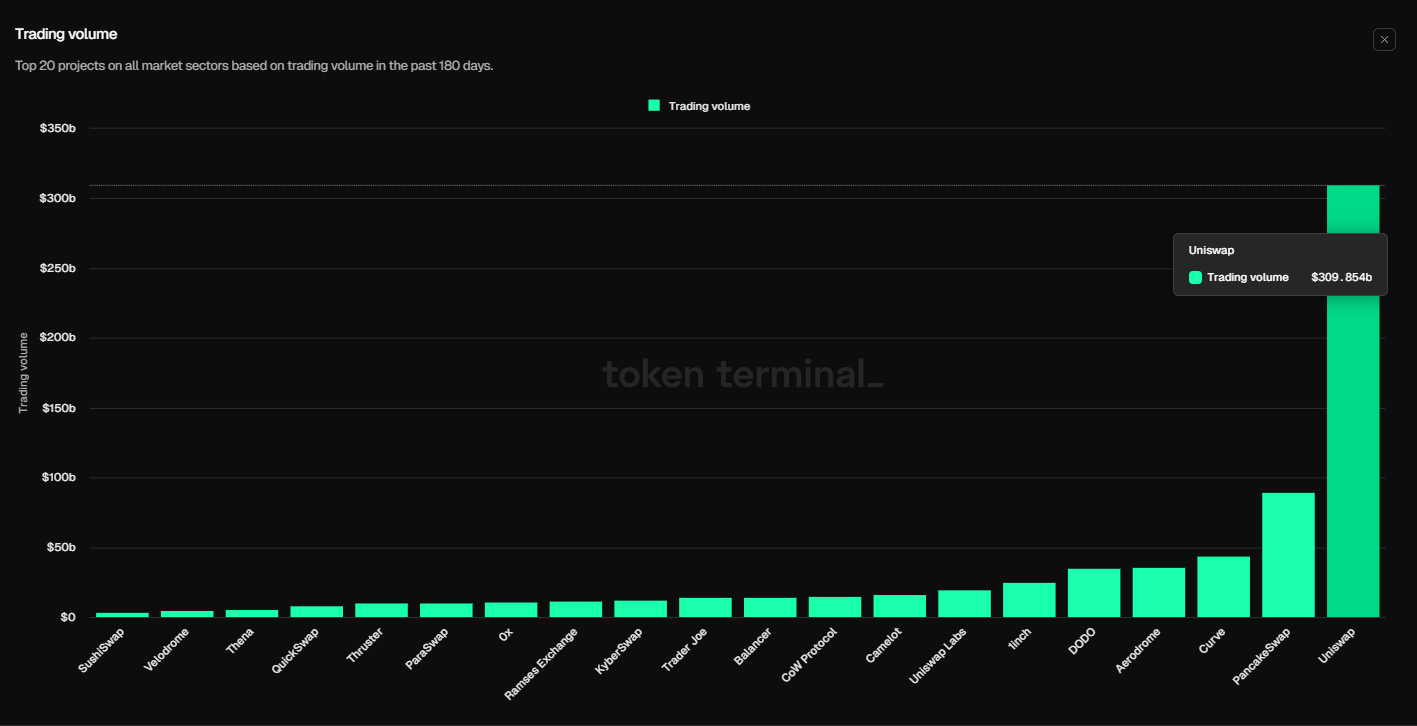

- UNI’s 180-day buying and selling quantity is the very best within the DEX sector.

Uniswap (UNI) worth trades above $7.8 and good points over 6% on the time of writing on Thursday, reflecting optimism as on-chain metrics point out sturdy efficiency. Token Terminal knowledge reveals UNI has outpaced different decentralized exchanges (DEX) platforms in each day lively customers, price assortment, and buying and selling quantity over the previous three months. Moreover, the Santiment’s Provide on Exchanges metric has continuously declined since August, suggesting rising confidence amongst buyers and a possible rally forward.

Uniswap outperforms most DEX exchanges

The crypto aggregator platform Token Terminal knowledge reveals how Uniswap has outperformed most decentralized exchanges over the past three months.

Uniswap’s each day lively customers assist monitor community exercise over time and align with the bullish outlook. The graph under reveals that the each day lively customers on the Uniswap platform are 799,900, the very best each day customers in comparison with the highest 20 initiatives within the DEX sector. This means that demand for UNI’s platform utilization is rising, which may propel a rally in Uniswap worth.

High 20 DEX initiatives lively each day customers chart. Supply: Token Terminal

Moreover, Uniswap’s price assortment surpasses that of different platforms within the DEX sector. Previously three months, UNI has collected over $399 million in charges, additional bolstering the bullish outlook for UNI’s worth.

High 20 DEX initiatives Charges chart. Supply: Token Terminal

One other facet bolstering the platform’s bullish outlook is a surge in merchants’ curiosity and liquidity within the UNI chain. UNI’s 180-day buying and selling quantity is $309.85 billion, the very best in comparison with the highest 20 initiatives in DEX sectors.

High 20 DEX initiatives buying and selling quantity chart. Supply: Token Terminal

Lastly, the Santiment Provide on Exchanges metric declined from 76.74 million on September 28 to 75.58 million on Thursday and has continuously declined since August. This 1.5% decline in provide on exchanges signifies rising confidence amongst buyers as holders take away UNI tokens from exchanges and retailer them in chilly wallets, lowering promoting stress on UNI’s worth.

UNI Provide on Exchanges chart. Supply: Santiment