Japan’s 40Y Bond Yield has hit 2.85%, dangerously near its historic 3% excessive. Japan’s predicament may trigger a trickle-down impact that may spike U.S. yields and ultimately ship the crypto market right into a downward spiral.

In keeping with information from Buying and selling Economics, Japan’s 40-year Bond Yield peaked at 2.85% on March 10, primarily based on over-the-counter interbank yield quotes. The positioning states the final time Japan’s 40Y Bond Yield reached an all-time excessive of three% was in January 2011. Nonetheless, Bloomberg famous that it additionally reached that degree in January 2024.

Japan is the holder of the world’s largest debt pile, which is greater than double its $5 trillion-valued financial system. Rolling over that debt at larger yields would require larger prices, and with the Financial institution of Japan proudly owning round 70% of their authorities bonds, markets may begin doubting its sustainability

For many years, Japan’s financial coverage has saved their charges extraordinarily low. Nonetheless, the spike in Japan’s 40Y Bond Yield may sign a shift in inflation and rates of interest domestically. If yields proceed to rise and doubtlessly attain the three% excessive, it might lure Japanese buyers again to home yields and away from U.S. yields.

For context, Japan is without doubt one of the largest overseas holders of US Treasuries. As Japanese yields turn out to be extra engaging, Japanese buyers may choose them over U.S. debt that provides decrease yields. This might cut back demand for U.S. Treasuries, which may result in larger U.S. yields because the U.S. authorities makes an attempt to compete.

An uptick in U.S. yields may imply an increase in borrowing prices for each authorities and personal companies. Not solely that, elevated yields may strengthen the U.S. {dollars} alongside U.S. Treasuries.

You may additionally like: How Trump’s proposed tariffs may have an effect on crypto

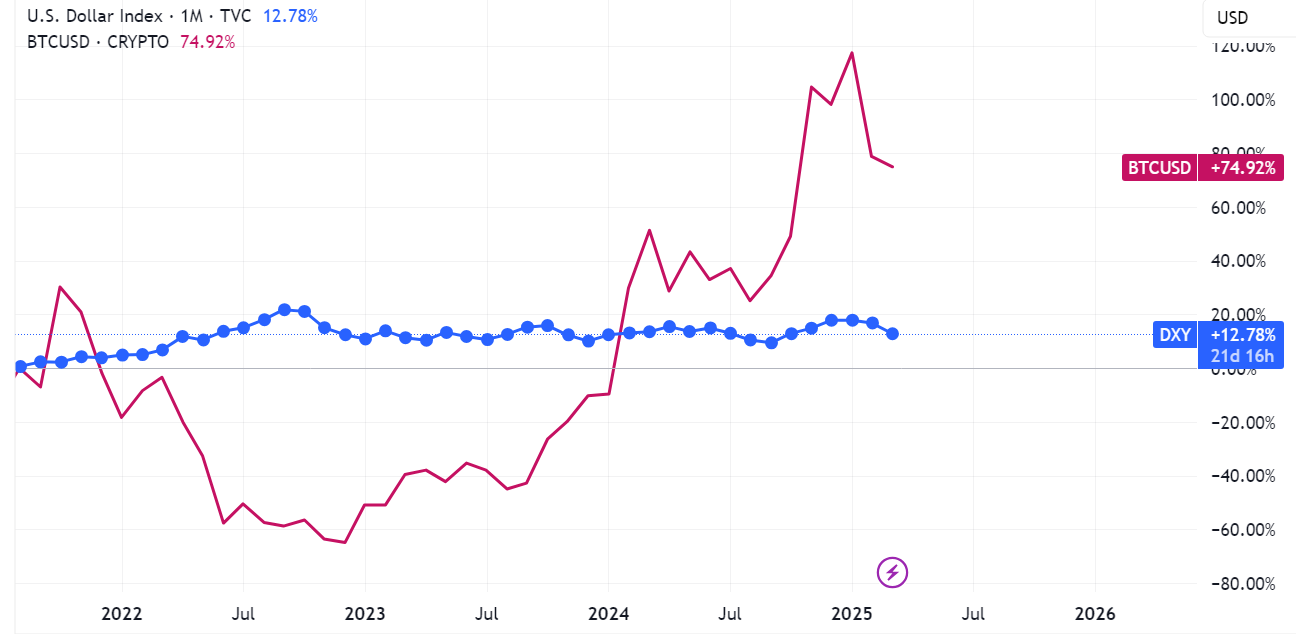

Chart showcasing the inverse relationship between the U.S. greenback and Bitcoin, March 10, 2025 | Supply: TradingView

As seen on the chart above, the U.S. greenback index and the crypto market (represented by the staple Bitcoin (BTC) value) have an inverse relationship. Due to this fact, when the greenback goes up, crypto tends to go down.

When typical property just like the greenback and U.S. Treasuries provide higher returns, buyers may flock in the direction of them and divert their funds away from riskier different property, comparable to shares and the crypto market. Moreover, rising yields on authorities bonds may additionally point out tighter international liquidity.

For the crypto market, which often advantages from free financial circumstances and ample liquidity, this financial shift might be catastrophic. Crypto markets are significantly delicate to shifts in international liquidity and danger sentiment, due to this fact this shift may end in elevated volatility and downward strain for crypto property.

With buyers pulling their funds away from dangerous property, it may ultimately cut back inflows into crypto the crypto market, leading to a drag on crypto costs.

General, Japan’s 40Y Bond Yield may spell bother for the crypto market. The shift in financial circumstances led by the Japan’s 40Y Bond Yield reaching its 3% excessive may strengthen the greenback, tighten international liquidity, and reduces investor capital flowing into riskier property like crypto.

Learn extra: Japan PM calls crypto ‘extraordinarily vital’ forward of 2025 crypto tax overview