Financial institution of Japan officers are starting to acknowledge what as soon as appeared outlandish: that cryptocurrencies may someday develop into a significant a part of on a regular basis funds in Japan—and even perhaps problem the yen itself.

Whereas they stress that such a shift received’t occur in a single day, the notion that digital property may reshape the nation’s cost panorama is now not mere hypothesis; it’s more and more being handled as a believable state of affairs.

At a current assembly with private-sector companions concerned within the BOJ’s central financial institution digital foreign money pilot, Govt Director Kazushige Kamiyama mentioned that whereas Japan nonetheless sees excessive ranges of banknote issuance, “utilization of notes may fall considerably sooner or later amid speedy digitalisation.”

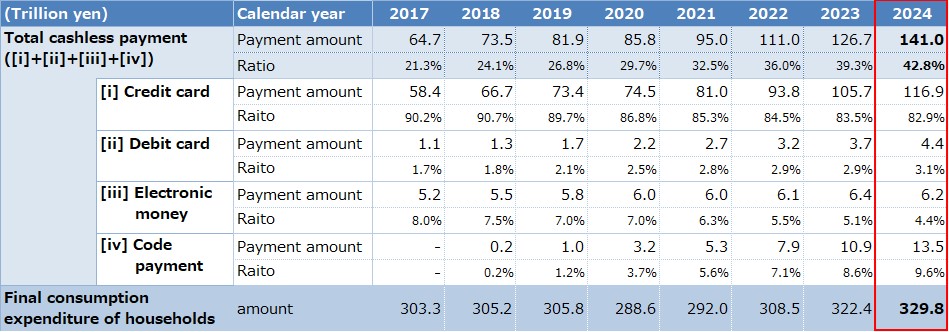

Modifications within the breakdown of the cashless cost quantity and cashless cost ratios by numerator | Supply: Japan’s Ministry of Economic system, Commerce and Trade

It was a nod to what’s changing into more and more troublesome to disregard these days. The nation as soon as identified for clinging to paper yen has been shifting quick. Authorities knowledge confirmed cashless funds jumped to 42.8% of all transactions in 2024, practically tripling from simply over 13% in 2010. Japan even hit its official 40% goal a yr forward of schedule.

The Financial institution of Japan isn’t making any guarantees simply but. It hasn’t determined whether or not it’ll really roll out a digital yen — principally its model of a central financial institution digital foreign money — however the pilot program that kicked off in 2023 is now operating at full velocity.

Whereas BOJ officers aren’t embracing crypto as a substitute for fiat, their rising help for a digital yen suggests they see decentralized property as a severe contender within the funds area.

Kamiyama says the BOJ wants to think about how you can maintain the retail funds system “handy, environment friendly, accessible universally, whereas being protected and resilient.” That’s the place issues get extra speculative.

Future the place crypto wins

Talking over the weekend, BOJ Deputy Governor Shinichi Uchida steered one thing not often mentioned aloud by a central banker in Japan: if the BOJ fails in its core responsibility — value stability — individuals may cease trusting the yen. And in that case, he warned, one other instrument may step in.

In a digitally superior society, Uchida mentioned, there may be “no assure that foreign money issued by the central financial institution of a sovereign nation will proceed to perform as a typically acceptable cost instrument.” Though he didn’t drop any names, however he did recommend that cryptocurrencies and stablecoins may finally step in to fill the hole.

Nonetheless, Uchida was cautious to say he doesn’t count on money to vanish “any time quickly,” however the truth that he raised the prospect of crypto overtaking the yen — hypothetically or not — says rather a lot about how the dialog is shifting in central financial institution circles.

The place issues stand now

As of mid-2025, Japan’s financial system stays fragile. Inflation has been risky, hovering simply above 2% in current months. Development is sluggish, and the BOJ remains to be navigating the lengthy tail of post-pandemic stimulus insurance policies.

In that atmosphere, digital funds have gained floor, not simply by way of CBDC discussions, however in the true financial system. Native surveys recommend youthful shoppers are more and more turning to cellular apps and QR code programs. Crypto use remains to be modest in comparison with South Korea or the U.S., however it’s rising.

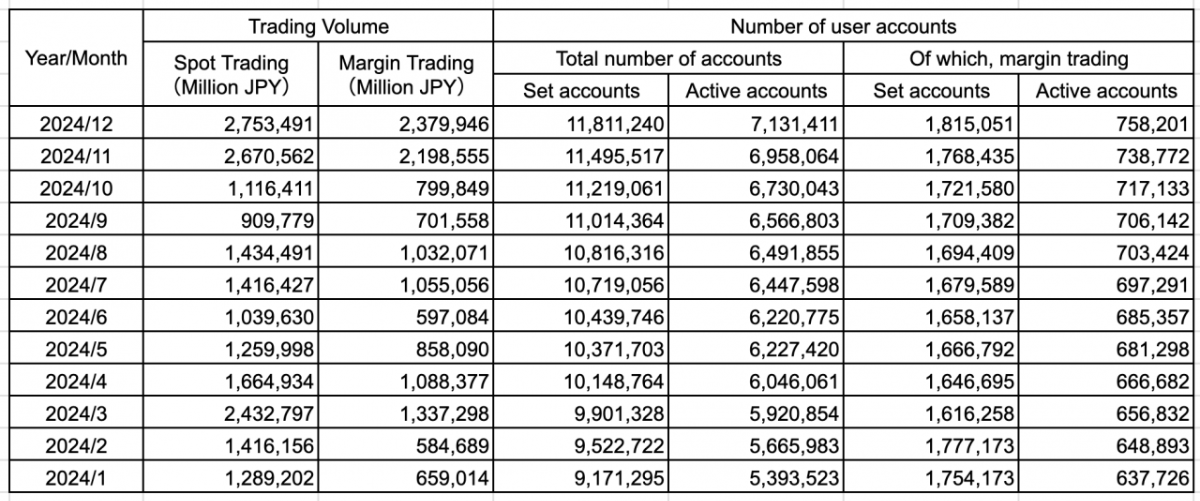

Buying and selling quantity of variety of Japanese crypto accounts | Supply: Bitbank Ventures

In accordance with a report from Bitbank Ventures, there are over seven million energetic crypto accounts in Japan as of December 2024, up from 5 million in early 2024. Bitcoin (BTC) and Ethereum (ETH) stay essentially the most generally held, however stablecoins pegged to the yen or greenback are additionally gaining traction in cross-border commerce and remittances.

After which there’s regulation. Japan has lengthy had a few of the tightest crypto guidelines on the planet. However these days, regulators have proven extra flexibility, particularly with regards to stablecoins and their position in cost infrastructure.

You may also like: Japan eyes G7 help to thwart North Korea’s crypto-funded weapons programme

The CBDC query

Whilst crypto adoption rises, the BOJ remains to be very a lot centered by itself digital providing. The CBDC pilot remains to be in its energetic section, involving checks with main Japanese banks like MUFG, SMBC, Mizuho, together with regional banks and fintech companies.

And whereas the digital yen isn’t stay but — and there’s nonetheless no official launch date — BOJ officers have been talking out extra about why it issues and the position it may play in Japan’s future financial system. Uchida known as the CBDC a “important piece of infrastructure” that would assist preserve public belief within the yen. Nonetheless, he emphasised that demand for money will doubtless stay sturdy. At the very least within the close to time period.

Globally, the race can also be heating up. The European Central Financial institution is doubling down on plans for a digital euro. And within the U.S., President Donald Trump’s govt order banning a digital greenback has expectedly pushed the talk ahead — by politicizing it. His transfer, seen by some as an endorsement of crypto and stablecoins, is prompting different central banks to behave quicker.

As an example, as crypto.information reported earlier, JPMorgan Chase, Financial institution of America and different main banks are reportedly exploring a shared stablecoin to maintain tempo with rising competitors. One concept reportedly being mentioned is to let different banks use the stablecoin. Some regional and group banks have reportedly additionally explored a separate stablecoin consortium, although particulars stay unclear.

Japan will not be dashing. But it surely’s clearly getting ready. And that preparation now consists of at the least entertaining the concept that crypto may develop into greater than only a fringe asset.

Learn extra: Will the rising Japanese yen have an effect on Bitcoin and altcoin costs?