JPMorgan simply unveiled a inventory forecast mannequin that’s making waves throughout Wall Road. The banking big’s new strategy to inventory market prediction instruments has uncovered somethin surprising about how markets really work. Their AI inventory market forecasting system analyzes six totally different market indicators, and the findings are difficult just about every part we thought we knew about market volatility indicators and investor danger administration.

Inside JPMorgan’s AI Inventory Forecast Mannequin And Market Volatility Influence

The Six-Sign Framework That’s Altering All the pieces

So right here’s how JPMorgan’s inventory forecast mannequin really works. Strategists on the financial institution, led by Nikolaos Panigirtzoglou, constructed this technique that appears at six key indicators: quantity, worth, positioning, flows, financial momentum, and in addition value momentum. Every of those will get measured in opposition to its personal historic efficiency utilizing what they name z-scores.

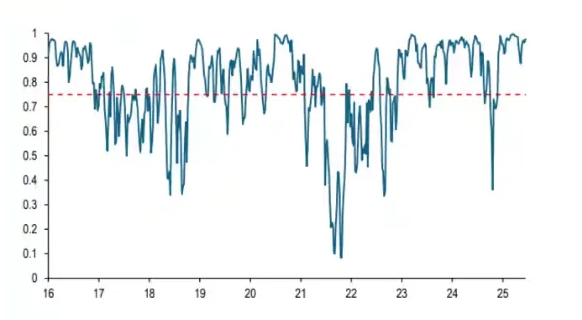

The staff educated their mannequin on information going again to late 2022, after which they examined it on newer numbers. What they discovered was fairly spectacular – their six-month predictions for down strikes had been appropriate 76% of the time throughout coaching intervals. Even the “out of pattern” testing achieved 63% accuracy, which is method higher than most competing inventory market prediction instruments on the market.

The Stunning Discovery About Valuations

Now right here’s the place issues get actually attention-grabbing with JPMorgan’s inventory forecast mannequin. You know the way everybody at all times says that low cost shares are good investments? Effectively, this ai inventory market forecasting analysis is saying the other.

The strategists discovered one thing that goes in opposition to standard knowledge. In keeping with their evaluation, when valuations look engaging, future returns are likely to disappoint. This occurs as a result of good valuations typically get tied up with declining 10-year Treasury yields, which may sign bother for financial progress down the street.

Financial Momentum and Market Positioning

The JPMorgan mannequin reveals that stronger financial momentum – measured by way of world manufacturing information – and better buying and selling exercise each improve the probabilities of market positive factors. However right here’s the catch: when there are excessive ranges of bullish positions, or giant flows into inventory funds versus bonds, that’s really a warning signal.

These market volatility indicators recommend overcrowding, which generally results in corrections. It’s like when everybody’s piling into the identical commerce – that’s often when issues begin getting dangerous for investor danger administration methods.

What the Mannequin Says Proper Now

On the time of writing, JPMorgan’s inventory forecast mannequin is delivering some fairly optimistic information. The system reveals a 96% chance that shares will rise over the subsequent six months. That’s one of many highest confidence ranges we’ve seen from these sorts of inventory market prediction instruments.

This bullish studying comes as US inventory futures have been rising, placing new S&P 500 data inside attain. The AI inventory market forecasting mannequin’s present evaluation means that positioning ranges and market situations assist this optimistic outlook.

What This Means for Traders

This analysis from JPMorgan is basically altering how we must always take into consideration conventional market indicators. The truth that good valuations may really sign future issues means buyers have to rethink their strategy to discovering bargains.

The mannequin’s give attention to market volatility indicators and positioning information gives precious insights into when markets is likely to be getting too crowded. For investor danger administration functions, the findings recommend that when institutional cash flows closely favor shares over bonds, that’s when correction dangers begin build up.

Proper now, the 96% bullish sign from JPMorgan’s inventory forecast mannequin is actually encouraging. However given how correct these inventory market prediction instruments have been at predicting downturns, buyers ought to positively concentrate when the mannequin finally turns bearish.