Ethereum (ETH) is displaying early indicators of restoration because it consolidates close to the $3,250 mark, reclaiming important assist ranges.

Regardless of lagging behind the broader cryptocurrency market, which has been led by Bitcoin’s (BTC) near-$100,000 rally, ETH is poised for important momentum as altcoin season gathers steam.

Ethereum key ranges to look at

In a latest TradingView evaluation, analyst RLinda famous that ETH is signaling an imminent breakout, with key resistance and assist ranges poised to find out its subsequent course.

On the upside, a breakout above the quick resistance at $3,442 would affirm bullish momentum, with the following goal at $3,568.

If this stage is breached, ETH may goal for the psychological barrier of $3,750, and through a powerful rally, the value may even climb to $4,000, pushed by the altcoin season momentum.

On the draw back, the quick assist at $3,028 can be important to keep up the bullish construction, with stronger assist at $2,820 performing as a continuation zone. A failure to carry these ranges may push ETH decrease.

That being stated, Ethereum’s trajectory stays intently tied to Bitcoin’s efficiency, prevailing market sentiment, and exterior catalysts.

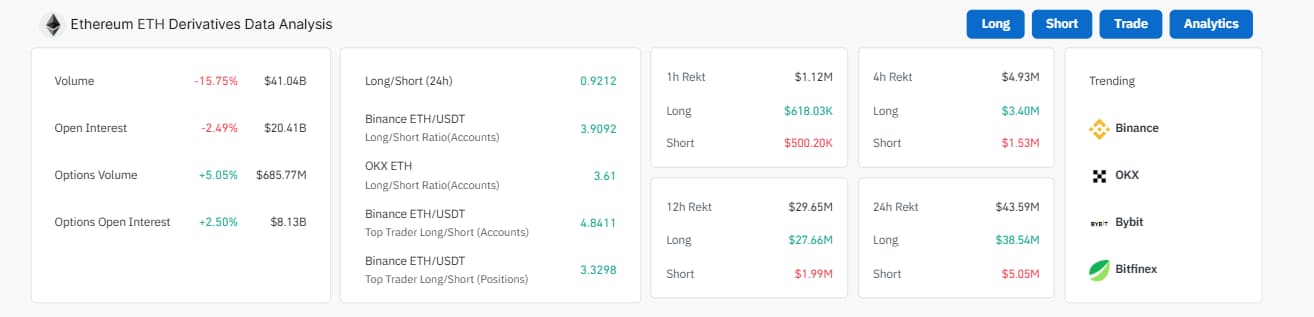

Derivatives knowledge: Optimism regardless of declines

The Ethereum derivatives knowledge signifies a bullish tilt, supported by key metrics regardless of a slight decline in total exercise.

Whereas buying and selling quantity has dropped by 15.75% to $41.04 billion and open curiosity has decreased by 2.49% to $20.41 billion, the choices market reveals rising demand, with choices quantity rising by 5.05% to $685.77 billion and choices open curiosity growing by 2.50% to $8.13 billion.

Lengthy positions dominate the market, with the Binance ETH/USDT lengthy/brief ratio at 3.9092 and OKX at 3.61, whereas prime merchants on Binance exhibit even stronger bullish sentiment, with an extended/brief ratio of 4.8411 for accounts.

Moreover, substantial brief liquidations, totaling $38.54 million prior to now 24 hours in comparison with solely $5.05 million in longs, spotlight a brief squeeze driving bullish momentum. Regardless of minor declines in quantity and open curiosity, the info suggests merchants are optimistic about Ethereum’s upward worth potential.

Analysts like Alan Santana have interpreted the latest worth surge as a possible indicator of the beginning of a brand new bull market, with Ethereum projected to climb as excessive as $8,000 within the coming months.

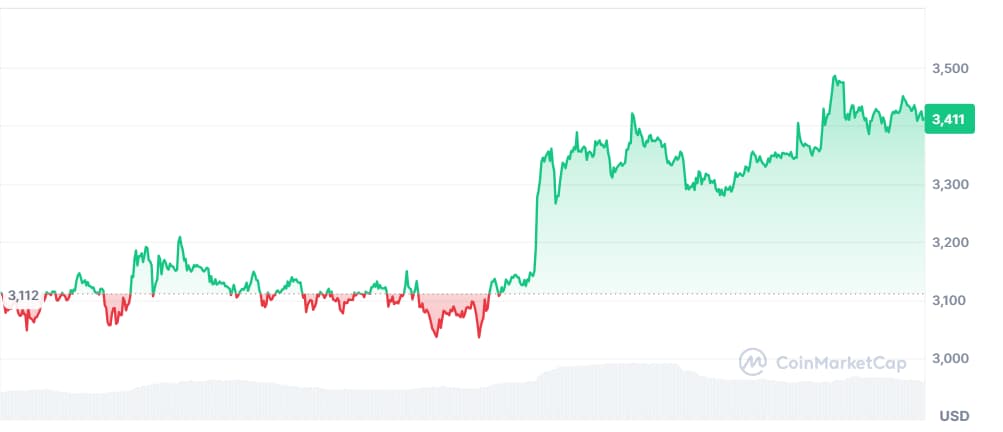

Ethereum worth evaluation

Ethereum is presently buying and selling at $3,315, marking a 3% dip over the past 24 hours however sustaining a stable 7% acquire for the week.

This latest resilience comes amid a major shift in market sentiment, pushed by renewed curiosity in U.S.-based spot Ethereum ETFs.

In keeping with knowledge from SoSoValue, these ETFs noticed a internet influx of $91.21 million on Friday, their first constructive influx since November 13, signaling a possible revival in institutional confidence.

Institutional gamers and whales have additionally contributed to Ethereum’s bullish outlook. Analyst Ali Martinez famous a outstanding accumulation of 430,000 ETH, price roughly $1.4 billion, over the previous two weeks. This surge in large-scale shopping for displays rising confidence amongst main buyers, positioning Ethereum for additional worth appreciation.

AI-driven forecasts additional strengthen the optimism, projecting Ethereum’s year-end worth to vary between $3,800 and $4,200. The mixture of ETF inflows and whale exercise has set the stage for a doubtlessly sustained rally, leaving buyers hopeful that the present momentum will propel Ethereum to new highs because the altcoin season gathers steam.

Featured picture through Shutterstock