The tokenization of real-world property (RWAs) is accelerating a basic shift in world finance, with blockchain-based U.S. Treasuries, equities, commodities, and personal credit score poised for exponential progress this 12 months, in keeping with a report by market maker Keyrock and tokenization platform Centrifuge.

Keyrock and Centrifuge Evaluation: Tokenized RWAs May Seize 10% of Stablecoin Market by 12 months’s Finish

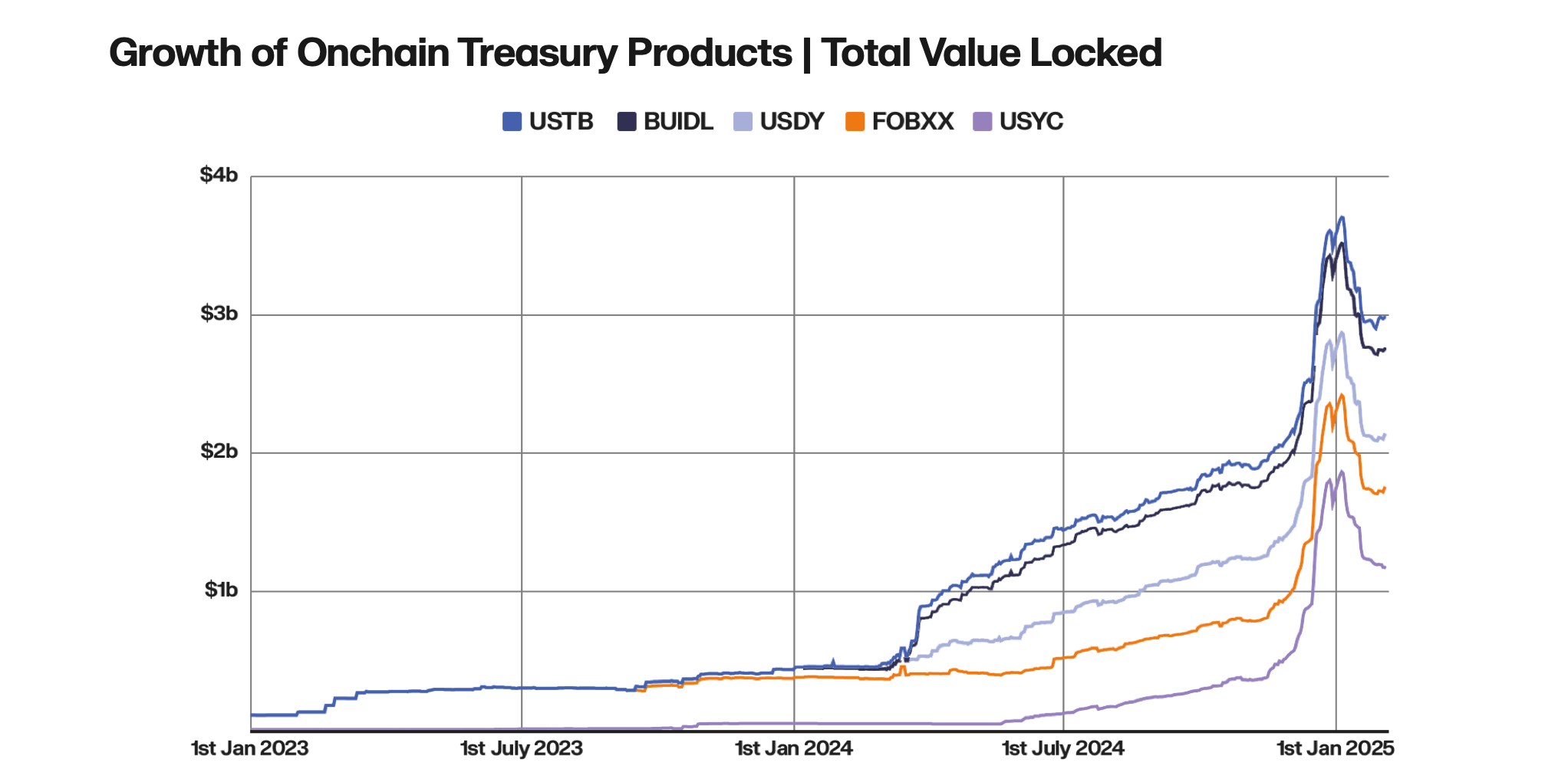

Tokenized U.S. Treasuries have surged 415% year-over-year, pushed by yield-seeking stablecoin holders and institutional adoption, the 2 companies report. Keyrock and Centrifuge mission that this sector might attain $28 billion if tokenized merchandise seize 10% of the $210 billion stablecoin market. “We anticipate tokenized Treasuries to evolve from a distinct segment innovation right into a core infrastructure part of worldwide digital finance,” the report notes.

The evaluation explains that tokenized equities lag at $15 million TVL however face a pivotal 2025 as regulatory readability expands. Backed Finance and Ondo World Markets now allow permissionless entry to tokenized S&P 500 exchange-traded funds (ETFs) and company shares.

“The democratization of subtle monetary instruments via non-KYC, permissionless protocols guarantees to unlock trillions in untapped market potential from beforehand underserved areas and populations,” the Keyrock and Centrifuge research particulars.

The report highlights that commodities like gold battle with liquidity gaps regardless of $1.2 billion in tokenized provide, although artificial platforms like Ostium Labs purpose to seize speculative demand. Non-public credit score leads with $12.2 billion TVL, as Centrifuge’s institutional swimming pools slash securitization prices by 97%.

Regulatory hurdles persist, notably for equities, however Keyrock and Centrifuge notice that bipartisan U.S. laws and European frameworks like MiCA are easing pathways. The report forecasts that complete tokenized RWAs might hit $50 billion in a 2025 bull case, fueled by institutional uptake and vital decentralized finance (DeFi) integration.

“This motion envisions restructuring world finance by democratizing entry, rising effectivity, and enhancing transparency throughout asset lessons,” the tokenized RWA evaluation explains. “As a substitute of gradual settlement pipelines, markets might function on blockchain rails with near-real-time settlement and verifiable possession information, lowering counterparty dangers and back-office friction.”

With tokenized Treasuries modernizing settlements and personal credit score democratizing entry, Keyrock and Centrifuge place 2025 because the inflection level for blockchain’s $30B–$50B breakthrough.