The most important publicly listed Wall Road Bitcoin (BTC) miner, MARA Holdings (NASDAQ: MARA), has introduced the acquisition of a $200 million line of credit score. The credit score facility is secured by a portion of the corporate’s crypto holdings, highlighting the rising development of cryptocurrency-backed financing within the company world.

The assertion introduced yesterday (Tuesday) by MARA does not delve too deeply into particulars, solely informing that the cryptocurrency miner used a portion of its substantial Bitcoin stack to safe a $200 million line of credit score.

Fred Thiel, CEO, MARA, Supply: LinkedIn

What is going to the funds be used for? Right here too, no detailed info was supplied past a normal assertion that “MARA could use the funds to capitalize on strategic alternatives and for different normal company functions.”

It is price noting that MARA, often known as Marathon Digital Holdings till August, is the most important BTC producer listed on Wall Road, with a present market capitalization of almost $5 billion. It considerably outpaces Core Scientific, which is in second place with a worth of $3.3 billion.

The transfer comes just a few months after MARA determined to buy Bitcoin for $249 million. In August, it efficiently accomplished a $300 million providing of convertible senior notes, most of which was allotted to purchasing BTC.

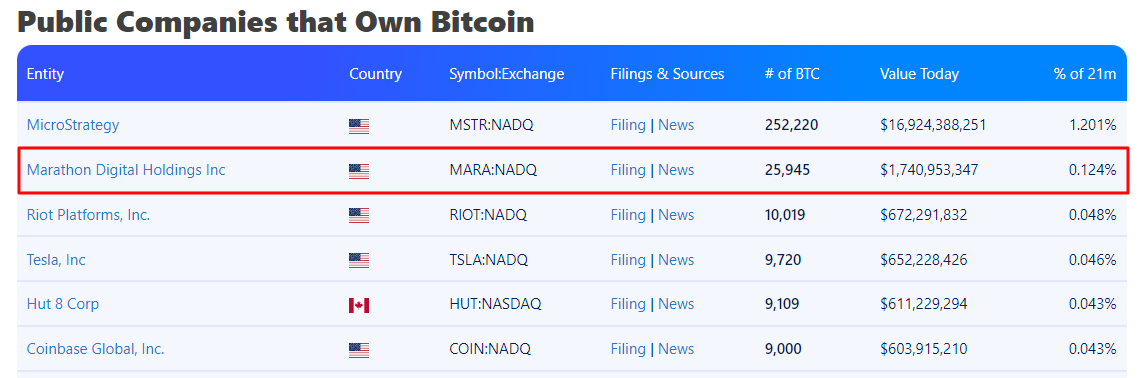

MARA is presently the second-largest public holder of Bitcoin, proper behind MicroStrategy. In keeping with Bitbo knowledge, it holds 0.12% of the whole BTC provide, or almost 26,000 tokens, with an estimated worth of virtually $1.8 billion.

MARA Inventory: Potential for a 50% Rebound In keeping with Macquarie

Regardless of the current rebound in Bitcoin’s worth, which is returning to round $68,000 this week and has grown by 60% in 2024, MARA shares have not given holders as a lot pleasure. 12 months-to-date, they’re down 28% and examined almost year-long lows in September.

Nonetheless, the most recent report from monetary group Macquarie means that this example could quickly change. The agency initiated protection of the corporate’s shares with an “Outperform” ranking and claims that its transfer in direction of synthetic intelligence (AI) and high-performance computing (HPC) may result in a 50% enhance in valuation. Macquarie’s present worth goal for MARA shares is $22, the best since July.

Wall Road Bitcoin Miners Transfer to AI and HPC

MARA is on the forefront of a development amongst Bitcoin miners, which includes looking for new sources of revenue from their huge knowledge facilities (so-called mines) within the face of rising competitors and difficulties within the mining sector, whereas business margins are declining.

Whereas MARA has not made any official bulletins relating to a shift in direction of AI, current modifications in management counsel a possible transfer on this route. The corporate has bolstered its Board of Administrators with new appointments, together with people with vital expertise in synthetic intelligence and knowledge middle operations.

VanEck’s head of digital property analysis, Matthew Sigel

Trade analysts are being attentive to the potential for Bitcoin mining corporations to pivot in direction of AI and high-performance computing. Matthew Sigel, head of digital property analysis at VanEck, initiatives that this strategic shift may generate substantial worth for mining companies within the coming years.

Sigel factors out the synergy between AI corporations’ power wants and Bitcoin miners’ entry to energy assets, stating, “AI corporations want power, and Bitcoin miners have it. Because the market values the rising AI/HPC knowledge middle market, entry to energy—particularly within the close to time period—is commanding a premium.”