Choices tied to Defiance’s 2X lengthy MicroStrategy ETF (MSTX) exhibit excessive bullish positioning.

The leveraged ETF is designed to 2 instances or 200% of the every day efficiency of MSTR’s share worth.

The crypto market proper now is sort of a curler coaster racing forward after which including a number of additional loops for good measure, pushing the fun and threat to new heights.

With bitcoin (BTC) on the run towards the $100,000 mark, merchants are utilizing choices tied to an already leveraged 2x lengthy exchange-traded fund (ETF) tied to bitcoin holder MicroStrategy’s share worth to amplify good points.

The Defiance Each day Goal 2X Lengthy MSTR ETF, buying and selling underneath the ticker MSTX on Nasdaq, seeks to ship two instances or 200% of the every day efficiency of MSTR’s share worth. The ETF surged 20%, briefly topping $180 on Tuesday, as MSTR jumped 10% to $473.

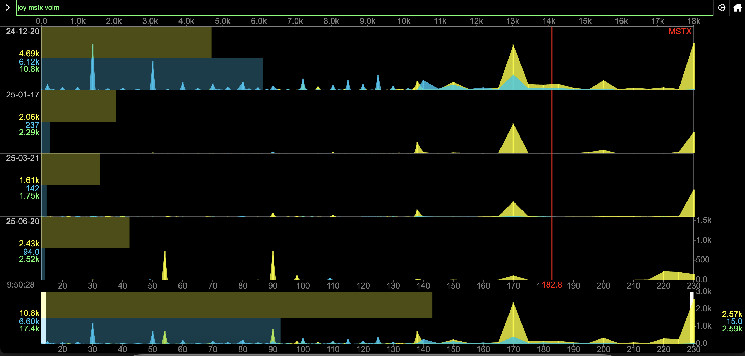

In the meantime, buying and selling volumes in choices tied to the ETF blew up, with market members piling into the deep out-of-the-money (OTM) larger strike name possibility at $230, in accordance with knowledge tracked by analytics platform ConvexValue. Deep OTM calls are cheaper than these close to the going market fee of the underlying asset, providing an uneven payout potential.

The demand for the $230 strike name was unfold throughout a number of expiries, together with contracts set to choose June 20, 2025. A name possibility provides the purchaser the suitable however not obligation to purchase the underlying asset at a predetermined worth on or earlier than a selected date. The choice permits the customer to regulate a big place within the underlying asset whereas paying a small premium upfront, thereby amplifying potential good points.

The acute bullish sentiment is according to the MSTR choices market, the place calls lately traded at a document premium relative to places often used to guard towards worth slides, in accordance with knowledge supply Market Chameleon. Related uber bullish flows have been crossing the tape on the CME, Deribit and the nascent choices tied to BlackRock’s spot bitcoin ETF, hinting at retail investor mania and construct up of speculative excesses that always result in market corrections.

The frenzied motion comes as expectations for friendlier regulatory strategy underneath President-elect Donald Trump and Fed fee cuts drive BTC larger. The main cryptocurrency by market worth set new lifetime highs above $97,000 early Thursday, taking the month-to-date acquire to 38%, CoinDesk knowledge present.

MSTR is the world’s largest public-listed BTC holder with a coin stash of 331,200 ($3.04 billion) steadily collected since 2020.