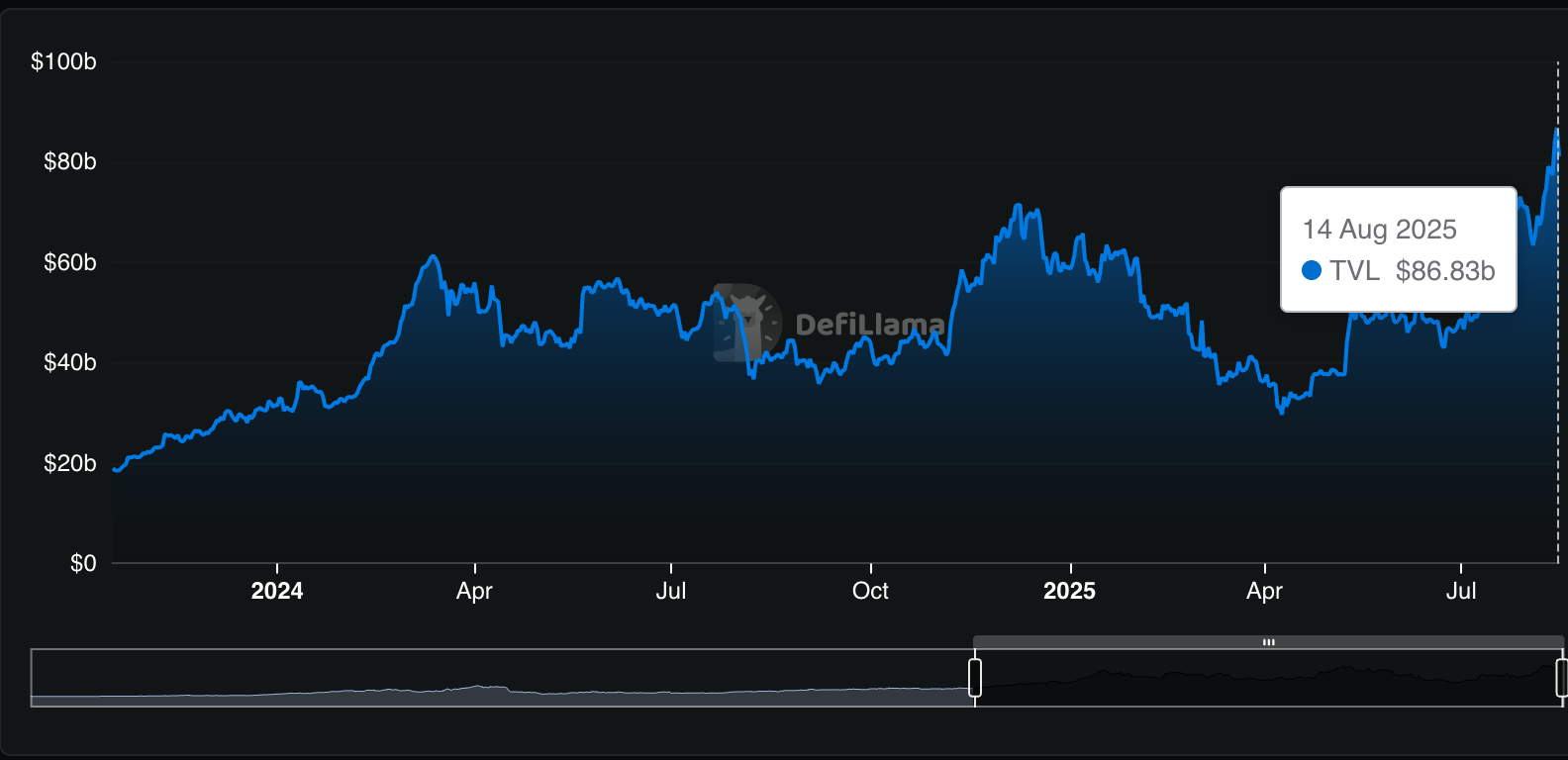

Liquid staking protocols surged to a document of over $86 billion in whole worth locked (TVL) yesterday, Aug. 14, in response to DefiLlama, marking a brand new excessive for the sector as demand for staking grows.

Right now, the overall liquid staking TVL stands at simply over $81 billion, with over $62 billion on the Ethereum community.

The brand new ATH determine represents over 50% of whole decentralized finance (DeFi) TVL, which presently stands at round $164 billion, per DefiLlama.

The document TVL comes after a interval of volatility for each liquid staking and DeFi as a complete, following a pointy decline between December 2024 and April. Consultants say the rebound indicators rising consumer confidence in Ethereum’s staking ecosystem and renewed urge for food for yield-generating crypto merchandise.

Liquid staking TVL. Supply: DefiLlama

Protocol Progress

Liquid staking protocol Lido is main the expansion, with the platform reaching a brand new all-time excessive TVL of $41.07 billion this week — practically half of your entire sector. This represents a 95% surge since early July, when its TVL was roughly $21 billion.

Lido’s native token LDO is presently buying and selling at $1.37, up 21% over the previous week and greater than 48% over the previous month.

Following Lido, Binance Staked ETH holds $14.81 billion in TVL, Rocket Pool has $3.17 billion, and Jito Liquid Staking sits at $2.97 billion, per DeFiLlama.

Liquid staking refers to when crypto holders deposit belongings right into a third-party liquid staking supplier and obtain tokens that symbolize their staked crypto and staking rewards, as an alternative of locking up funds totally.

ETH Rally and ETF Inflows

Notably, the surge in liquid staking TVL has coincided with a month-long Ethereum (ETH) value and TVL rally, as ETH pushed towards a brand new all-time excessive in latest days. ETH is presently buying and selling round $4,400, up 37% over the previous month.

Final week, The Defiant reported that staked ETH hit a brand new all-time excessive of 30%, per Coinbase, suggesting rising long-term confidence in Ethereum. Although as of this week, as ETH examined $4,800 ranges, the queue for validators to unstake ETH reached one other document excessive.

Conventional finance (TradFi) exercise helps drive the development as spot ETH exchange-traded funds (ETFs) have recorded greater than $2.9 billion in internet inflowsover the previous week, not but together with at this time’s inflows, surpassing the earlier weekly document of $2.1 billion set in mid-July. ETH ETFs additionally broke their day by day influx document this week, taking in $1.02 billion on Monday, Aug. 11, per knowledge from SoSoValue.

Up to now, ETH ETFs have reached a complete internet asset worth of $29.22 billion – over 5% of Ethereum’s market cap – with cumulative internet inflows totaling practically $13 billion.

SEC Readability

Including to market confidence, earlier this month, the U.S. Securities and Change Fee (SEC) Division of Company Finance clarified that, in its view, sure liquid staking actions should not thought-about securities transactions.

Whereas the assertion shouldn’t be an official SEC ruling, it sparked enthusiasm amongst buyers, particularly for establishments seeking to take part in staking, and liquid staking particularly.

On the time of the announcement, Marcin Kazmierczak, co-founder of RedStone, referred to as the SEC’s steering a “watershed second” for the crypto trade in feedback shared with The Defiant.

“The excellence between protocol-driven staking and applications with managerial discretion gives much-needed regulatory certainty,” he defined, including:

“Liquid staking platforms on Ethereum and different chains have already attracted vital institutional capital, with TVL rising past pre-2022 ranges. This readability ought to speed up institutional adoption, as corporations can now confidently deploy capital with out regulatory ambiguity.”