Bitcoin’s Market Worth to Realized Worth, or MVRV ratio, stays one of the dependable on-chain indicators for figuring out native and macro tops and bottoms throughout each BTC cycle. By isolating information throughout totally different investor cohorts and adapting historic benchmarks to fashionable market situations, we will generate extra correct insights into the place Bitcoin could also be headed subsequent.

The Bitcoin MVRV Ratio

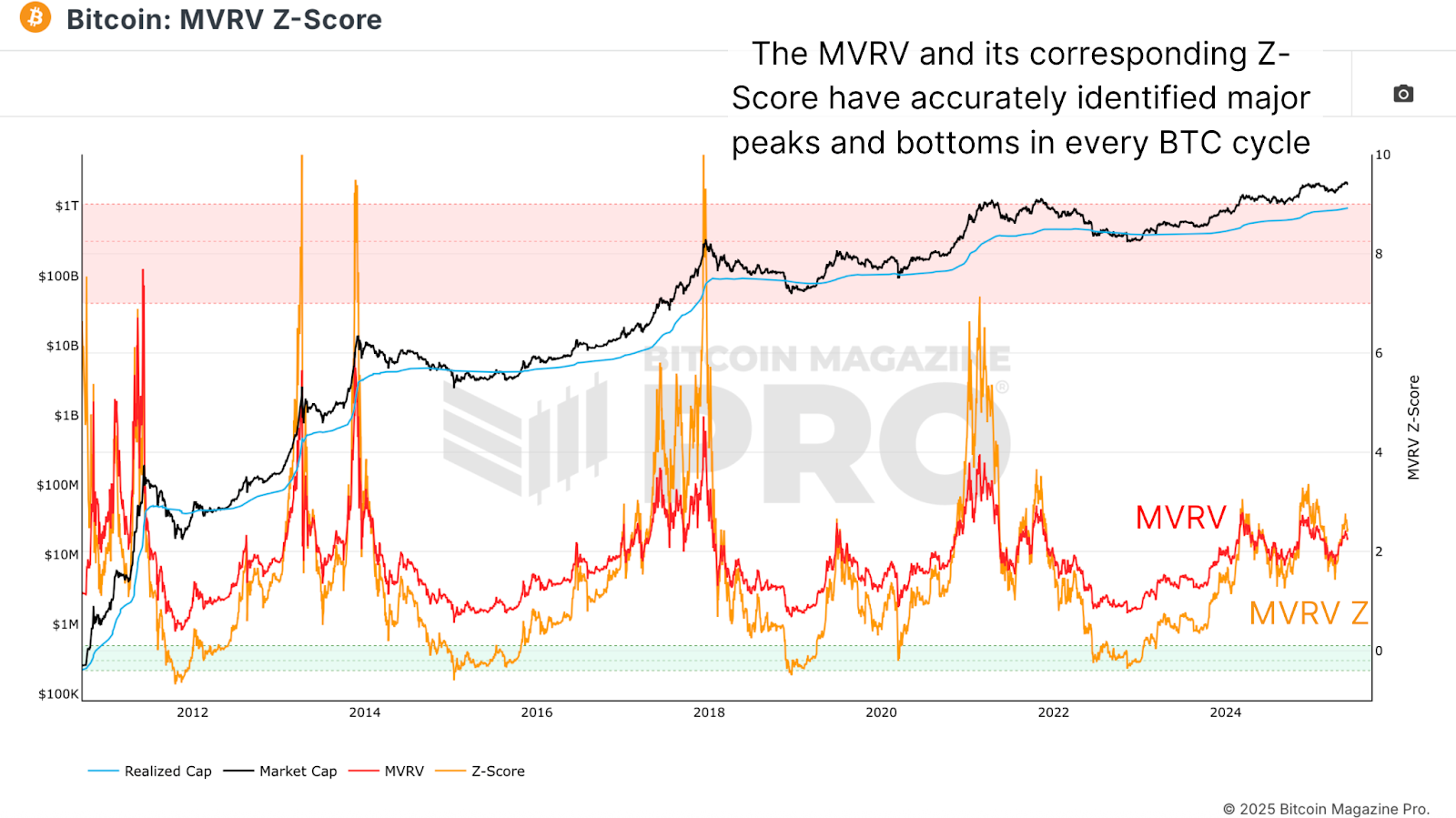

The MVRV Ratio compares Bitcoin’s market worth to its realized worth, primarily the common value foundation for all cash within the community. As of writing, BTC trades round $105,000 whereas the realized worth floats close to $47,000, placing the uncooked MVRV at 2.26. The Z-Rating model of MVRV standardizes this ratio primarily based on historic volatility, enabling clearer comparisons throughout totally different market cycles.

Determine 1: Traditionally, the MVRV Ratio and the MVRV Z-Rating have precisely recognized cycle peaks and bottoms. View Stay Chart

Brief-Time period Holders

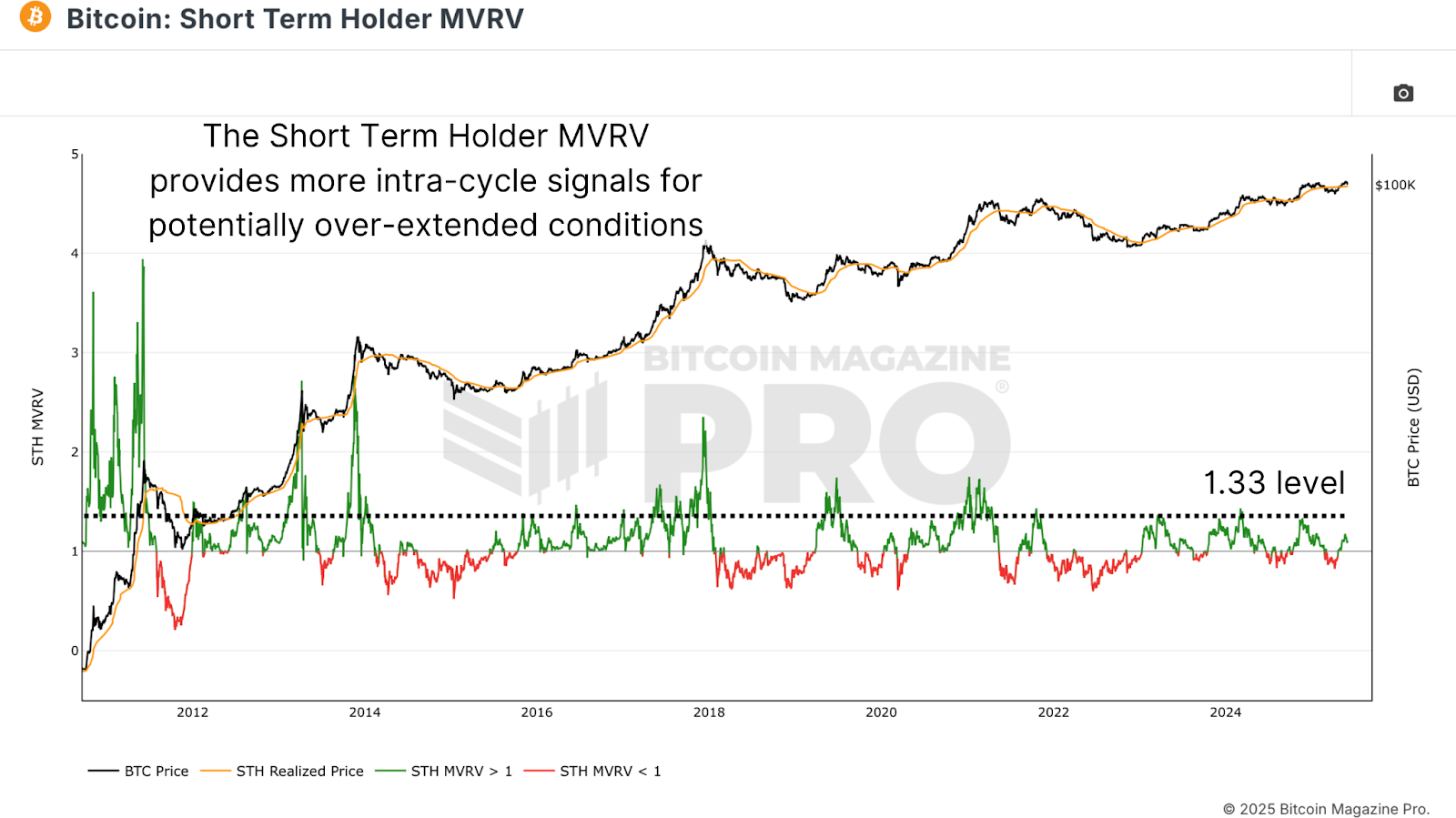

Brief-term holders, outlined as these holding Bitcoin for 155 days or much less, at the moment have a realized worth close to $97,000. This metric usually acts as dynamic help in bull markets and resistance in bear markets. Notably, when the Brief Time period Holder MVRV hits 1.33, native tops have traditionally occurred, as seen a number of instances in each the 2017 and 2021 cycles. Up to now within the present cycle, this threshold has already been touched 4 instances, every adopted by modest retracements.

Determine 2: Brief Time period Holder MVRV reaching 1.33 in newer cycles has aligned with native tops. View Stay Chart

Lengthy-Time period Holders

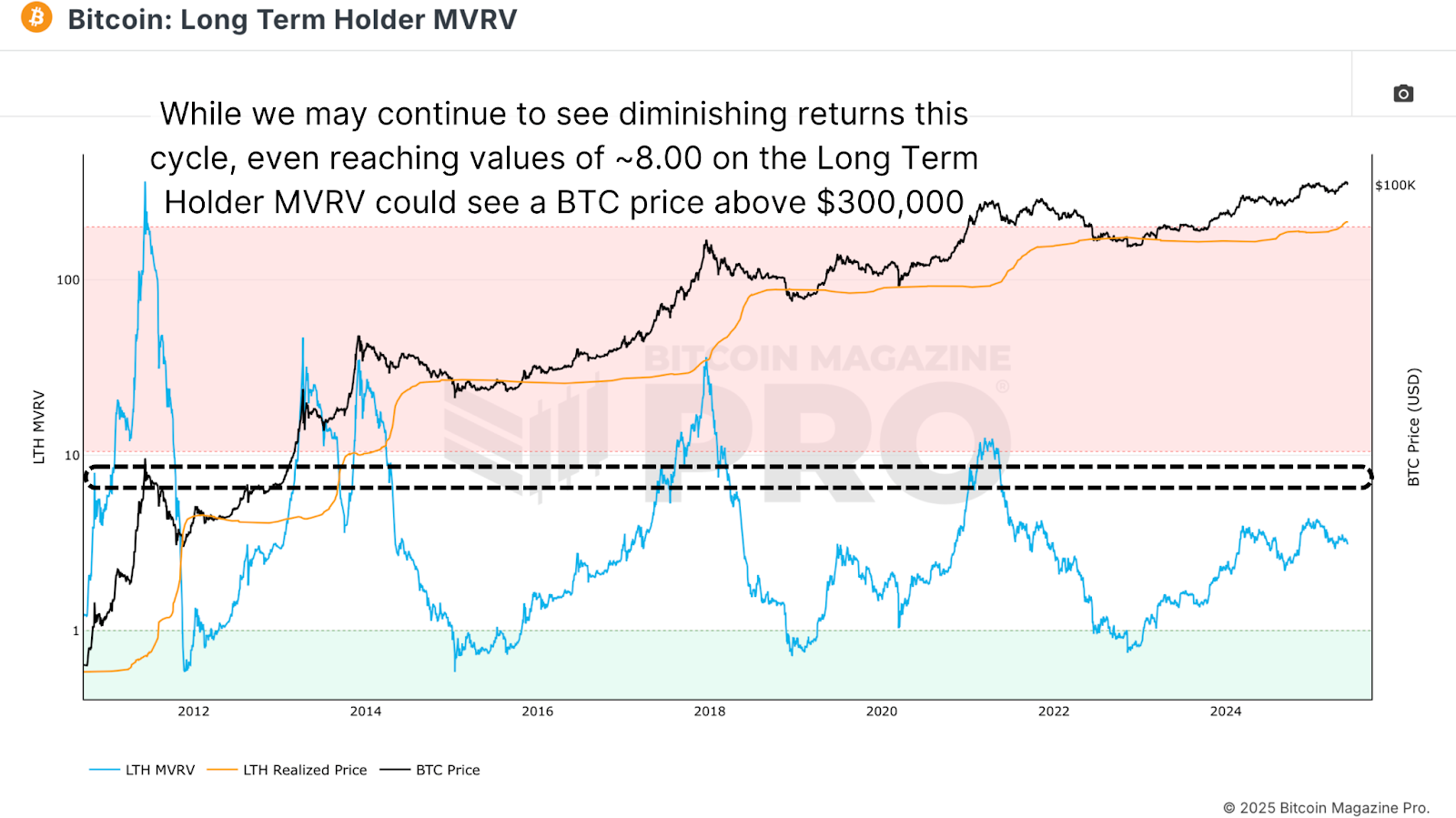

Lengthy-term holders, who’ve held BTC for greater than 155 days, at the moment have a median value foundation of simply $33,500, placing their MVRV at 3.11. Traditionally, Lengthy Time period Holder MVRV values have reached as excessive as 12 throughout main peaks. That mentioned, we’re observing a development of diminishing multiples every cycle.

Determine 3: Reaching a Lengthy Time period Holder MVRV worth of 8 may extrapolate to a BTC worth in extra of $300,000. View Stay Chart

A key resistance band now sits between 7.5 and eight.5, a zone that has outlined bull tops and pre-bear retracements in each cycle since 2011. If the present development of the realized worth ($40/day) continues for an additional 140–150 days, matching earlier cycle lengths, we may see it attain someplace within the area of $40,000. A peak MVRV of 8 would suggest a worth close to $320,000.

A Smarter Market Compass

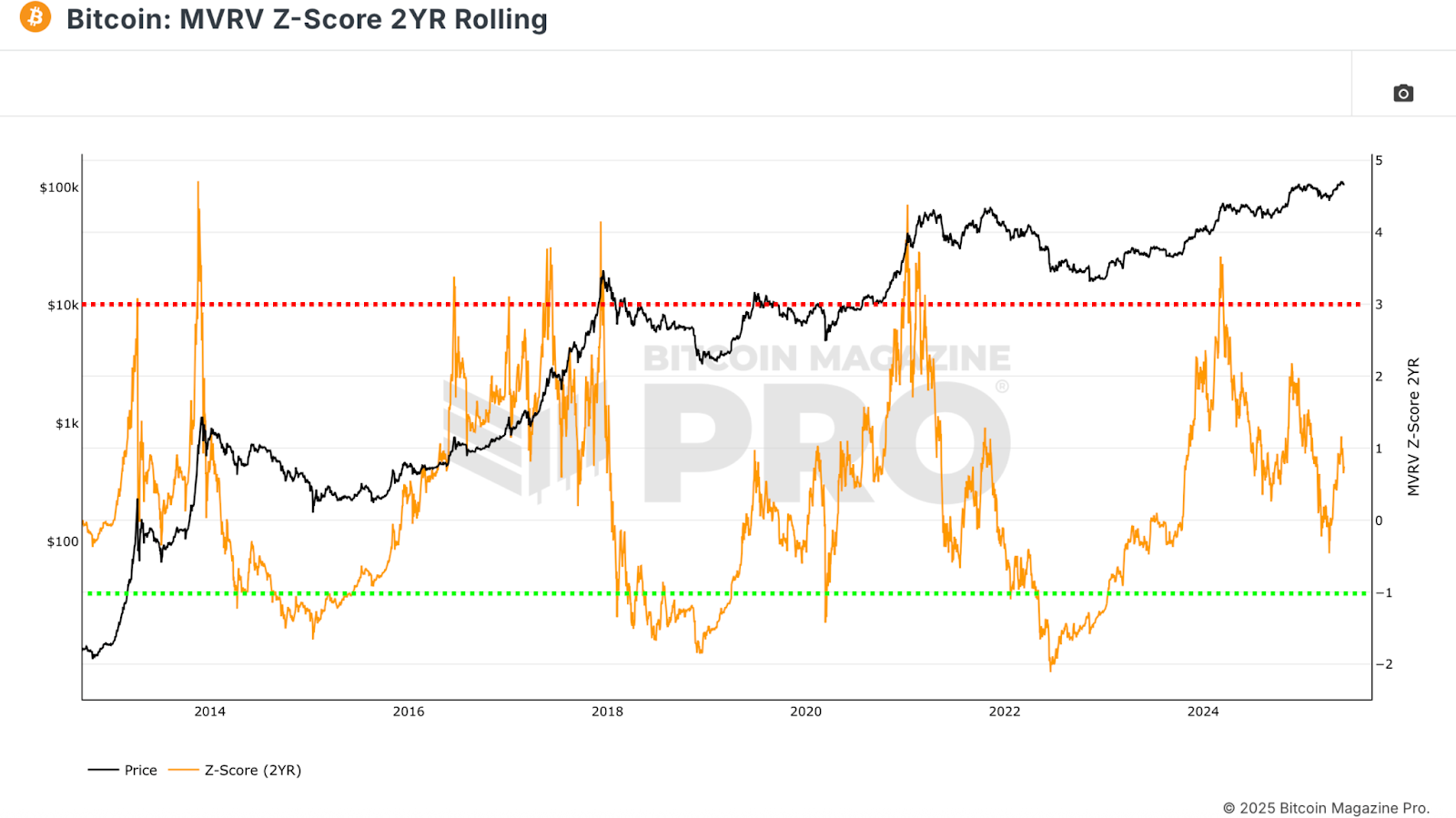

Not like static all-time metrics, the 2-Yr Rolling MVRV Z-Rating adapts to evolving market dynamics. By recalculating common extremes over a rolling window, it smooths out Bitcoin’s pure volatility decay because it matures. Traditionally, this model has signaled overbought situations when reaching ranges above 3, and prime accumulation zones when dipping under -1. At present sitting below 1, this metric means that substantial upside stays.

Determine 4: The present 2-Yr Rolling MVRV Z-Rating suggests extra constructive worth motion forward. View Stay Chart

Timing & Targets

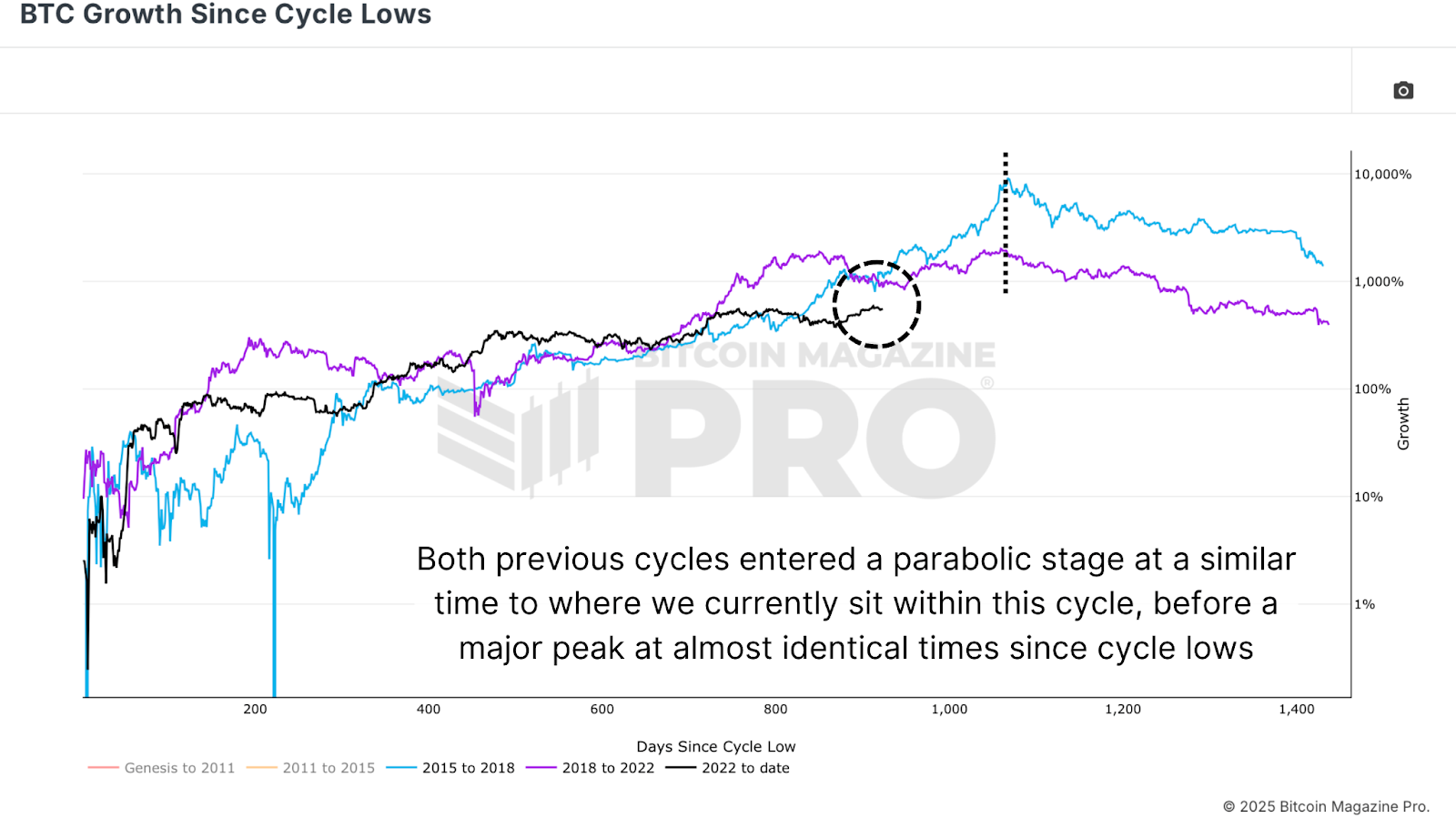

A view of the BTC Development Since Cycle Lows chart illustrates that BTC is now roughly 925 days faraway from its final main cycle low. Historic comparisons to earlier bull markets counsel we could also be round 140 to 150 days away from a possible high, with each the 2017 and 2021 peaks occurring round 1,060 to 1,070 days after their respective lows. Whereas not deterministic, this alignment reinforces the broader image of the place we’re within the cycle. If realized worth tendencies and MVRV thresholds proceed on present trajectories, late Q3 to early This autumn 2025 could deliver remaining euphoric strikes.

Determine 5: Will the present cycle proceed to exhibit development patterns just like these of the earlier two cycles? View Stay Chart

Conclusion

The MVRV ratio and its derivatives stay important instruments for analyzing Bitcoin market habits, offering clear markers for each accumulation and distribution. Whether or not observing short-term holders hovering close to native high thresholds, long-term holders nearing traditionally vital resistance zones, or adaptive metrics just like the 2-Yr Rolling MVRV Z-Rating signaling loads of runway left, these information factors needs to be utilized in confluence.

No single metric needs to be relied upon to foretell tops or bottoms in isolation, however taken collectively, they provide a robust lens by way of which to interpret the macro development. Because the market matures and volatility declines, adaptive metrics will turn out to be much more essential in staying forward of the curve.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding selections.

This submit Mapping Bitcoin’s Bull Cycle Potential first appeared on Bitcoin Journal and is written by Matt Crosby.