The market is underneath clear risk-off stress, and Ethereum crypto at this time is reflecting heavy promoting in an surroundings dominated by worry and elevated volatility.

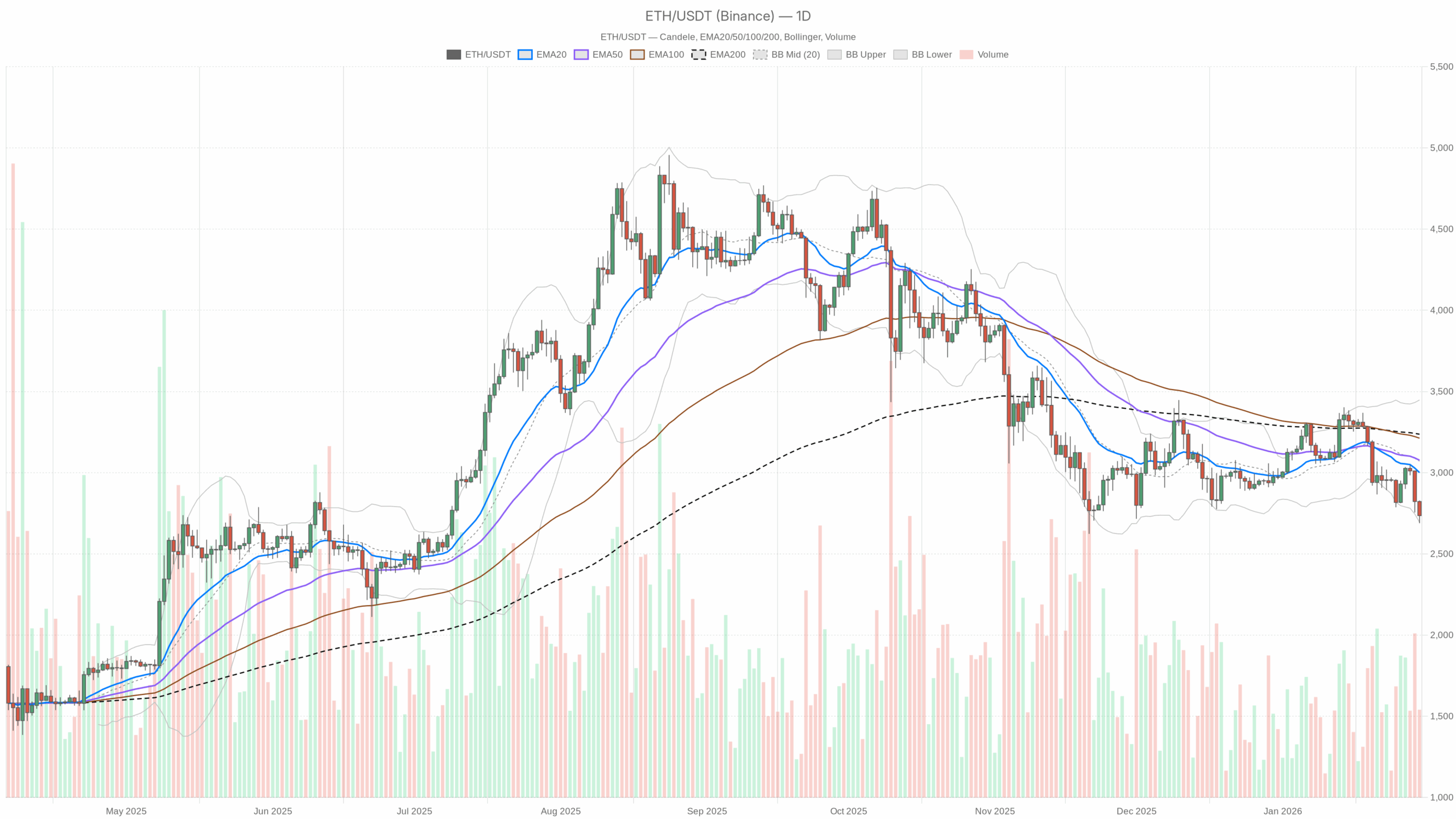

Day by day Chart: Fundamental Situation and Bearish Bias

Ethereum (ETHUSDT) is buying and selling round $2,735 after a pointy washout throughout the crypto advanced. The backdrop is clearly risk-off: complete crypto market cap is down virtually 6% in 24h, BTC dominance is again above 57%, and the Worry & Greed Index sits at 16 – Excessive Worry. In different phrases, this isn’t simply an ETH subject; it’s a broad de-risking part.

At this second, the dominant pressure is pattern stress to the draw back, with Ethereum buying and selling under all key every day transferring averages and hugging the decrease Bollinger Band. Nonetheless, intraday momentum is beginning to present the first indicators of promoting fatigue. That is the traditional level in a downtrend the place the market should determine: both prolong right into a capitulation leg or flip right into a mean-reversion bounce.

The major state of affairs is bearish primarily based on the every day timeframe. ETH is in a draw back pattern construction with value under the 20, 50, and 200-day EMAs, momentum indicators detrimental, and volatility elevated. Any bullish case from right here is, for now, a counter-trend bounce relatively than a confirmed pattern reversal.

Day by day (D1) – Macro Bias and Construction

Value vs EMAs (Pattern Construction)

Shut: $2,735.47

EMA 20: $3,000.38

EMA 50: $3,076.76

EMA 200: $3,236.98

Value is buying and selling nicely under all three EMAs, with a transparent draw back alignment (value < EMA20 < EMA50 < EMA200). It is a mature bearish pattern configuration, not only a fast shakeout. The space to the EMA20 (round $265) highlights how aggressively value has deviated from its short-term imply. That often means two issues directly: the downtrend is actual, however the market can be more and more stretched to the draw back, laying the groundwork for a bounce if sellers run out of gasoline.

RSI (Momentum & Stretch)

RSI 14: 34.74

Day by day RSI is underneath 40 however not but in deep oversold territory. Momentum is clearly bearish, however not at panic extremes. This traces up with the thought of a weak downtrend with room for additional draw back, but shut sufficient to oversold {that a} sharp volatility spike might simply push RSI into the 20s and set off a reduction rally. Put merely, bears are in management, however the benefit shouldn’t be limitless.

MACD (Momentum Pattern)

MACD line: -71.11

Sign line: -36.38

Histogram: -34.72

The MACD line is nicely under the sign line and each are detrimental, with a sizeable detrimental histogram. That’s attribute of a agency draw back momentum part, confirming the bearish pattern signaled by the EMAs. Importantly, the histogram is deeply detrimental, which frequently occurs late in an impulse leg; it tells us sellers have been urgent exhausting just lately, which might precede both continuation if information worsens or a snapback if shorts develop into overcrowded.

Bollinger Bands (Volatility & Positioning)

Center band (20-period SMA proxy): $3,071.32

Higher band: $3,447.65

Decrease band: $2,694.99

Value: $2,735.47 (close to the decrease band)

ETH is buying and selling simply above the decrease Bollinger Band. Which means value is sitting close to the underside of its latest volatility envelope. In plain phrases, the market has been pricing in draw back aggressively. When candles hug the decrease band, downtrends are likely to persist, however being this near the band additionally alerts {that a} mean-reversion try in direction of the mid-band (round $3,070) is believable as soon as promoting eases.

ATR (Volatility Regime)

ATR 14 (every day): $138.06

With every day ATR at roughly $140, the common every day swing is round 5% of present value. That is an elevated volatility regime, the sort that punishes tight stops and late entries. Either side of the guide want to just accept wider intraday ranges; a $200–250 transfer in a day wouldn’t be uncommon underneath these situations.

Day by day Pivot Ranges (Reference Zones)

Pivot level (PP): $2,751.04

Resistance 1 (R1): $2,813.08

Assist 1 (S1): $2,673.43

Value is hovering slightly below the every day pivot level, slipping between PP and S1. That locations the market in a barely bearish intraday posture on the every day map. A sustained transfer again above $2,751 after which $2,813 would mark the primary signal that consumers try to reclaim short-term management. Shedding S1 ($2,673) with momentum would affirm that sellers are usually not finished but.

4H/1H Context – Momentum vs Exhaustion

1H EMAs (Quick-Time period Pattern)

Shut: $2,737.08

EMA 20: $2,795.62

EMA 50: $2,868.15

EMA 200: $2,957.04

The hourly pattern can be firmly bearish, with value compressed under all three EMAs. The distances between the EMAs present a well-established downtrend; there isn’t any intraday bullish cross but. This helps the every day bearish bias, however the diploma of separation from the EMA20 once more alerts a short-term overshoot to the draw back, forming good situations for fast bounces, not but for full reversals.

1H RSI (Intraday Momentum)

RSI 14: 30.52

Hourly RSI is hovering simply above oversold. Intraday sellers are urgent, however they’re near the purpose the place every further leg down turns into more durable to maintain. That is sometimes the place scalpers begin fading extremes, whereas swing merchants nonetheless respect the draw back pattern.

1H MACD (Intraday Momentum)

MACD line: -51.93

Sign line: -51.26

Histogram: -0.67

On the 1H, each MACD and sign are deep in detrimental territory, however the histogram is just barely detrimental. That tells us the downward momentum could also be stabilizing relatively than accelerating. Bears are nonetheless in management, however the part of aggressive acceleration is probably going behind us for this speedy swing.

1H Bollinger Bands & Volatility

Center band: $2,792.57

Higher band: $2,900.09

Decrease band: $2,685.06

Value: $2,737.08

ETH is buying and selling within the decrease half of the hourly Bollinger envelope however not pinned to the decrease band. That aligns with a market that’s bearish however pausing relatively than in full capitulation. There may be room for a squeeze up towards $2,790–2,800 with out altering the broader pattern.

1H ATR and Pivot

ATR 14 (1H): $35.88

Pivot level (PP): $2,736.11

R1: $2,749.38

S1: $2,723.82

Hourly ATR close to $36 exhibits lively intraday swings. Value at the moment sits proper on the intraday pivot, making this a resolution space. A push above R1 would point out a short-term reduction bounce; a break under S1 would preserve the intraday downtrend intact.

15m Execution Context – Microstructure

15m EMAs (Very Quick-Time period Stream)

Shut: $2,738.06

EMA 20: $2,742.12

EMA 50: $2,768.74

EMA 200: $2,871.22

On the 15-minute chart, value is marginally under the EMA20 however nicely under the EMA50 and EMA200. Shortest-term circulate is attempting to stabilize; the market shouldn’t be aggressively under the EMA20 anymore, however the broader intraday construction stays bearish. That is typical of a market pausing after a selloff.

15m RSI

RSI 14: 46.17

RSI on 15m is close to the center of the vary, signaling impartial short-term momentum. Sellers not have the identical grip that they had earlier; short-term consumers are beginning to match them on this micro timeframe. This usually precedes both an area consolidation vary or a brief squeeze if bears overstay.

15m MACD

MACD line: -8.35

Sign line: -10.86

Histogram: +2.51

Right here we lastly see a small bullish inflection: the MACD line is crossing up towards the sign and the histogram has turned constructive. Momentum on the shortest timeframe is rotating from heavy promoting into a possible bounce try. Importantly, that is an execution sign solely, not a change within the higher-timeframe pattern.

15m Bollinger Bands, ATR and Pivot

Center band: $2,741.76

Higher band: $2,769.59

Decrease band: $2,713.92

ATR 14 (15m): $15.33

Pivot level (PP): $2,736.34

R1: $2,739.78

S1: $2,734.62

Value is oscillating across the mid-band and the 15m pivot, with comparatively tight ATR. That signifies a short-term equilibrium zone the place market members are reassessing after the prior dump. For lively merchants, it is a typical space to plan entries and exits, nevertheless it doesn’t by itself resolve the higher-timeframe path.

Market Setting & Information Backdrop

The macro crypto surroundings is in a defensive stance: complete market cap dropped almost 6% in 24 hours whereas quantity surged over 66%. That’s traditional high-volume risk-off conduct. BTC dominance at 57% tells you capital is rotating into Bitcoin and away from altcoins like ETH.

On the regulatory entrance, the US Senate advancing a crypto regulation invoice to broaden CFTC oversight, and looming White Home negotiations with banks and crypto firms, are feeding uncertainty. When regulation headlines hit throughout a susceptible technical part, markets often value in further threat premium, precisely what we’re seeing now. The bottom line is whether or not the ultimate end result is perceived as readability, which is finally constructive, or constraint, which is structurally bearish for speculative flows.

Bullish Situation for Ethereum

For a constructive case, you might be basically betting on imply reversion inside a broader downtrend, at the very least initially.

Bounce path: Quick-term timeframes are already exhibiting early rotation: 15m MACD is popping up, 15m RSI is neutralizing, and value is stabilizing round intraday pivots. A typical bounce sequence can be:

1. Maintain above the 1H S1 at $2,723 and the every day S1 area close to $2,673, avoiding a brand new low.

2. Reclaim and maintain the 1H pivot at ~$2,736, then push towards R1 at $2,749–2,813 (hourly and every day resistance bands).

3. Lengthen towards the 1H EMA20 round $2,796 and probably the every day mid-Bollinger band close to $3,070 if the bounce develops right into a fuller squeeze.

As this unfolds, you’d need to see:

– Day by day RSI turning again towards 40–45, confirming that momentum is stabilizing.

– 1H MACD histogram flipping constructive, exhibiting that bulls have seized short-term management.

– Value beginning to shut above the 1H EMA20 persistently, relatively than being capped by it.

What invalidates the bullish state of affairs?

A clear break and every day shut under $2,673 (every day S1) with RSI sliding deeper into the 20s would invalidate the easy bounce thesis and open the door to a extra aggressive leg down. If value will get rejected sharply from the $2,800–2,850 zone and falls again underneath the 1H pivot, it could sign that bears are nonetheless totally in cost.

Bearish Situation for Ethereum

The prevailing construction favors the bears. The bearish state of affairs is that this present pause is just a relaxation earlier than the subsequent leg decrease.

Continuation path:

1. Value fails to carry above the intraday pivot (~$2,736) and breaks under 1H S1 at $2,724.

2. Sellers push ETH all the way down to the every day S1 at $2,673 and begin closing candles under it.

3. As soon as that degree is misplaced, the downtrend extends with every day RSI slipping firmly under 30 and the every day MACD histogram remaining deeply detrimental or increasing additional.

Beneath this path, the market can be transitioning from a managed pattern to a potential capitulation part. Value might then probe decrease liquidity pockets nicely under $2,600, with ATR increasing past the present $140 vary.

To maintain confidence within the bearish continuation, bears need to see:

– 1H RSI caught under 40 regardless of bounces.

– 15m MACD failing to construct a long-lasting constructive histogram and rolling again down.

– Value motion repeatedly rejecting the 1H EMA20–EMA50 band ($2,800–2,870) on each bounce.

What invalidates the bearish state of affairs?

If ETH can stage and maintain a break again above $2,850 (roughly into the zone of the 1H EMA50) after which start closing every day candles above the every day EMA20 close to $3,000, the present downtrend would lose its dominance. At that time, the narrative shifts from “promote the rip” to “vary or new uptrend in formation,” and the clear bearish construction can be damaged.

Learn how to Suppose About Positioning Proper Now

Throughout all timeframes, Ethereum is in a downtrend with early, fragile indicators of exhaustion. The every day chart clearly argues for warning: value under all EMAs, detrimental MACD, sub-40 RSI, and a market surroundings gripped by excessive worry. The intraday charts, nevertheless, are beginning to present that sellers are not accelerating; they’re defending floor they’ve already received.

For merchants, this is likely one of the trickiest environments as a result of volatility is excessive, ranges are being examined shortly, and either side are susceptible to being squeezed. Pattern merchants will usually favor to remain aligned with the every day bearish bias, trying to fade bounces into resistance bands like $2,800–2,900. Imply-reversion merchants will see worth within the proximity to the decrease Bollinger Band and can search for robust intraday affirmation, reminiscent of MACD flips and a reclaim of EMAs, earlier than stepping in on the lengthy aspect.

No matter bias, threat administration issues greater than path right here. With every day ATR round $140 and hourly ATR close to $36, place sizing and cease placement have to mirror the truth that Ethereum can simply transfer a number of % towards you in a single session. The regulatory noise from the US solely provides one other layer of uncertainty, which might flip technical ranges into air pockets when headlines break.

Briefly, Ethereum crypto at this time is in a bearish part underneath macro stress, with short-term merchants probing for a bounce. Till the every day pattern construction modifications, any upside stays counter-trend and fragile.

If you wish to monitor markets with skilled charting instruments and real-time knowledge, you possibly can open an account on Investing utilizing our companion hyperlink:

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We might earn a fee at no further value to you.

Disclaimer: This text is a market evaluation and displays technical and contextual views on the time of writing. It isn’t monetary recommendation, an funding suggestion, or a solicitation to purchase or promote any asset. Cryptocurrency markets are extremely risky; at all times conduct your individual analysis and consider your threat tolerance earlier than making buying and selling choices.