Japan’s Prime Minister Sanae Takaichi, typically dubbed the nation’s “Iron Woman,” has secured a historic landslide victory within the February 8, 2026, snap parliamentary elections. Her Liberal Democratic Occasion (LDP) is projected to win between 274 and 326 of the 465 seats within the decrease home, marking the biggest post-war electoral margin for any Japanese get together.

The decisive outcome consolidates Takaichi’s authority and positions her to pursue bold financial and regulatory reforms.

Japan’s Sanae Takaichi Secures Landslide Win, Units Stage for Crypto Tax Reform

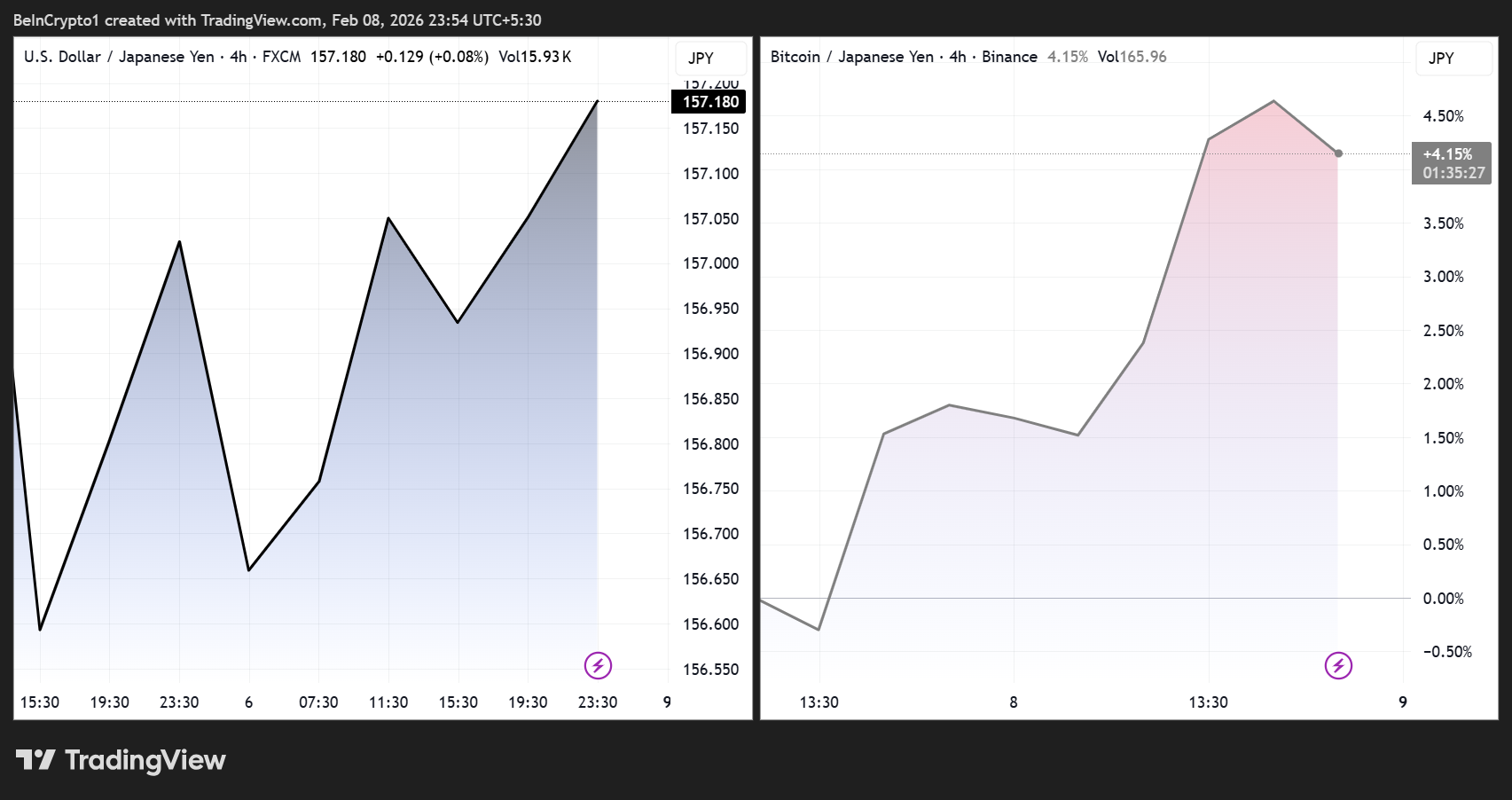

Markets reacted swiftly to the result. The greenback/yen climbed 0.2% to 157, whereas the $BTC/JPY buying and selling pair rose nearly 5%, signaling investor confidence in Takaichi’s pro-growth agenda.

$BTC/JPY Worth Efficiency”>

$BTC/JPY Worth Efficiency”>

USD/JPY and $BTC/JPY Worth Efficiency. Supply: TradingView

This so-called “Takaichi commerce” attracts momentum from expectations of fiscal stimulus, unfastened financial coverage, and elevated liquidity.

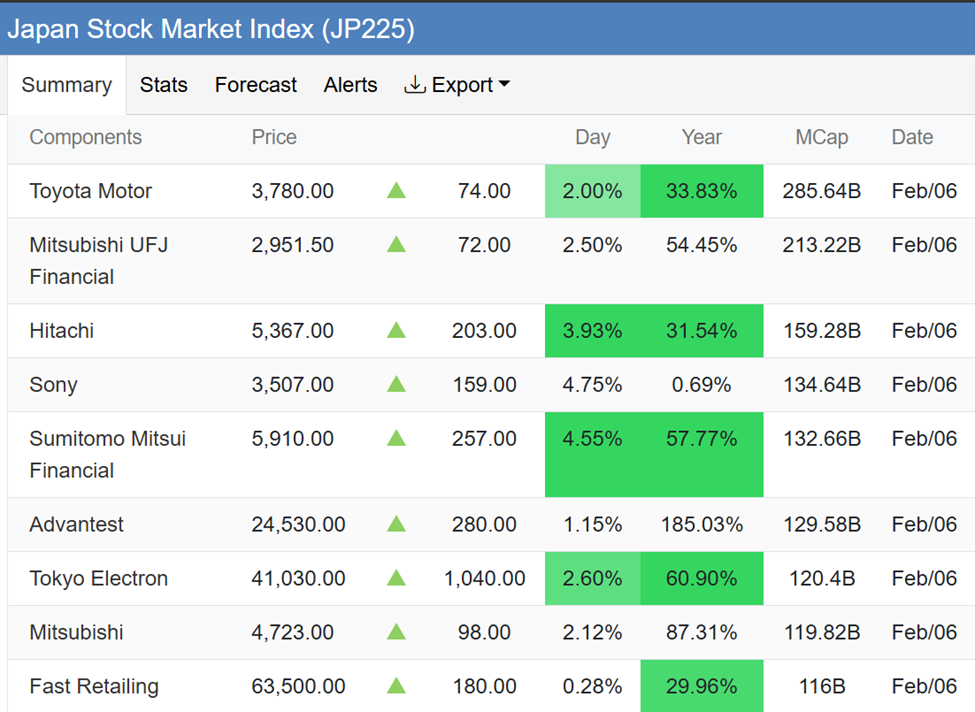

It has already lifted Japanese equities to document highs, whereas authorities bonds and the yen have confronted strain.

Japanese Equities Efficiency. Supply: Buying and selling Economics

US officers rapidly weighed in on the outcome, with Treasury Secretary Scott Bessent calling the victory “historic” and emphasizing the power of US-Japan relations beneath Takaichi’s management.

My sincerest congratulations to Prime Minister @takaichi_sanae on her historic victory, securing the most important post-war electoral margin in Japanese historical past.

As @POTUS has mentioned, she won’t let the folks of Japan down.

When Japan is powerful, the U.S. is powerful in Asia, and the… pic.twitter.com/v7KHHflAkH

— Treasury Secretary Scott Bessent (@SecScottBessent) February 8, 2026

Days earlier than, President Donald Trump additionally supplied a full endorsement, highlighting her management qualities and up to date commerce and safety successes.

In flip, Takaichi expressed gratitude, reaffirming plans to go to the White Home in spring 2026 and describing the US-Japan alliance as having “limitless potential” constructed on deep belief and cooperation.

I’m sincerely grateful to President Donald J. Trump for his heat phrases.

I sit up for visiting the White Home this spring and to persevering with our work collectively to additional strengthen the Japan–U.S. Alliance.

Our Alliance and friendship with the US of America are… pic.twitter.com/EKeowvyeDo— 高市早苗 (@takaichi_sanae) February 8, 2026

Takaichi’s Mandate Indicators Potential Crypto Tax Overhaul and Blockchain-Pleasant Insurance policies

Takaichi’s electoral mandate is broadly seen as a inexperienced mild to speed up Japan’s crypto reforms. The nation at present taxes crypto positive aspects as miscellaneous revenue at charges as much as 55%.

This framework has pushed some traders overseas regardless of Japan’s main place in blockchain adoption.

Underneath dialogue for fiscal 12 months 2026 are reforms that would:

- Cut back positive aspects tax to round 20%

- Enable loss carryforwards for 3 years, and

Reclassify sure digital belongings as monetary merchandise.

The overall sentiment is that her pro-growth insurance policies and willingness to collaborate with crypto-friendly opposition events, such because the Japan Innovation Occasion and the Democratic Occasion for the Folks, may lastly push these long-awaited measures by way of by 2028.

Earlier in her tenure, Takaichi endorsed insurance policies supporting expertise, innovation, and financial safety, aligning with broader blockchain and Web3 improvement.

Whereas she has not made crypto a central marketing campaign challenge, her aggressive fiscal stance, modeled after her mentor Shinzo Abe’s “Abenomics,” may create an financial surroundings that favors threat belongings, together with Bitcoin, Ethereum, and Japan-related digital tasks.

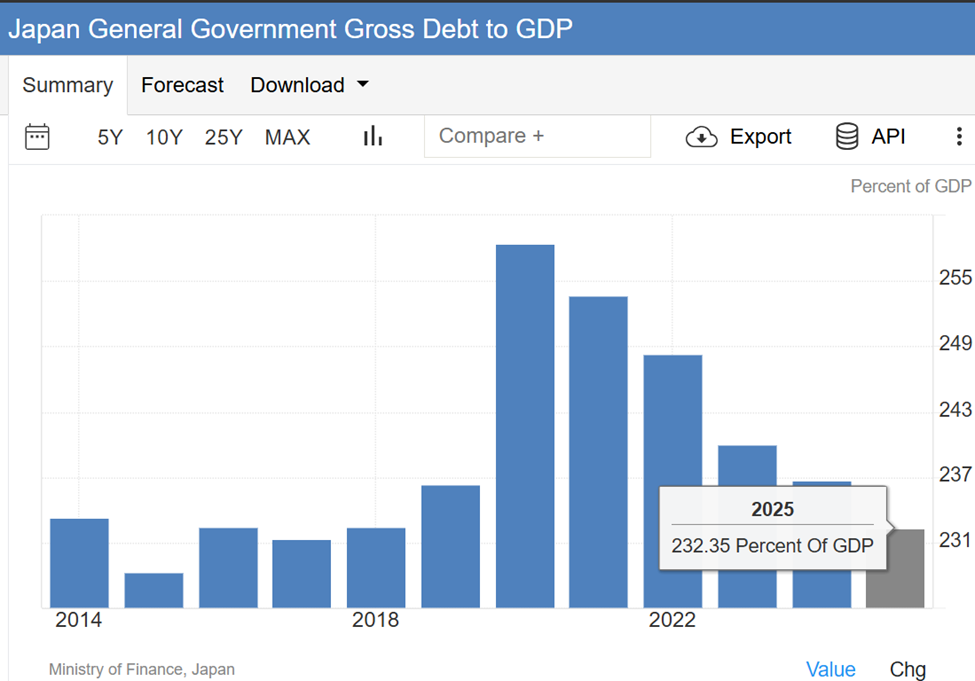

“Takaichi has pledged aggressive fiscal coverage funded largely by way of bond issuance…will her electoral momentum gasoline even bigger stimulus, or give her the political cowl to proceed extra cautiously, as traders stay uneasy over Japan’s large debt load and up to date spikes throughout the JGB yield curve,” posed Rob Wallace.

Certainly, uncertainties stay. Japan’s nationwide debt exceeds 250% of GDP after topping out at 232.35% in 2025. In the meantime, latest spikes in authorities bond yields have raised investor considerations about fiscal sustainability.

Japan Normal Authorities Gross Debt to GDP. Supply: Buying and selling Economics

Key cupboard appointments and regulatory priorities shall be essential in shaping the tempo and scope of crypto reform. Finance Minister Katsunobu Kato’s continued function may keep coverage continuity, although his restricted engagement on crypto points might mood bold modifications.

Digital Minister Masaki Taira has but to articulate particular positions on crypto or Web3.

However, the Monetary Companies Company’s ongoing proposals, mixed with Takaichi’s sturdy political mandate, counsel a turning level for Japan’s digital asset sector.

If profitable, reforms may present clearer regulatory frameworks, tax reduction, and authorized recognition for crypto, laying the groundwork for a extra innovation-friendly ecosystem.

The put up Markets and Crypto Eye Coverage Reforms As Japan’s Sanae Takaichi Secures Historic Victory appeared first on BeInCrypto.