Markets might have moved previous the height of U.S. tariff coverage uncertainty, however the path forward stays risky, in line with a brand new report from Nansen.

Nansen Highlights ‘Bessent Put’ as U.S. Moderates Commerce Stance

In a report shared with Bitcoin.com Information, Aurelie Barthere, Principal Analysis Analyst at Nansen, argues that current U.S. tariff negotiations recommend a shift towards pragmatism, easing some investor fears. The report highlights Treasury Secretary Bessent’s rising affect over commerce coverage, contrasting with the diminished position of hardline aides like Navarro and Commerce Secretary Lutnick.

This shift, coupled with non permanent tariff exemptions for semiconductors and tech merchandise, alerts a possible de-escalation, Nansen’s analysis analyst notes. Nonetheless, Barthere says dangers linger. Sectoral tariffs and unresolved negotiations with China may extend uncertainty, impacting client spending and enterprise funding.

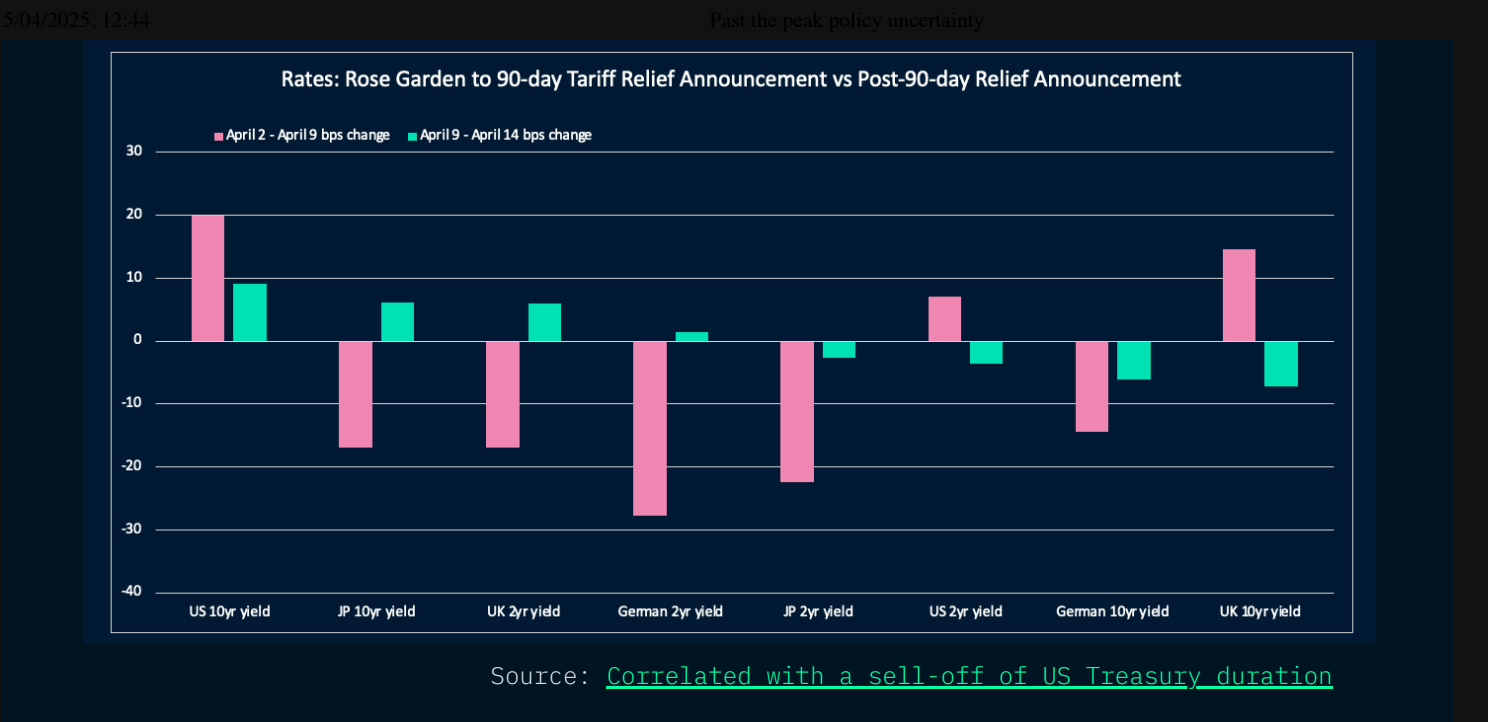

The report factors to weakening U.S. Treasury demand and a falling greenback as indicators of international capital hedging towards additional volatility. Equities exterior the U.S., notably in Europe and China, underperformed through the peak of tariff tensions, Nansen information exhibits. But, the agency cautions that the shortage of viable options might preserve world buyers anchored to U.S. markets.

Barthere’s evaluation recommends a conservative strategy, favoring belongings like bitcoin ( BTC), discounted tech shares resembling Nvidia, and high-margin European pharma corporations. Gold can be cited as a geopolitical hedge. The agency’s Danger Barometer turned “risk-on” late final week, reflecting cautious optimism. However Barthere warns the climb shall be bumpy:

Now we have seemingly handed the height tariff uncertainty, with danger belongings now climbing a bumpy wall of fear.