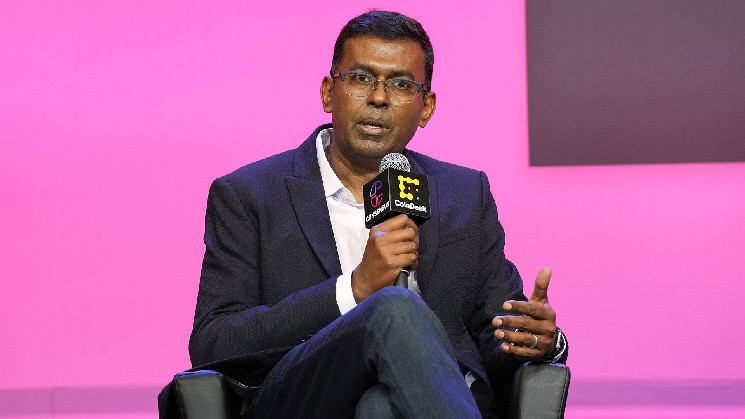

Conventional finance companies which have adopted crypto are transferring previous the experimentation section and are actively engaged on real-world options, Mastercard’s head of crypto and blockchain, Raj Dhamodharan, informed CoinDesk.

“Many people within the business are transferring past experimentation; it’s really actual options,” he mentioned, noting that Mastercard has already enabled stablecoin funds for monetary establishments. These establishments can select to settle transactions utilizing stablecoins, reflecting a broader development in crypto adoption.

Final week, the funds big introduced a partnership with crypto compliance agency Notabene, which is able to combine Mastercard’s Crypto Credential into its SafeTransact platform to make digital asset transactions safer and user-friendly.

The Crypto Credential system continues to be a spotlight of Mastercard’s efforts to make crypto extra mainstream. It permits customers to ship funds utilizing acquainted identifiers like e mail addresses moderately than complicated pockets addresses whereas making certain compliance with regulatory requirements. The system additionally helps stop misdirected transactions by verifying whether or not a recipient’s pockets can obtain a particular asset.

“What’s stopping [crypto] from going mainstream is actually that customers want to have the ability to discover one another utilizing what they already know,” Dhamodharan mentioned.

Mastercard’s aim, based on Dhamodharan, is to be a connector between conventional finance and blockchain networks, making certain regulatory compliance whereas enabling new enterprise fashions. The corporate plans to announce extra partnerships and use circumstances in 2025, reinforcing its dedication to integrating crypto into world funds.

“As an business as a complete, we have to be very open to creating [crypto] accessible as broadly as doable,” he mentioned.

Beforehand, the funds big partnered with a number of crypto-native firms, together with Binance. The 2 parted methods in August 2023 after Binance confronted a collection of authorized points within the U.S. Mastercard re-allowed customers to buy crypto on the alternate once more a yr later.

“Binance is a good accomplice of ours,” Dhamodharan mentioned. “We proceed to accomplice with them in various new methods the place we may help them with on-ramp and off-ramp. These are the persevering with conversations.”

Taking crypto to the ‘subsequent stage’

Dhamodharan can also be optimistic about the way forward for tokenization, which he mentioned would require new enterprise fashions to feed the rising demand for tokenization real-world belongings by firms like BlackRock and Franklin Templeton.

“If there may be extra readability over time when it comes to how deposits might be represented in some kind on the general public chain, from a regulatory standpoint, I feel this could even go to the subsequent stage when it comes to the way it can scale,” he mentioned.

In 2025, Mastercard’s focus lies on the on-ramp/off-ramp between crypto and the banking world, whereas making that course of as easy and protected as doable in addition to increasing options and features of its Crypto Credential product. The third focus is stablecoins, the corporate mentioned.

“We expect the long run goes to be a world of each deposits as a result of that is the place the cash is, and that is the place folks and companies maintain cash and stablecoins, which may transfer on-chain simply and get settled simply.”

Learn extra: Mastercard and JPMorgan Hyperlink As much as Convey Cross-Border Funds on the Blockchain