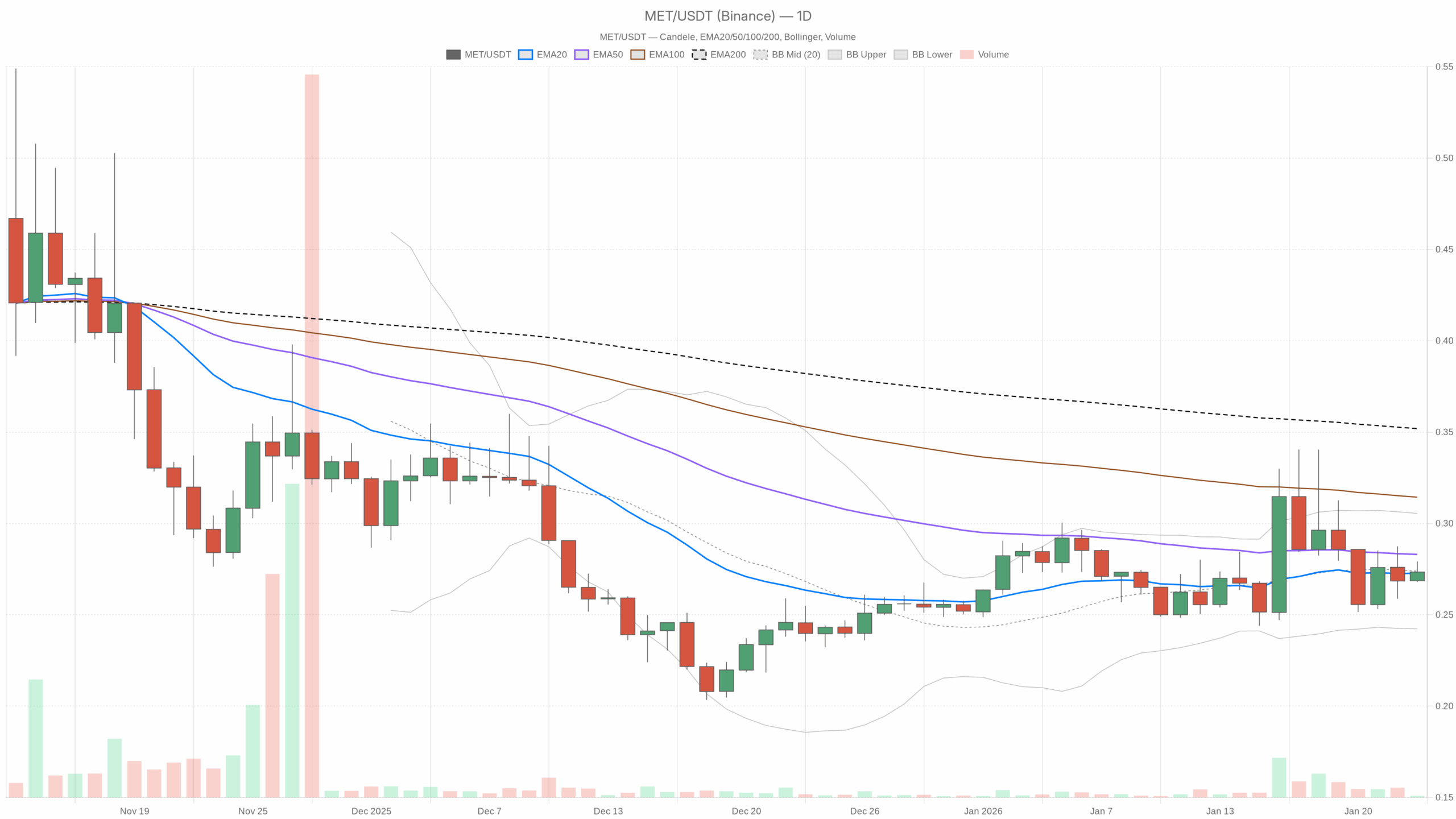

Worth motion on Meteora crypto (MET/USDT) is caught round a decent vary at $0.27, with volatility compressed and market sentiment in Excessive Worry, suggesting a bigger transfer is probably going forward.

Principal situation for METEORA crypto from the every day chart: leaning neutral-to-bearish

Based mostly on the every day (D1) knowledge, the first stance is neutral-to-bearish reasonably than outright bullish:

- Worth is nicely under the 200-day EMA at $0.35 – that could be a basic signal of a market nonetheless buying and selling inside a broader downtrend regime.

- EMAs on the shorter facet (20 and 50) are compressing round value, exhibiting consolidation reasonably than trending habits.

- Momentum indicators (RSI, MACD) are principally flat – this isn’t a trending tape, it’s a ready room.

In different phrases, the larger image continues to be managed by sellers. Nonetheless, in the previous couple of weeks they’ve stopped urgent, and the market is deciding whether or not $0.27 will grow to be a base or only a non permanent shelf earlier than one other leg decrease.

Every day (D1) view – construction and key indicators on Meteora crypto

1. Development and shifting averages (EMA20, EMA50, EMA200)

Values (D1):

Shut: $0.27

EMA20: $0.27

EMA50: $0.28

EMA200: $0.35

Worth is sitting proper on the 20-day EMA and only a hair underneath the 50-day EMA, whereas the 200-day EMA continues to be far above at $0.35.

The way to learn this: quick time period, MET is in sideways equilibrium across the 20-day common, which normally means the market is undecided. Furthermore, the marginally decrease 50-day versus 200-day setup, and value buying and selling nicely underneath the 200-day, verify that the macro development stays down. Bulls are attempting to stabilize, not trending larger but. To flip the narrative, MET must reclaim and maintain above the 50-day, then begin closing the hole to the 200-day.

2. Every day RSI (14)

RSI14 (D1): 50.06

RSI proper on 50 is about as impartial because it will get.

What this means: there’s no significant momentum edge to both facet on the every day. Sellers have misplaced the higher hand they’d in the course of the prior down leg, however consumers haven’t taken management both. That is in keeping with a consolidation after a decline – a spot the place markets both construct a base or reload for an additional drop.

3. Every day MACD

MACD (D1):

Line: ~0.00

Sign: ~0.00

Histogram: 0.00

MACD is totally flat, hovering across the zero line.

What this means: development power is absent on the every day timeframe. There is no such thing as a clear bullish enlargement or bearish acceleration. When MACD is that this muted similtaneously RSI is useless heart, it normally tells you the robust transfer already occurred and the market is catching its breath. The following enlargement transfer ought to be handled as essential as a result of it’s going to seemingly outline the subsequent multi-week leg.

4. Bollinger Bands (D1) – volatility and vary

Values (D1):

BB mid (20-period foundation): $0.27

Higher band: $0.31

Decrease band: $0.24

Worth is glued to the center band, with bands set roughly between $0.24 and $0.31.

What this means: Meteora crypto is in a tight, mid-band consolidation. Worth is neither urgent volatility to the upside nor testing the decrease band. That is basic vary habits after a transfer. The band width (~$0.07) defines a primary volatility envelope: breaks and every day closes close to $0.31 would level to a volatility enlargement larger, whereas every day closes close to $0.24 would present volatility returning to the draw back.

5. Every day ATR (14) – volatility magnitude

ATR14 (D1): 0.03

With MET/USDT at $0.27, an ATR of $0.03 means the typical every day vary is about 11–12% of value.

What this means: relative to many altcoins, that degree of ATR is reasonable reasonably than explosive. The market has calmed down in contrast with peak volatility phases, aligning with the consolidation image from Bollinger Bands. For merchants, this implies place sizing can not assume ultra-low volatility. A standard day can nonetheless simply swing a couple of cents across the present value.

6. Every day pivot ranges – short-term assist/resistance map

Pivot Factors (D1):

PP: $0.27

R1: $0.28

S1: $0.27 (successfully the identical space as PP on this knowledge set)

The principle pivot (PP) is true on the present value, and the primary resistance simply above at $0.28. Help is successfully the identical area, signaling a really tight every day vary.

What this means: the market is balanced intraday round $0.27. Any clear push above $0.28 with follow-through could be the primary signal that short-term consumers are keen to pay up. Conversely, dropping $0.27 on a convincing every day shut would trace that the vary is resolving decrease. For now, these ranges simply body a slim battlefield reasonably than exhibiting a directional edge.

Intraday context – H1 and M15 on MET/USDT

1-hour (H1) – micro development and short-term momentum

Values (H1):

Shut: $0.27

EMA20: $0.27

EMA50: $0.27

EMA200: $0.28

RSI14: 53.43

MACD: flat round 0.00

BB mid: $0.27 (bands roughly $0.26–0.28)

ATR14 (H1): 0.00 (successfully extraordinarily low within the present knowledge)

On the hourly chart, value is stacked proper on high of the quick EMAs, with the 200-hour EMA a bit of larger at $0.28. RSI sits barely above 50, indicating a tiny bullish tilt, however MACD is once more flat.

What this means: the H1 timeframe is impartial with a slight intraday bullish lean. Consumers are doing simply sufficient to maintain MET from slipping, however not sufficient to interrupt the upper timeframe construction. The very slim Bollinger Bands and negligible ATR let you know liquidity is skinny and the tape is sluggish. These are sometimes circumstances for a sudden, sharp transfer as soon as a catalyst or bigger move hits.

15-minute (M15) – execution-level noise

Values (M15):

Shut: $0.27

EMA20: $0.27

EMA50: $0.27

EMA200: $0.27

RSI14: 47.89

MACD: flat round 0.00

BB mid: $0.27 (bands basically hugging value)

ATR14 (M15): 0.00 (vary extraordinarily compressed)

All of the quick EMAs are clustered on the similar value and intraday volatility is nearly non existent.

What this means: on quarter-hour, MET/USDT is in pure chop mode. There is no such thing as a dependable momentum and no clear micro development. That is an surroundings the place overtrading intraday swings sometimes results in getting whipped round for nothing. M15 is helpful right here solely to fine-tune entries across the broader situations, to not generate a stand-alone view.

Market surroundings – threat urge for food and sentiment

The broader crypto market is exhibiting:

- BTC dominance round 57.5% – capital is comparatively concentrated in bitcoin, an indication of defensive positioning.

- Whole market cap down about 0.4% in 24h, with quantity down sharply (~-22%) – participation is muted.

- Worry & Greed Index at 24 – formally Excessive Worry.

What this means for Meteora: altcoins like MET are not working in a risk-on surroundings. When BTC dominance is excessive and sentiment is fearful, liquidity prefers majors and stablecoins. That tends to cap upside on smaller names until there’s a robust, asset-specific catalyst. On the similar time, excessive worry usually coincides with value-building phases. Markets grow to be uneven, the place dangerous information can nonetheless push value decrease, however excellent news can set off outsized short-covering rallies.

Situations for Meteora crypto (MET/USDT)

Bullish situation

For bulls, the wager is that $0.27 is forming a base inside a broader downtrend, and {that a} reduction rally is coming as soon as worry eases.

What bulls wish to see:

- A every day shut above $0.28, clearing the R1 pivot and pushing value above each the 20 and 50-day EMAs with a long way.

- RSI on D1 nudging up from 50 in direction of the 55–60 zone, signaling that consumers are lastly gaining directional management.

- MACD turning barely optimistic on D1, with the histogram ticking above zero – affirmation that the consolidation is breaking into a brand new upswing.

- Worth stretching in direction of the higher Bollinger Band close to $0.31. A every day shut close to or above that band would point out volatility increasing to the upside.

If that sequence performs out, the primary logical targets sit round $0.31 (higher band and prior vary resistance). Past that, the larger psychological and technical space is the 200-day EMA at $0.35. Reaching wherever near that degree would signify a significant reduction rally contained in the still-intact bigger downtrend.

What would invalidate the bullish case: a decisive every day shut under $0.27 with RSI rolling down underneath 45 and value drifting in direction of the decrease band at $0.24. That might present that the present base failed and that MET is shifting from sideways digestion again right into a directional down transfer.

Bearish situation

For bears, the view is easier: Meteora is trapped under a falling long-term development, sentiment is fearful, and the present equilibrium is only a pause earlier than one other leg down.

What bears wish to see:

- MET slipping under $0.27 and beginning to shut every day candles in direction of $0.25–0.24, re-engaging the decrease Bollinger Band.

- RSI on D1 sliding underneath 45, confirming that promoting stress has returned.

- MACD turning adverse with the histogram printing purple bars underneath zero, exhibiting renewed bearish momentum after the flat section.

- On H1, value failing at or simply under the $0.28 / EMA200 (H1) space repeatedly – appearing as a ceiling reasonably than being reclaimed.

In that case, the primary near-term draw back zone is the $0.24–0.25 area, in keeping with the decrease every day band. If these ranges give manner with robust quantity, there’s room for an extension decrease, particularly if broader market worry intensifies or BTC takes one other hit.

What would invalidate the bearish case: a clear, sustained break above $0.31 on the every day. That might imply value has pushed past the higher band and away from the cluster of quick EMAs, with momentum now not favoring the draw back. Bears would want to reassess if MET begins spending time above that band and gravitates in direction of the 200-day EMA.

Impartial / range-bound situation

Probably the most trustworthy studying proper now could be that MET/USDT is already in a spread, and it could merely maintain oscillating whereas the broader market decides its subsequent transfer.

A continued impartial situation would seem like:

- Worth holding roughly between $0.24 and $0.31 with out decisive breaks on both facet.

- RSI hovering across the 45–55 band, MACD staying flat close to zero.

- EMAs (20 and 50) persevering with to compress sideways round present ranges.

In that surroundings, MET would behave extra like a imply reversion instrument: fades close to the perimeters of the vary, nothing sustained. That is the place intraday merchants scalp and positional merchants wait.

Positioning, threat, and the way to consider Meteora right here

Meteora crypto is sitting in a basic indecision pocket: underneath its long-term development, in a compressed volatility regime, inside a fearful broader market. The alerts throughout timeframes will not be strongly aligned. D1 is neutral-to-bearish, H1 has a slight bullish lean, and M15 is pure noise. When timeframes disagree like this, conviction ought to be saved low and threat managed.

For directional merchants, the hot button is to anchor on every day ranges:

- $0.27 is the pivot battleground.

- $0.24 to the draw back and $0.31 to the upside mark the perimeters of the present volatility envelope.

- The 200-day EMA at $0.35 is the road that separates a easy bounce from a extra severe development restore.

Volatility is presently compressed, however ATR and the band width let you know strikes can nonetheless be significant as soon as they begin. In a market dominated by excessive worry, false breaks and sharp squeezes are frequent. Due to this fact, guarding towards over leverage and respecting invalidation ranges is extra essential than attempting to foretell the precise subsequent tick.

To sum up, this evaluation is supposed as a structural and technical roadmap for MET/USDT, not as a sign to purchase or promote. The important thing edge right here is endurance: let value present whether or not this $0.27 shelf turns into a springboard or a lure door, then align with the rising path reasonably than attempting to guess it upfront.

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We might earn a fee at no further price to you.

Disclaimer: The content material above is for informational and academic functions solely. It’s not funding, buying and selling, or monetary recommendation, and it shouldn’t be used as the premise for any funding choice. Cryptoassets are extremely unstable and carry a big threat of loss. At all times conduct your individual analysis and contemplate your threat tolerance earlier than partaking in any buying and selling exercise.