In response to an official launch, Michael Saylor’s Technique has bought 4980 Bitcoin (BTC) for $531.9 million. The agency bought every coin for a mean of $106,801. The corporate presently holds a complete of 597,325 BTC, price a whopping $42.40 billion. As of at present’s costs, Technique’s BTC holdings come at a mean worth of $70,982 per coin.

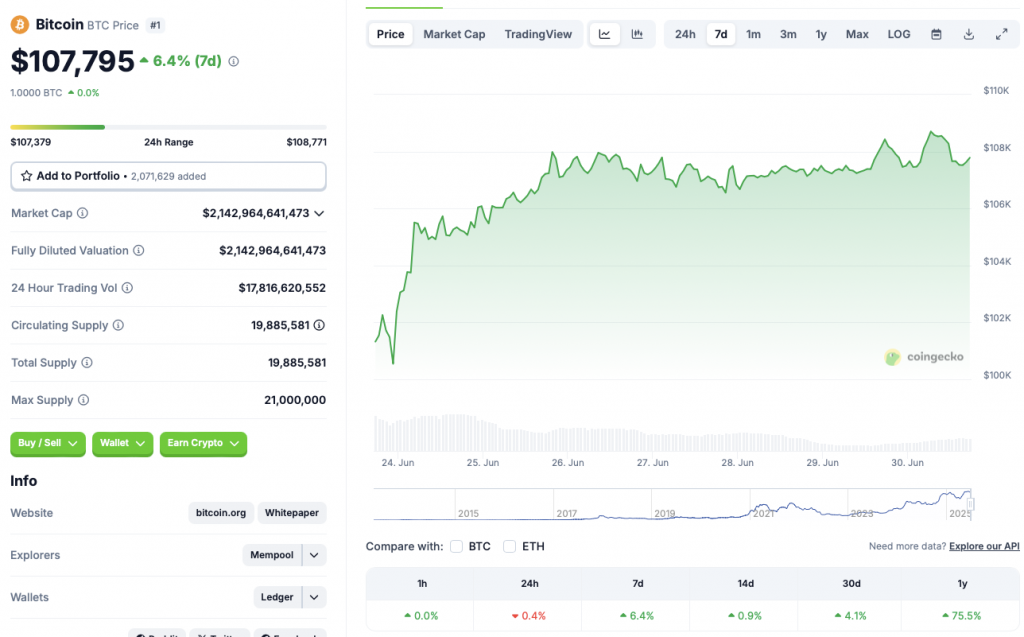

Bitcoin Faces Resistance at $108,000

BTC presently faces resistance at $108,000. The asset is struggling to interrupt this worth barrier. The unique crypto has confronted a 0.4% correction within the day by day charts. Regardless of the slight dip, BTC is buying and selling within the inexperienced zone within the different time frames. BTC is up 6.4% within the weekly charts, 0.9% within the 14-day charts, 4.1% within the month-to-month charts, and 75.5% over the earlier 12 months.

BTC ETFs have additionally seen constant inflows over the previous few weeks. The inflows got here even when the crypto market was dealing with substantial uncertainty with international geopolitical tensions and commerce wars. Spot BTC ETFs noticed $2.22 billion in inflows from June 23 to June 27. The Federal Reserve’s resolution to maintain rates of interest unchanged additionally didn’t hinder institutional inflows.

BTC is presently down by solely 3.6% from its all-time excessive of $111,814. If the asset continues its upward trajectory, we might hit a brand new all-time excessive very quickly.

BTC’s present rally is probably going fueled by principally institutional cash. Retail buyers are seemingly nonetheless unsure in regards to the international financial setting. We might even see an increase in retail investments if the Federal Reserve cuts rates of interest and makes borrowing simpler. President Trump has repeatedly mocked Fed chair Jerome Powell for not reducing rates of interest. The crypto market might even see a sudden rise in retail cash if President Trump convinces Powell to cut back rates of interest.