Michael Saylor-led MicroStrategy (MSTR) stands on the high of organizations that adopted Bitcoin as its main Treasure reserve asset and is formally becoming a member of the Nasdaq 100 index in the present day, December 23, 2024. It is a important second for MicroStrategy as a result of the agency began out as a software program firm and is now a number one participant within the monetary market.

MSTR Pre-Market Buying and selling Value

For the reason that announcement, the $MSTR inventory worth has been fluctuating, and presently, the pre-market worth stands at $357.50 as per Buying and selling View.

Analysts predict that there might be a potential rally within the costs of the $MSTR inventory resulting from elevated visibility and potential institutional curiosity as MSTR turns into part of the Nasdaq 100. Analysts additionally recommend that after the market opens up, the inventory costs might hit the $400 mark.

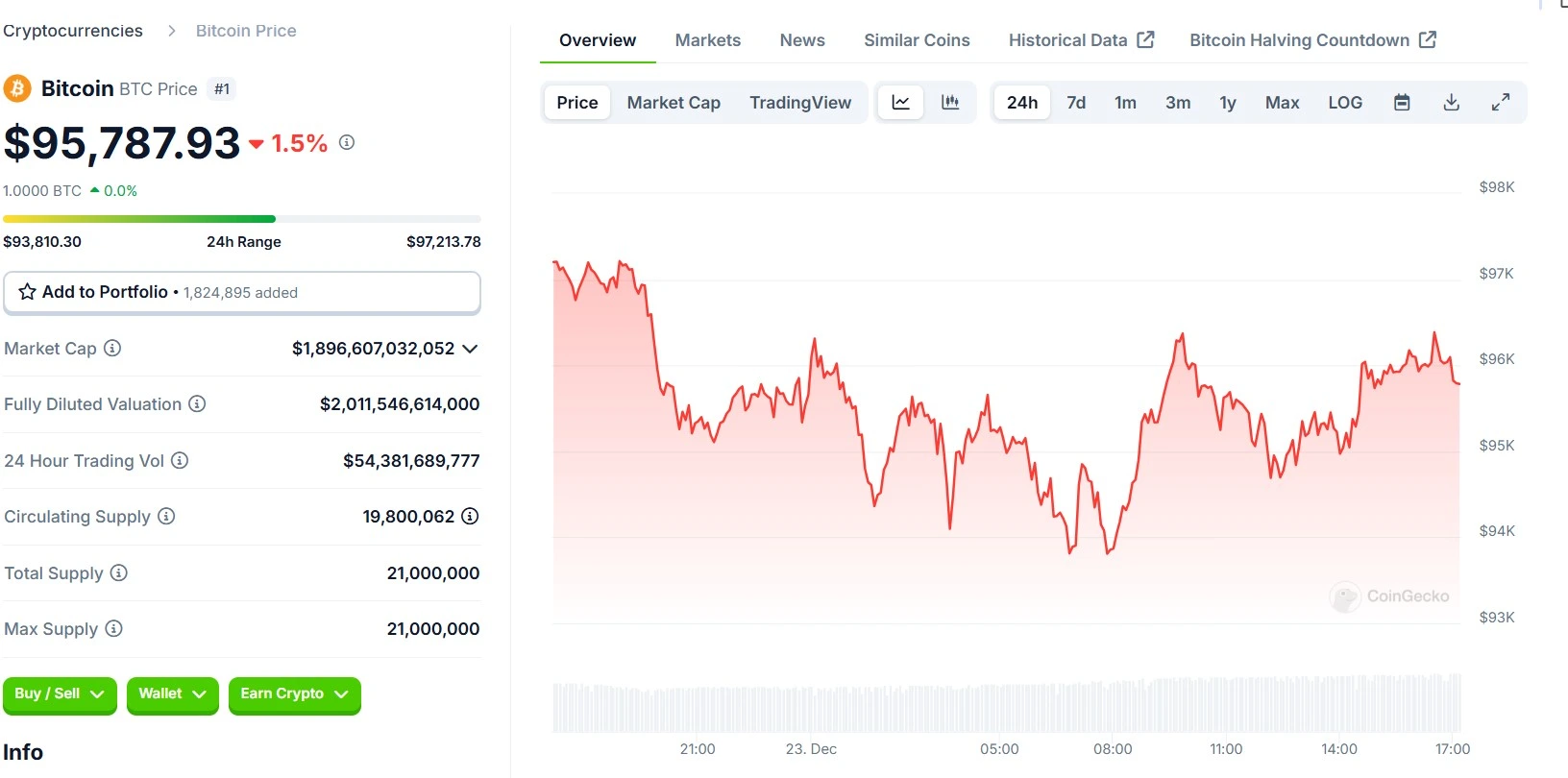

MicroStrategy’s efficiency revolves round Bitcoin, the corporate presently holds 79.296K BTC as per Arkham Intelligence. The Saylor-led firm acquired BTC at an estimated price of $7.64 billion. At press time, the value of the Bitcoin token stands at $95,787.93, with a dip of 1.5% within the final 24 hours.

BTC 24 Hours Chart (Supply: CoinGecko)

Will MicroStrategy Purchase Extra Bitcoin?

In keeping with a Polymarket guess, 89% of customers voted there’s an 89% probability that MSTR will purchase extra Bitcoins earlier than 2024 ends. The worth of the token had hit an all-time excessive of $108,000 however now it’s buying and selling at $96,000 which makes a very good alternatives for establishments like MicroStrategy to purchase extra Bitcoins at such low costs.

Polymarket ballot betting if MSTR will purchase extra Bitcoins earlier than 2024 endsAs the corporate celebrates this milestone, traders will likely be rigorously observing MicroStrategy’s subsequent strikes and see if it might probably hit the $400 mark.

Additionally Learn: Elon Musk Weighs in on Rumors of Biden Pardoning SBF