Miners had been among the many energetic depositors of BTC on Binance, becoming a member of the inflows from newly created whale wallets. Miner reserves stay excessive, however can nonetheless produce short-term promoting strain.

Miners are locking in short-term good points from BTC, whereas retaining their steadiness of 1.89M cash, together with older wallets which will by no means transfer their property. Within the quick time period, Binance was the principle venue for BTC deposits, as miners are at present producing cash at a revenue.

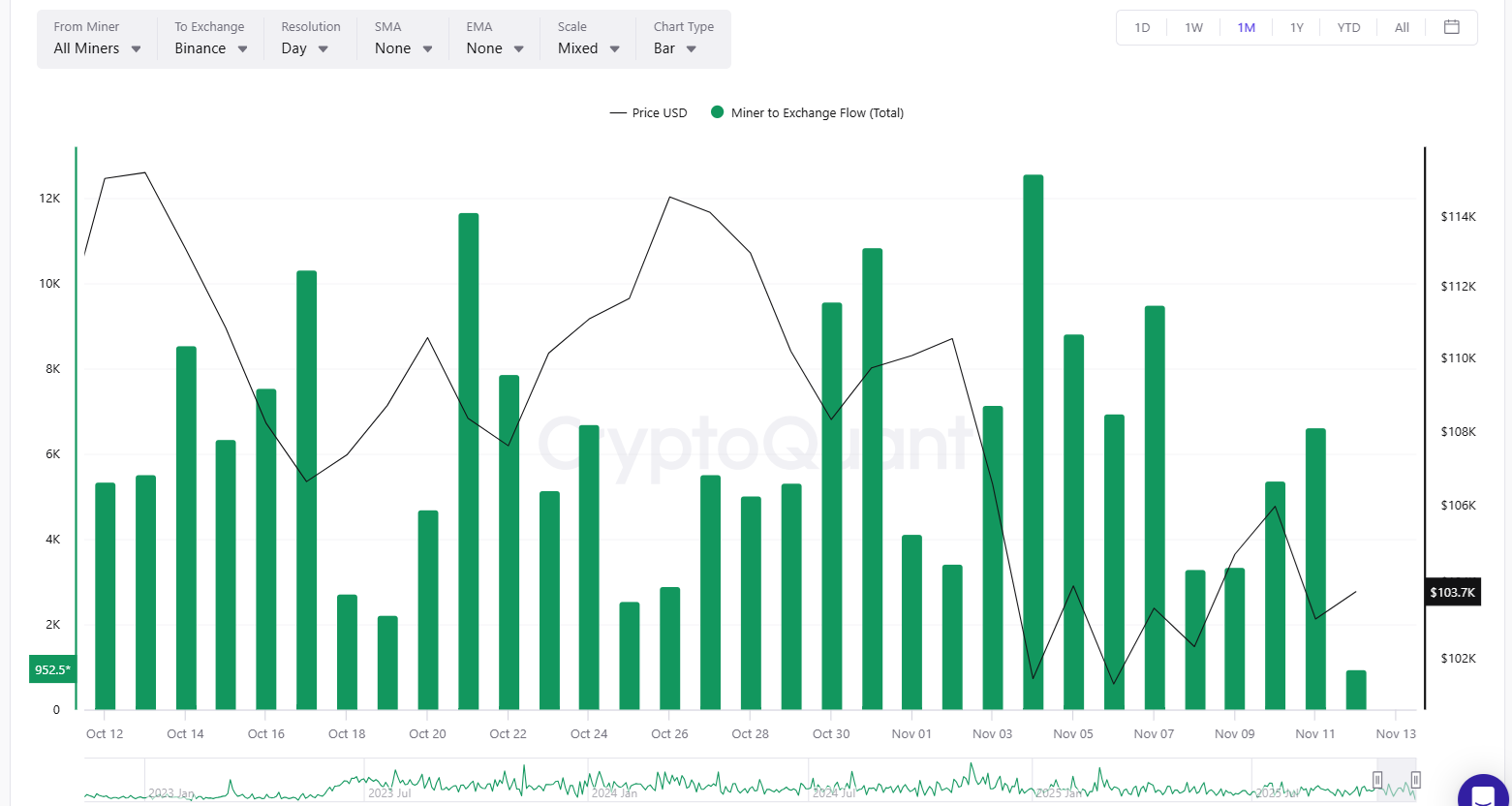

Miner inflows to Binance remained excessive in November, transferring over 71,000 BTC within the month to this point. | Supply: CryptoQuant.

Miners are working beneath all-time excessive aggressive situations, whereas BTC remained comparatively weak, buying and selling at $104,115.

In early November, deposits peaked at 12,564 BTC flowing into Binance in a single day. Miner deposits additionally far outpace the current purchases from treasury corporations. Beforehand, all newly mined BTC was inadequate to fulfill demand.

Miners could also be making an attempt to lock in good points, as at present block manufacturing is worthwhile. Regardless of the low block reward, miners are utilizing extra environment friendly machines, permitting them to promote extra cash for revenue. The market continues to be able to absorbing the BTC even at costs above $100,000.

Miners transfer down from all-time capability document

Miners achieved new exercise data in October, making BTC extra aggressive. A lot of the cash produced went to the largest swimming pools. On the similar time, mining was largely a high-investment exercise, after the creation of recent mining information facilities.

BTC issue is at an all-time peak, and has grown throughout many of the newest reassessment durations. As mining is very aggressive, there are few makes an attempt to close down capability to realize decrease issue. New capability is coming on-line, after miners modernized their fleets with the most recent ASIC.

BTC miners haven’t seen any distressing situations since July, as their price of mining has additionally decreased. With extra environment friendly machines, block manufacturing is as soon as once more aggressive, whereas miners have achieved entry to low-cost electrical energy contracts. For miners, the previous couple of months are among the many 12 months’s longest durations with out indicators of misery or mining BTC at a price larger than the market value.

BTC change reserves stay low

General, regardless of the current deposits, BTC change reserves stay low. Spot promoting meets demand, as BTC is altering palms to new whale wallets.

Binance holds over 566K BTC in its reserves, a web development of over 10K cash in just a few weeks. Nonetheless, even Binance’s reserves are decrease in comparison with earlier cycles.

Miners are additionally diverging of their causes to promote. A few of the corporations could also be promoting older cash, making an attempt to pivot and finance new AI information facilities.

General, miners have vastly totally different prices for producing cash. The older mining operations can go as little as $45,000 to provide a coin. Newer investments are producing BTC for as excessive as $117,000. Latest evaluation suggests the disparity could result in additional consolidation in mining area.