Bitcoin

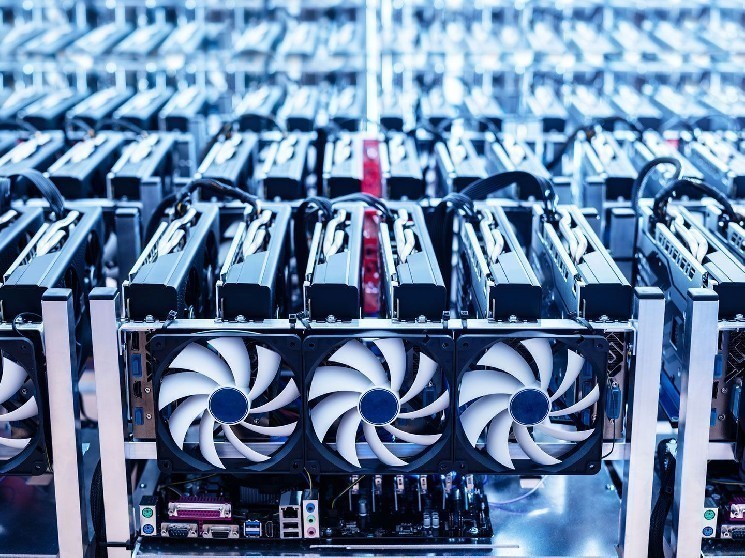

The hashrate refers back to the whole mixed computational energy used to mine and course of transactions on a proof-of-work blockchain, and is a proxy for competitors within the trade and mining problem. It’s measured in exahashes per second (EH/s).

The profitability enhance got here as excessive summer time warmth throughout the U.S. drove up vitality costs, prompting much less environment friendly miners to throttle operations.

To this point in July, bitcoin has surged previous $123,000, to set a brand new all-time excessive pushed by more and more favorable crypto regulation and a weakening U.S. greenback following tariff-related feedback from President Donald Trump. The macro and regulatory backdrop has intensified investor curiosity and supplied a contemporary tailwind for mining corporations, the report stated.

Regardless of the improved profitability, North American public miners noticed a month-over-month decline in bitcoin manufacturing, analysts Jonathan Petersen and Jan Aygul wrote.

In June, they mined a complete of three,382 BTC, down from 3,754 in Might. They accounted for 25.1% of the worldwide community, versus 26.3% the prior month, the report famous.

MARA (MARA) led in output with 713 BTC mined, adopted by CleanSpark with 685 tokens.

MARA additionally maintained its lead in energized hashrate, posting 57.4 EH/s on the finish of June, down barely from Might’s 58.3 EH/s. CLSK held the second-highest hashrate at 45.3 EH/s, the financial institution stated.

Bitcoin mining economics improved final month. A hypothetical 1 EH/s mining fleet would have generated roughly $57,000 in day by day income throughout June, up from $54,000 in Might, the report added.

Learn extra: Bitcoin Community Hashrate Declined in June as Miners Reacted to Latest Heatwave: JPMorgan