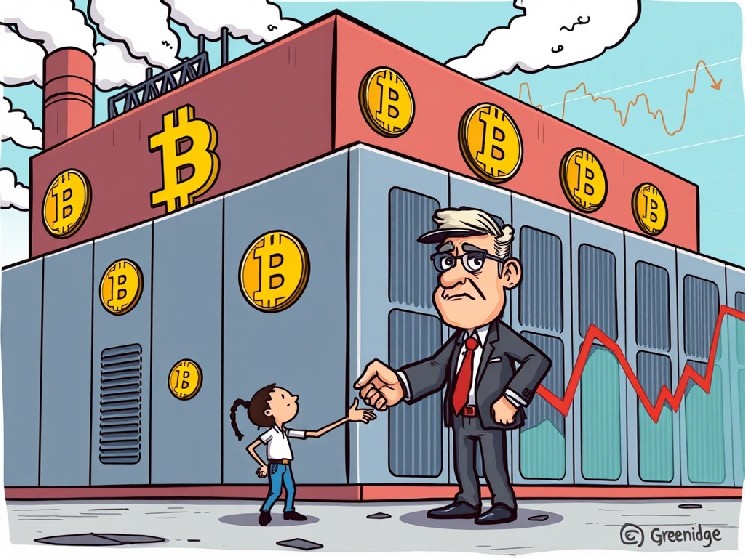

The dynamic world of cryptocurrency usually brings surprising developments, and up to date information from Greenidge Era definitely captures consideration. This story highlights the continuing challenges confronted by some vital gamers within the digital asset area.

Greenidge Era, a notable entity within the Bitcoin mining facility sector, just lately agreed to a pivotal Greenidge sale. This strategic transfer entails offloading its Columbus, Mississippi, operation, signaling a direct response to persistent monetary pressure throughout the firm.

What’s Behind This Essential Greenidge Sale?

Greenidge Era has reached an settlement to promote its Bitcoin mining facility situated in Columbus, Mississippi. The purchaser is U.S. Digital Mining Mississippi, a unit of their competitor, LM Funding America.

This transaction is valued at roughly $3.9 million, as disclosed in a latest U.S. SEC submitting. The sale notably excludes the precise mining rigs and a close-by warehouse.

The events anticipate finalizing this deal by September 16, marking a major transition for the location.

Why the Monetary Pressure on Greenidge?

The Columbus web site, a 6.4-acre property, started operations in July 2024. Regardless of its latest institution, Greenidge has confronted appreciable hurdles.

A major problem has been managing a considerable debt burden. This monetary strain has undeniably impacted their operational flexibility.

Furthermore, tariffs imposed on imported tools have considerably elevated their prices, including to the corporate’s general monetary pressure and making environment friendly crypto mining harder.

What Does This Mining Web site Sale Imply for the Trade?

The mining web site sale by Greenidge provides a stark illustration of the risky nature inherent within the crypto mining business.

Firms on this sector constantly navigate fluctuating Bitcoin costs, escalating vitality bills, and sophisticated world provide chain dynamics.

This strategic divestment by Greenidge might be a calculated transfer to consolidate sources, cut back debt, and doubtlessly pivot in direction of extra sustainable operations in the way forward for crypto mining.

What’s Subsequent for Bitcoin Mining Services and Their Operators?

For Greenidge, this sale represents a crucial step in direction of reaching larger monetary stability. It could permit them to streamline their remaining operations or pursue new, much less capital-intensive ventures.

Conversely, LM Funding America, via its acquisition, is actively increasing its presence within the Bitcoin mining facility panorama. This transfer indicators their confidence within the long-term potential of the sector.

The business will keenly watch how this transformation in possession influences the location’s operational effectivity and general contribution to the customer’s portfolio.

The Greenidge sale of its Mississippi Bitcoin mining facility powerfully underscores the extraordinary pressures prevalent throughout the crypto mining area. It serves as a compelling indicator that even established gamers should strategically adapt to vital monetary pressure, usually resulting in essential asset divestments and a difficult surroundings for any new mining web site sale. This occasion supplies an important reminder of the fixed want for agility and strong monetary foresight within the ever-evolving digital asset business.

Continuously Requested Questions (FAQs)

-

Q1: Why is Greenidge promoting its Mississippi Bitcoin mining facility?

A1: Greenidge is promoting the ability attributable to vital monetary pressure, together with a considerable debt burden and elevated prices from tariffs on imported tools. -

Q2: What’s the sale worth of the Greenidge mining web site?

A2: The sale worth for the Columbus, Mississippi web site is roughly $3.9 million. -

Q3: What does this sale exclude?

A3: The sale particularly excludes the Bitcoin mining rigs and a close-by warehouse related to the ability. -

This autumn: How does this sale replicate the broader crypto mining business?

A4: This Greenidge sale highlights the risky nature of the crypto mining business, the place firms face challenges like fluctuating Bitcoin costs, rising vitality prices, and provide chain points. -

Q5: When is the Greenidge sale anticipated to shut?

A5: The transaction is predicted to shut by September 16.

When you discovered this perception into Greenidge’s strategic transfer useful, share this text together with your community! Keep knowledgeable concerning the dynamic shifts shaping the cryptocurrency mining panorama.

To be taught extra concerning the newest Bitcoin mining tendencies, discover our article on key developments shaping Bitcoin institutional adoption.

Disclaimer: The knowledge supplied just isn’t buying and selling recommendation, Bitcoinworld.co.in holds no legal responsibility for any investments made primarily based on the knowledge supplied on this web page. We strongly advocate unbiased analysis and/or session with a certified skilled earlier than making any funding selections.