The broader crypto market stays beneath strain, and inside this backdrop Monero value is attempting to stage a counter-trend bounce in opposition to a still-dominant bearish construction.

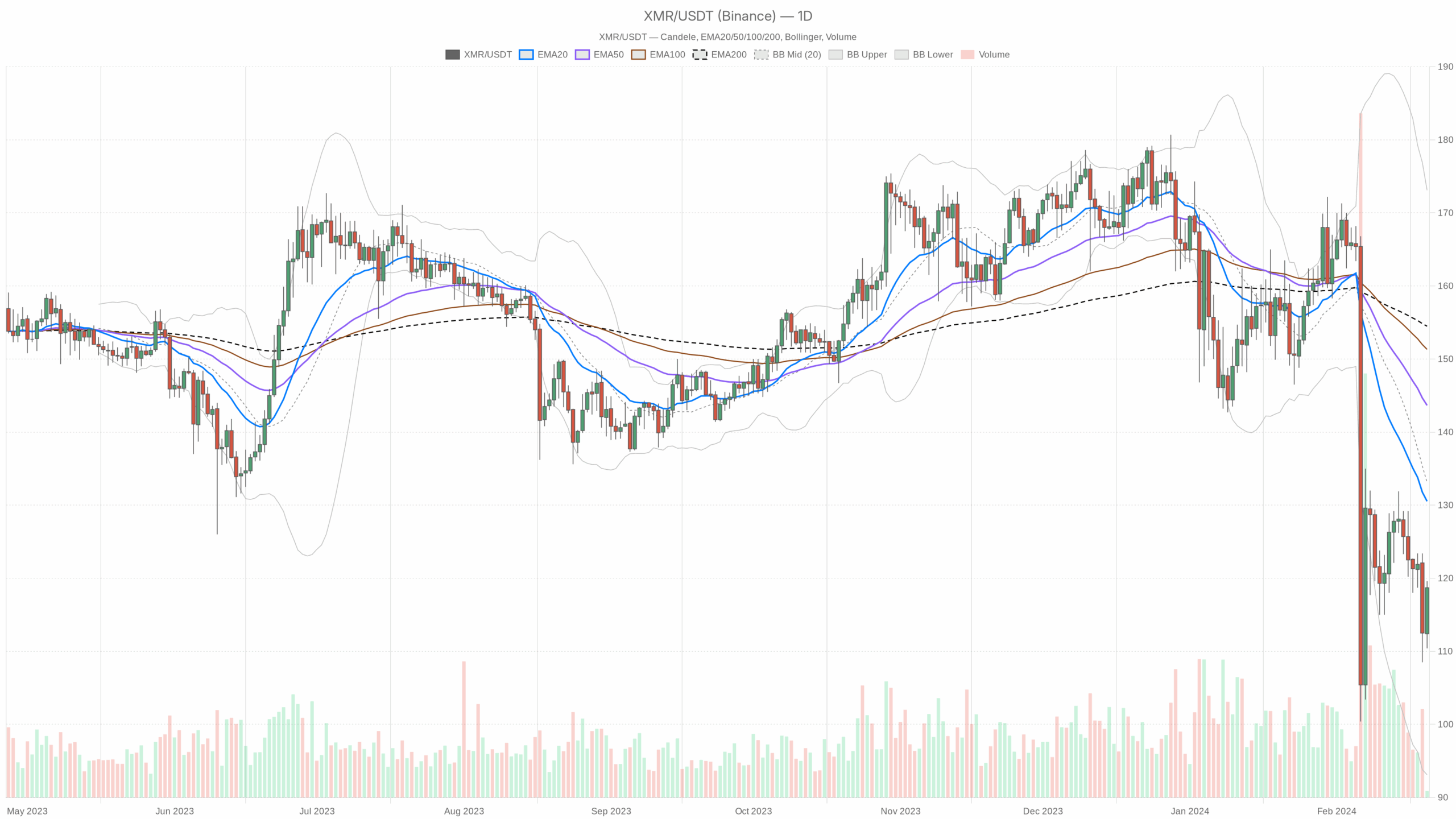

XMR/USDT day by day chart with EMA20, EMA50 and quantity”

XMR/USDT day by day chart with EMA20, EMA50 and quantity”loading=”lazy” />

Monero value: the place we stand now

Monero (XMRUSDT) is buying and selling round $118.7, sitting beneath all the important thing day by day transferring averages and effectively beneath the midline of its Bollinger Bands. Structurally, that is nonetheless a bears-in-charge market on the day by day chart, however with a transparent try at a short-term rebound on intraday timeframes.

This second issues as a result of we’re in a traditional pressure zone: the day by day development is down, but the 1-hour and 15-minute charts present energetic shopping for strain. In different phrases, Monero value is bouncing inside a broader downtrend. The dominant drive for now could be trend-following sellers on the day by day, whereas shorter-term merchants are probing for a backside.

Add to this a crypto-wide backdrop of excessive concern (Worry & Greed at 10) and barely unfavourable complete market cap over 24 hours, and also you get a market extra inclined to promote energy than to chase breakouts.

Major bias from D1: Bearish. Any bullish concept must be framed as a counter-trend transfer till the day by day construction truly shifts.

Every day chart (D1) – main development and construction

Development and transferring averages (EMA20, EMA50, EMA200)

- Value: $118.7

- EMA20: $130.53

- EMA50: $143.65

- EMA200: $154.49

- Regime: Bearish

Monero value is buying and selling beneath all three EMAs, with a transparent bearish stack (value < EMA20 < EMA50 < EMA200). That’s textbook downtrend construction: rallies into the 20-day or 50-day zones are statistically extra more likely to be bought than to show into full development reversals.

Quick take: Dips usually are not being purchased aggressively sufficient to reclaim development ranges; the trail of least resistance remains to be down till not less than the 20-day EMA is reclaimed and held.

RSI (14)

RSI is beneath 50 however above 30, which traces up with a weak, however not but oversold market. Sellers have management, however we aren’t at a capitulation excessive.

Interpretation: Downtrend with room to fall. There’s area for additional draw back earlier than a traditional oversold bounce is pressured. Any bounce from right here is extra doubtless positioning and short-covering than a transparent sign that the development has turned.

MACD

- MACD line: -9.66

- Sign line: -8.97

- Histogram: -0.69

MACD is unfavourable and the road is beneath its sign, with a modestly unfavourable histogram. Momentum is bearish however not accelerating.

Interpretation: The sturdy promote momentum part is behind us for now, however the market has not flipped to bullish. It’s extra of a grinding downtrend than a waterfall.

Bollinger Bands

- Center band (20-period): $133.10

- Higher band: $173.11

- Decrease band: $93.10

- Value vs mid: Value at $118.7 is beneath the center band

Value is buying and selling within the decrease half of the band vary however effectively above the decrease band. Volatility is extensive sufficient to permit large swings, however we’re not hugging the decrease band, which might sign sustained draw back strain.

Interpretation: XMR is weak inside a broad volatility envelope. It has room to maneuver each methods, however the positioning within the decrease half retains the bias pointed down until value can re-attack the center band round $133.

ATR (14) – Every day volatility

An ATR round $10 on a $118 asset implies day by day ranges near 8–9% of value are regular proper now.

Interpretation: Volatility is elevated however not excessive. Strikes of $10 up or down in a day are regular noise, so any ranges you care about want some respiratory room.

Every day pivot ranges

- Pivot (PP): $116.23

- Resistance 1 (R1): $122.07

- Assist 1 (S1): $112.87

Value at $118.7 is buying and selling above the day by day pivot however beneath R1.

Interpretation: On the day by day, XMR is attempting to stabilize barely above its short-term equilibrium at $116. A push by way of $122 after which towards the 20-day EMA close to $130 can be the primary signal that consumers are doing extra than simply defending assist.

1-hour chart (H1) – intraday bias

On the 1-hour chart, the regime is marked as impartial, however the intraday construction is attempting to show up.

Development and EMAs (H1)

- Value: $118.7

- EMA20: $115.86

- EMA50: $118.31

- EMA200: $122.02

- Regime: Impartial

Value is buying and selling above the 20-hour and really barely above the 50-hour EMA, however nonetheless beneath the 200-hour.

Interpretation: Quick-term, consumers have regained management of the final day or two, however the broader intraday development, outlined by the 200 EMA, is just not but damaged. This can be a counter-trend bounce inside a bigger downtrend.

RSI (14, H1)

RSI above 50 exhibits intraday momentum on the purchase facet, however it isn’t stretched.

Interpretation: On the 1-hour, the market is leaning bullish however nonetheless balanced. There’s room for additional upside earlier than overbought considerations kick in.

MACD (H1)

- MACD line: -1.71

- Sign line: -2.00

- Histogram: 0.29

MACD remains to be beneath zero however has crossed above its sign, giving a optimistic histogram.

Interpretation: Momentum is recovering from a beforehand bearish part. Consumers are stepping in, however they’re nonetheless working from a negative-momentum base. It suits the thought of a reduction rally, not a confirmed development reversal.

Bollinger Bands (H1)

- Center band: $116.28

- Higher band: $124.46

- Decrease band: $108.10

- Value vs mid: Value at $118.7 is above the center band

Value is hovering within the higher half of the band vary and above the midline.

Interpretation: Intraday management is with consumers, however value is just not but testing the higher band. The 1-hour chart helps additional upside makes an attempt so long as XMR holds above the mid-band area, round $116–117.

ATR (14, H1) – Intraday volatility

Hourly ranges round $3–4 are frequent proper now.

Interpretation: Intraday volatility is wholesome however not chaotic. Strikes from $118 to $122 or again to $115 can occur inside a session with out altering the larger image.

Hourly pivot ranges

- Pivot (PP): $117.40

- Resistance 1 (R1): $120.90

- Assist 1 (S1): $115.20

With value at $118.7, XMR is above the intraday pivot and between PP and R1.

Interpretation: For brief-term merchants, the market is in a buy-the-dip mode above $117–115 on this timeframe, with $120.9 as the subsequent apparent intraday take a look at.

15-minute chart (M15) – execution and really short-term tone

The 15-minute chart is for timing, not for big-picture bias, nevertheless it provides helpful shade.

Development and EMAs (M15)

- Value: $118.7

- EMA20: $114.02

- EMA50: $114.50

- EMA200: $118.12

- Regime: Impartial

Value is buying and selling above all three EMAs on the 15-minute, together with the 200 EMA.

Interpretation: Very short-term, bulls have the higher hand. On this timeframe, any dip again towards the 200 EMA, round $118.1, is a call level intraday merchants will watch carefully.

RSI (14, M15)

RSI is into overbought territory on the 15-minute chart.

Interpretation: The very short-term transfer is sizzling. That doesn’t imply a macro prime, nevertheless it does elevate the danger of a native pullback or sideways digestion earlier than any additional leg increased intraday.

MACD (M15)

- MACD line: 0.71

- Sign line: 0.11

- Histogram: 0.60

MACD is optimistic and above its sign, with a clearly optimistic histogram.

Interpretation: Quick-term momentum is firmly bullish. Mixed with the overbought RSI, this seems to be like a robust intraday push that will want a pause or small correction to reset.

Bollinger Bands (M15)

- Center band: $113.61

- Higher band: $116.71

- Decrease band: $110.52

- Value vs bands: Value at $118.7 is buying and selling above the higher band

Value has pushed past the higher Bollinger Band on this timeframe.

Interpretation: The 15-minute chart is exhibiting a short-term breakout or overextension. That always resolves both with a fast imply reversion again contained in the band or a consolidation whereas the band catches up.

ATR (14, M15)

Interpretation: Swings of $2 inside a couple of 15-minute candles are inside regular noise, so tight stops can simply be whipsawed at these horizons.

15-minute pivot ranges

- Pivot (PP): $117.77

- Resistance 1 (R1): $120.53

- Assist 1 (S1): $115.93

XMR is buying and selling above the pivot and between PP and R1.

Interpretation: Very short-term bias is up, however with value already prolonged above the higher band, chasing close to $118–119 carries poor speedy reward-to-risk until you might be concentrating on a fast transfer into the R1 area round $120.5.

Placing it collectively: the place Monero value stands

Now we have a traditional multi-timeframe battle:

- Every day (D1): Bearish development, beneath all main EMAs, weak momentum however not oversold.

- 1-hour (H1): Impartial-to-bullish intraday, recovering momentum, value above quick EMAs however beneath the 200 EMA.

- 15-minute (M15): Robust short-term bullish impulse, overbought and prolonged above the higher band.

In plain language, the larger image remains to be down, however we’re in the course of a bounce. Quick-term merchants are pushing Monero value increased inside a broader downtrend, in a macro atmosphere outlined by excessive concern and danger aversion.

Key situations for XMRUSDT

Bullish state of affairs (counter-trend for now)

For the bullish facet to achieve traction, the market wants to show this intraday rebound into one thing extra structural.

What bulls need to see:

- Maintain above $116–115 (H1 pivot and assist zone). That retains the 1-hour construction constructive.

- A sustained push by way of $120.9 (H1 R1) after which a take a look at of the H1 200 EMA round $122.

- From there, the larger take a look at is the day by day pivot or R1 confluence and particularly the EMA20 close to $130.5. Reclaiming and holding above the 20-day EMA can be the primary critical signal of a development restore on the day by day.

If consumers handle to carry above the 20-day EMA after a breakout, the narrative shifts from a useless cat bounce towards potential base-building, with the subsequent logical magnets close to the day by day Bollinger midline at $133 after which the EMA50 round $143–145.

What invalidates the bullish state of affairs:

- A clear break again beneath $115 (H1 S1) that holds on a closing foundation.

- Every day RSI slipping again towards low-30s whereas value stays beneath the 20-day EMA, confirming that this rebound was simply one other promoting alternative.

If that occurs, the bullish case reverts to simply one other bounce in a downtrend, and shorts regain the higher hand.

Bearish state of affairs (trend-following)

The bearish case aligns with the present day by day regime and the macro atmosphere of maximum concern.

What bears need to see:

- Failure to maintain above the $120–122 space (H1 R1 and 200 EMA), adopted by a roll-over of intraday momentum.

- A drop again beneath the day by day pivot at $116.23, turning it into resistance.

- Continuation decrease towards day by day S1 at $112.87 after which a possible take a look at deeper into the decrease half of the day by day Bollinger vary, psychological zone $100–105, with the decrease band down at $93.10.

With day by day RSI at 38, there may be nonetheless room for value to grind down towards that decrease band zone earlier than hitting an oversold wall.

What invalidates the bearish state of affairs:

- XMR reclaiming and holding above the day by day EMA20 ($130.5) for a number of classes.

- Every day RSI pushing again above 50 whereas MACD flattens and begins to rise, signaling a shift from managed downtrend to impartial or early uptrend.

So long as value is pinned beneath the 20-day EMA and the day by day regime stays bearish, sellers retain the structural benefit.

How to consider positioning, danger, and uncertainty

Context issues. The broader crypto market is beneath strain, BTC dominance is excessive, and the sentiment gauge is flashing Excessive Worry. On this backdrop, Monero value rallies usually tend to be handled as liquidity to promote into quite than the beginning of a broad risk-on part.

From a market-logic standpoint:

- Development merchants will naturally facet with the day by day downtrend and look to fade energy into EMA20 and EMA50 zones.

- Imply-reversion merchants will concentrate on the intraday lengthy facet, however with tight expectations: they’re using a bounce, not a confirmed new bull market.

- Volatility is excessive sufficient, with day by day ATR above $10, that place sizing and cease placement matter greater than standard. Being proper on path however flawed on dimension can nonetheless damage.

The true danger right here is overconfidence in both path. The day by day development says don’t fall in love with longs, whereas the intraday charts present that shorts entered too late could be squeezed by quick bounces just like the one we see on the 15-minute and 1-hour charts.

In sensible phrases, the cleanest space of settlement throughout timeframes is the $115–122 band. How value behaves round that zone over the subsequent couple of classes will let you know whether or not that is simply one other blip in a downtrend or the beginning of one thing extra constructive for Monero value.