The on-chain analytics agency Santiment has revealed how the vast majority of the altcoins are presently in what has traditionally been a purchase zone.

Mid-Time period Buying and selling Returns Are Extraordinarily Destructive For Most Altcoins

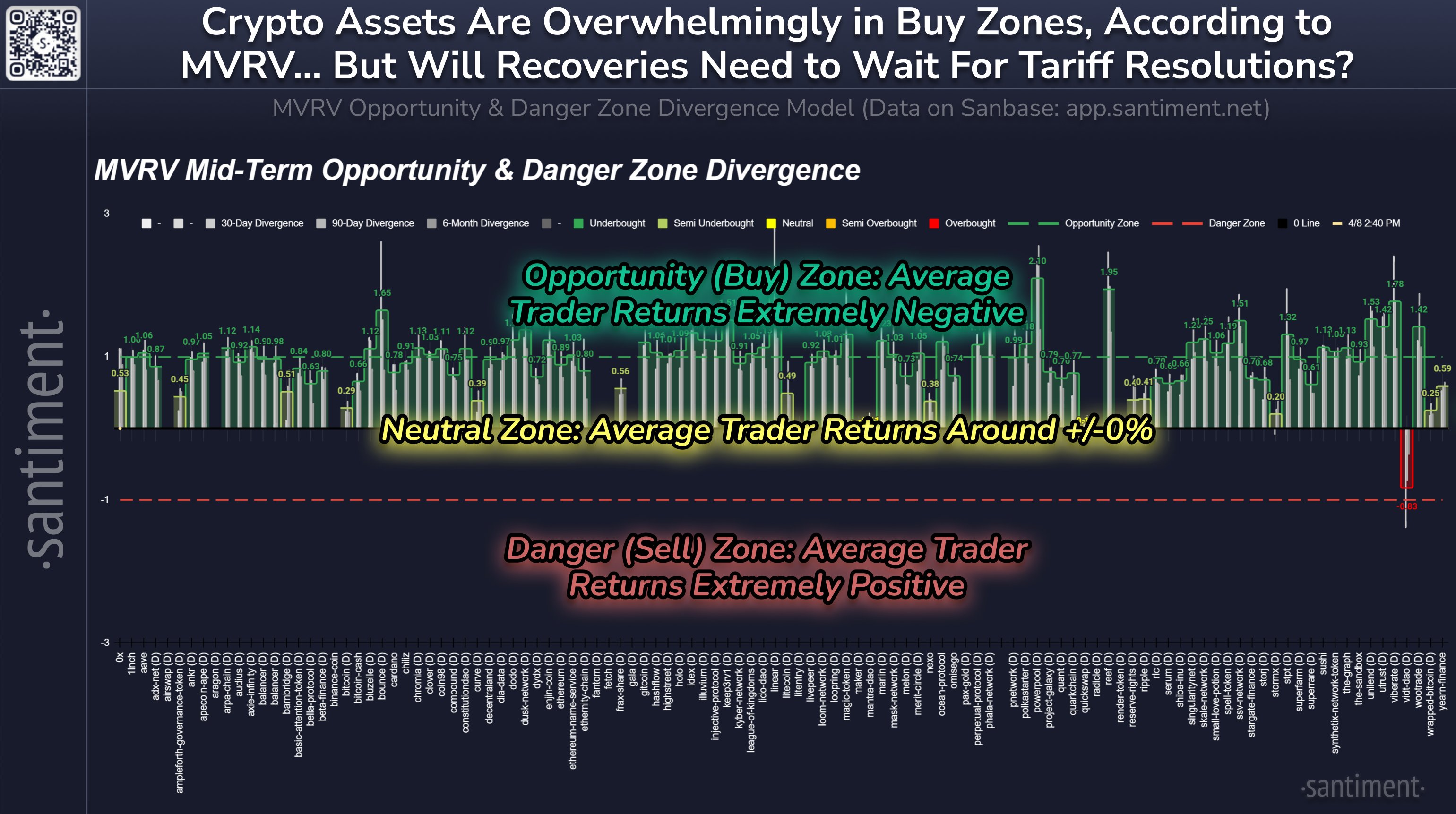

In a brand new put up on X, Santiment has shared an replace for its MVRV Alternative & Hazard Zone Divergence Mannequin for the varied altcoins within the sector. The mannequin relies on the favored “Market Worth to Realized Worth (MVRV) Ratio.”

The MVRV Ratio is an on-chain indicator that mainly tells us whether or not the buyers of a cryptocurrency as a complete are holding their cash at a internet revenue or loss.

When the worth of this metric is larger than 1, it means the common investor is holding a revenue. Alternatively, it being below this threshold suggests the dominance of loss.

Traditionally, holder profitability is one thing that has tended to impact the costs of digital property. Each time the buyers are in massive income, they will grow to be tempted to promote their cash as a way to notice the piled-up positive aspects. This could impede bullish momentum and end in a high for the value.

Equally, holders being considerably underwater ends in market situations the place profit-takers have run out, thus permitting for the cryptocurrency to achieve a backside.

Santiment’s MVRV Alternative & Hazard Zone Divergence Mannequin exploits these info as a way to outline purchase and promote zones for the altcoins. The mannequin calculates the divergence of the MVRV Ratio on numerous timeframes (30 days, 90 days, and 6 months) to search out whether or not an asset is inside one in every of these zones or not.

Right here is the chart shared by the analytics agency that exhibits how the totally different altcoins are presently trying primarily based on this mannequin:

Appears like many of the sector is presently within the purchase area | Supply: Santiment on X

On this mannequin, a worth better than zero suggests common dealer returns are destructive for that timeframe and that under it’s constructive. That is the alternative orientation of what it’s like within the MVRV Ratio, with the zero stage taking the function of the 1 mark from the indicator.

From the graph, it’s seen that nearly the entire altcoins have their MVRV divergence better than zero on the totally different timeframes. Out of those, most of them have their mid-term MVRV divergence better than 1. The chance zone talked about earlier lies past this mark, so the mannequin is presently displaying a purchase sign for almost all of the altcoins.

The typical destructive returns have come for these cash because the market has been in turmoil following the information associated to tariffs. Whereas the mannequin could also be displaying a purchase sign for the altcoins, it’s potential that this uncertainty will proceed to hang-out the market. As Santiment explains,

If and when a world tariff answer is reached, it will undoubtedly set off a really fast cryptocurrency restoration,” notes Nevertheless, that is presently a really large “if” primarily based on the most recent media protection on what’s shortly being known as a full-fledged “commerce struggle” between the US and the vast majority of the world.

BTC Worth

On the time of writing, Bitcoin is floating round $76,900, down greater than 9% within the final seven days.

The worth of the coin has already erased its try at restoration | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.