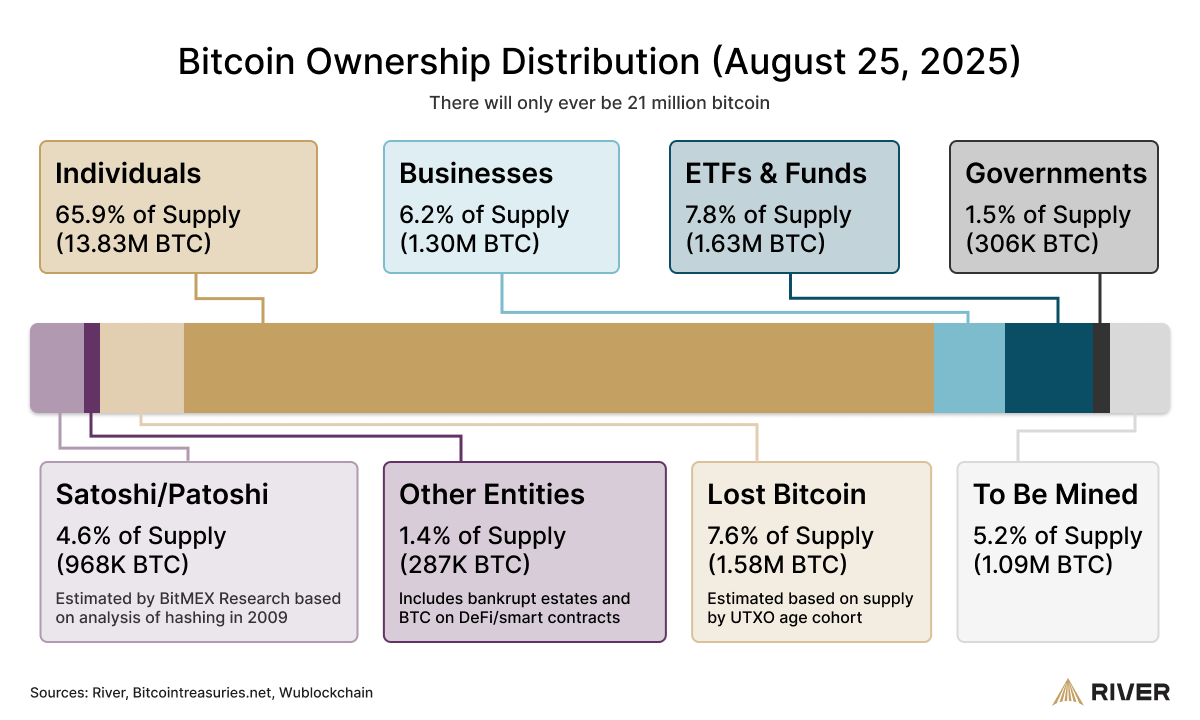

River says people nonetheless personal the vast majority of bitcoin.

The U.S.-based bitcoin monetary companies agency revealed possession distribution analysis dated Aug. 25, 2025 in a current submit on X. The examine teams provide into classes and reveals the share River attributes to every, utilizing public filings, custodial handle tagging and earlier blockchain analysis.

River estimates people management about 65.9% of circulating BTC, or 13.83 million cash. This bucket contains self-custodied wallets and alternate accounts River classifies as particular person.

On the institutional facet, River divides holdings into companies and ETFs and funds.

- Companies — a worldwide class masking company treasuries and traditional companies that report bitcoin holdings — account for about 6.2% of provide, or 1.30 million BTC.

- ETFs and funds — spot ETFs and funding automobiles that custody cash for purchasers — management about 7.8%, or 1.63 million BTC.

Governments are proven at about 1.5%, or 306,000 BTC, primarily based on sovereign addresses River tracks from public sources.

Two particular classes spherical out the distribution:

- Misplaced bitcoin makes up about 7.6%, or 1.58 million BTC. River says that is inferred from age heuristics exhibiting cash that haven’t moved for a few years and are probably unrecoverable.

- Satoshi/Patoshi holdings are pegged at about 4.6%, or 968,000 BTC, primarily based on earlier analysis into early-era mining patterns.

Lastly, about 5.2% of the provision, or 1.09 million BTC, has but to be mined earlier than the exhausting cap of 21 million is reached.

River’s analysis estimates as of Aug. 25, 2025, people maintain 65.9% of BTC, funds 7.8%

In plain phrases, River’s analysis is an try and map who holds bitcoin at the moment, to not forecast future costs. The estimates will not be definitive, since custodians mixture many purchasers, some wallets are misclassified and possession might be opaque.

River’s conclusion is that people nonetheless dominate holdings, however the institutional share is increasing, helped by the expansion of ETFs and firms that now deal with bitcoin as a balance-sheet asset.