-

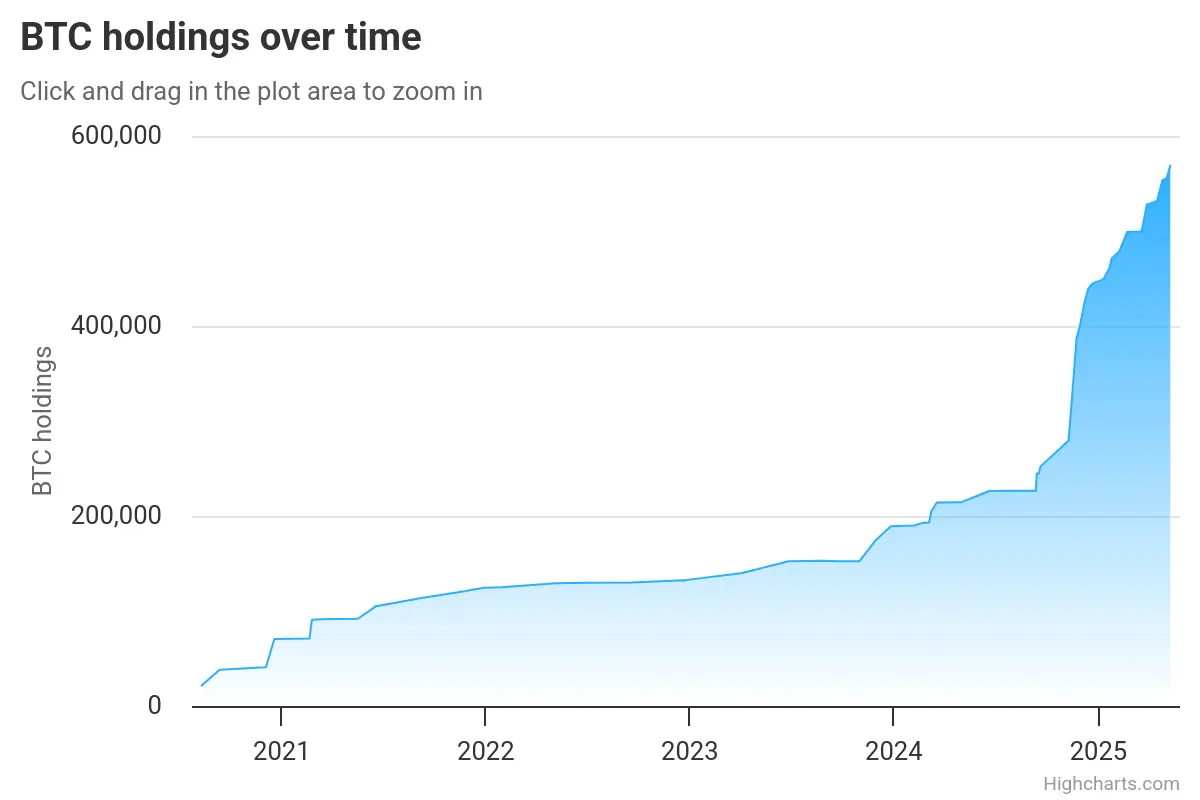

MicroStrategy acquires 13,390 BTC for $1.34B, boosting its whole holdings to 568,840 BTC, now valued at $59.23B with $19.83B in earnings.

-

MicroStrategy leads company Bitcoin adoption, outpacing Tesla and others, with a 34.92% surge in MSTR inventory fueled by bullish crypto sentiment.

MicroStrategy is doubling down on Bitcoin. In its twelfth acquisition of 2025, the corporate has bought a further 13,390 BTC for roughly $1.34 billion. This boosts its whole holdings to a staggering 568,840 BTC—equal to 2.7% of Bitcoin’s circulating provide.

With over $39.4 billion invested, MicroStrategy’s BTC stash is now valued at $59.23 billion, producing unrealized earnings of practically $19.83 billion.

Company Bitcoin Adoption: MicroStrategy Leads the Cost

MicroStrategy stands tall amongst public corporations holding Bitcoin, outpacing main gamers like Tesla, Coinbase, Galaxy Digital, and Metaplanet. The corporate’s aggressive accumulation technique has made it the biggest company holder of BTC worldwide.

Since January, MicroStrategy has added 122,440 BTC throughout 12 separate purchases. Its most up-to-date acquisition occurred on Could 12, 2025, when it spent $1.34B to accumulate 13,390 BTC—marking one more daring transfer in its long-term crypto funding plan.

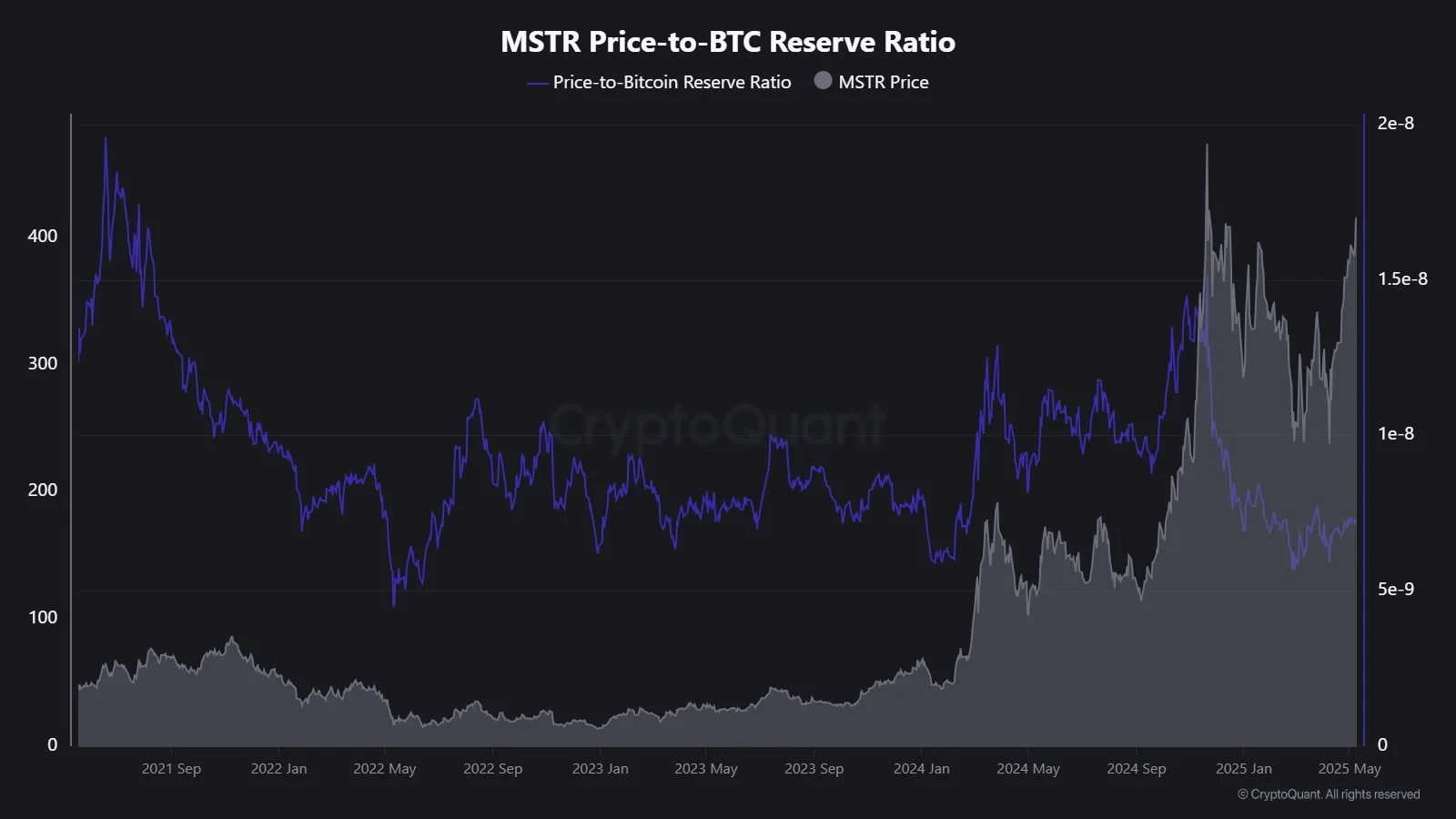

MSTR Worth-to-BTC Reserve Ratio: What It Reveals

The Worth-to-BTC Reserve Ratio for MicroStrategy presently stands at 7.27. This implies buyers are paying $7.27 for each $1 of Bitcoin the corporate holds. MSTR inventory is buying and selling round $404.90, having surged 34.92% year-to-date and 3.21% this month alone—fueled by bullish sentiment round Bitcoin and company crypto publicity.