Ethereum worth has weakened sharply over the previous a number of classes, extending losses as market sentiment deteriorated. The latest dip displays broader bearish circumstances and likewise deliberate investor actions.

Elevated promoting strain has made restoration more difficult. On the identical time, continued distribution dangers push $ETH additional decrease earlier than significant stabilization happens.

Ethereum Holders Transfer To Promote Their Holdings

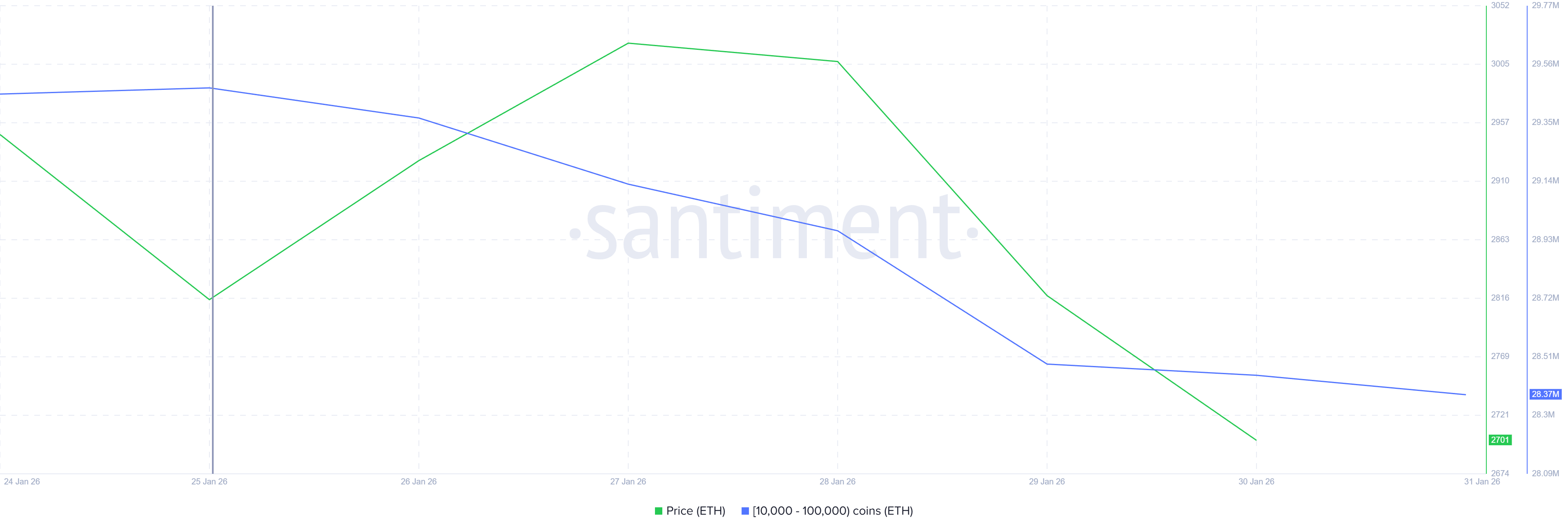

Whale exercise has performed a major position in Ethereum’s newest decline. Over the previous week, addresses holding between 10,000 and 100,000 $ETH diminished publicity aggressively. These giant holders offered greater than 1.1 million $ETH throughout this era. At present costs, the worth of that distribution exceeds $2.8 billion.

Such large-scale promoting provides direct strain on spot markets. When whales scale back holdings, liquidity absorbs provide at decrease costs. This habits typically accelerates short-term downtrends.

In Ethereum’s case, the sell-off strengthened bearish momentum and contributed to the latest breakdown beneath key technical ranges.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Ethereum Whale Holding. Supply: Santiment

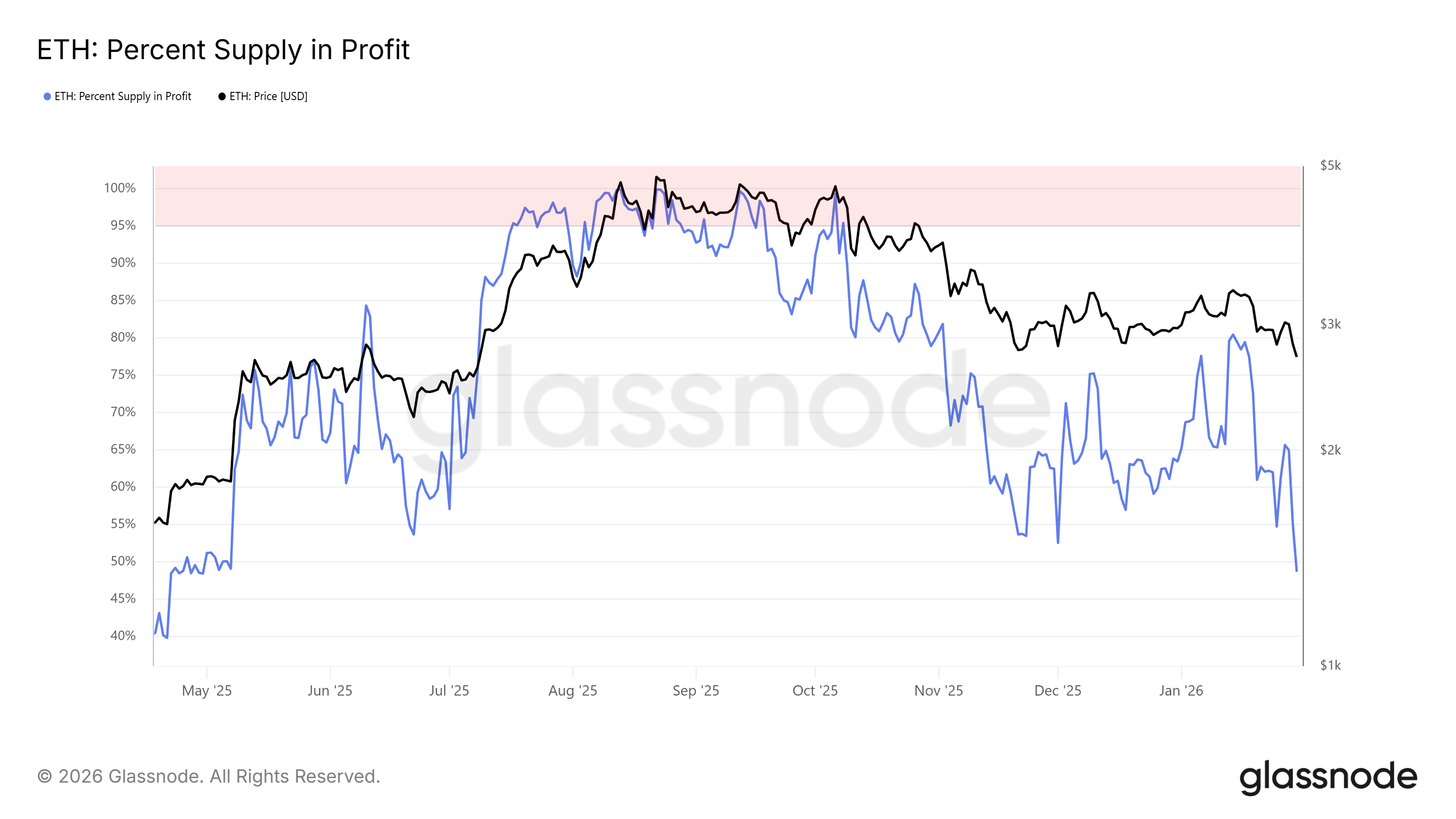

Macro indicators current a combined outlook for Ethereum. Information exhibits that the entire provide in revenue has dropped beneath the 50% threshold. When fewer holders sit on unrealized good points, worry typically will increase. This atmosphere can briefly scale back gross sales, as buyers hesitate to comprehend losses.

Nonetheless, the identical metric additionally carries draw back danger. If losses deepen additional, habits can shift rapidly. Buyers might promote to stop further drawdowns. Below such circumstances, the Ethereum worth might face renewed strain regardless of short-lived stabilization makes an attempt pushed by diminished profit-taking.

Ethereum Provide In Revenue. Supply: Glassnode

$ETH Worth Has A Lengthy Method To Go

Ethereum is buying and selling close to $2,636 on the time of writing. The asset has fallen 12.7% over the previous two days. This decline confirmed a bearish ascending wedge sample. The formation initiatives an extra 16% drop, concentrating on the $2,465 degree if momentum persists.

The likelihood of this situation has elevated following the lack of key assist. $ETH broke beneath $2,802, confirming the sample’s breakdown. Technical buildings typically achieve credibility as soon as assist ranges fail. So long as the value stays beneath the previous assist, bearish continuation stays the dominant danger.

$ETH Worth Evaluation. “>

$ETH Worth Evaluation. “>

$ETH Worth Evaluation. Supply: TradingView

A restoration path nonetheless exists below improved circumstances. If Ethereum holds the $2,570 assist degree, patrons might try a rebound. A sustained transfer again towards $2,802 could be crucial. Reclaiming that degree as assist would invalidate the bearish thesis and sign renewed power.

The submit Almost $3 Billion Ethereum Promoting May Drive a 16% Crash appeared first on BeInCrypto.