The 2024 bitcoin halving occasion sparked main adjustments within the mining scene, based on the most recent “State of the Community” report by Coin Metrics and analyst Matías Andrade.

Battle for Hashrate Dominance

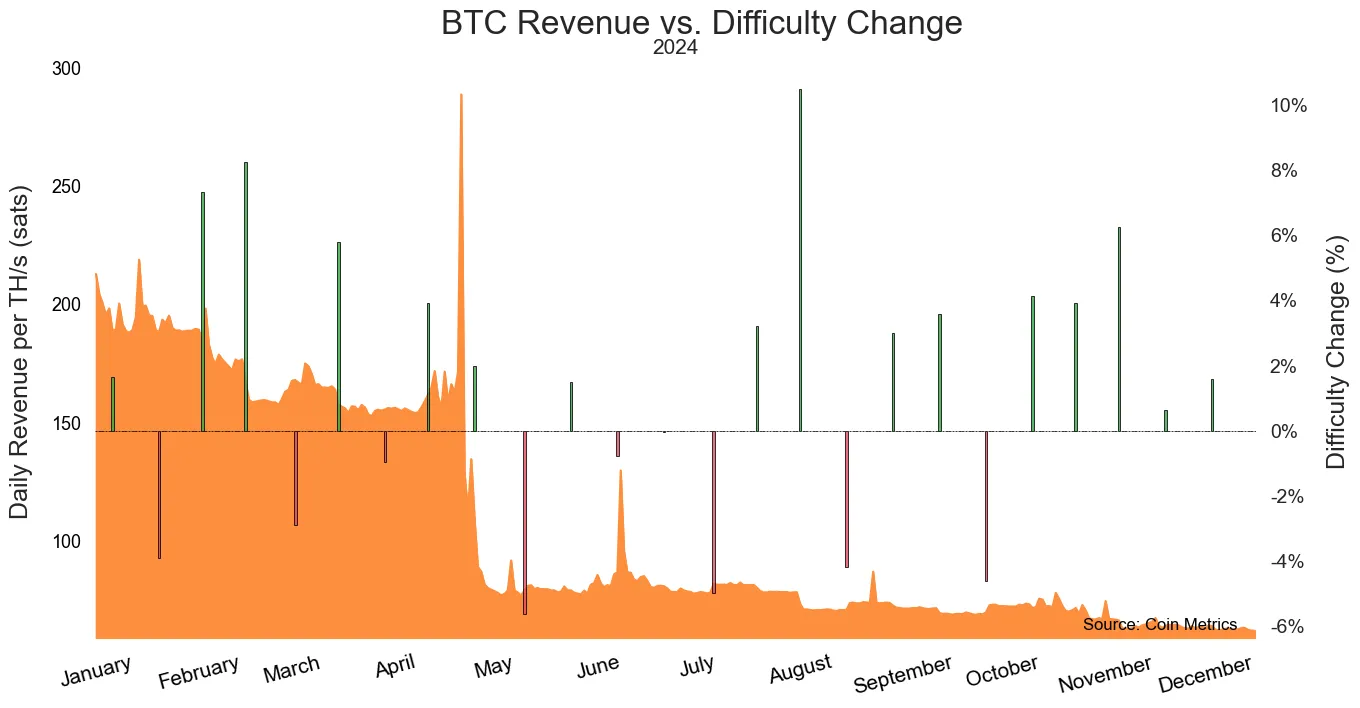

The April 2024 halving, which slashed block rewards from 6.25 BTC to three.125 BTC, severely impacted miner earnings. Coin Metrics’ new report reveals a pointy fall in BTC-denominated income per terahash per second (TH/s) of mining energy proper after the occasion.

Nevertheless, an exhilarating bounce in bitcoin’s value to over the $105,000 vary cushioned a number of the blows, boosting USD-denominated income per TH/s. Even so, profitability nonetheless lags behind its pre-halving heyday, signaling powerful occasions for miners making an attempt to maintain their revenue margins intact.

Coin Metrics’ evaluation exhibits that publicly traded bitcoin mining corporations have outshone bitcoin’s value progress, with wild ups and downs. Whereas bitcoin climbed by 54.3% since July, shares of main mining companies soared. Hut8, Bitdeer, and Core Scientific topped the charts, gaining 68%, 78.5%, and 60.2%, respectively.

Researcher Matías Andrade highlights that operational smarts, robust financials, and cutting-edge mining rigs have been pivotal in distinguishing the cream from the crop. Corporations that held onto bitcoin by means of the bear market additionally loved a monetary increase as BTC costs bounced again. The tech in mining {hardware} has been racing ahead.

Coin Metrics’ “MINE-MATCH” information factors to a giant change to S19-series ASICs, just like the XP and JPro fashions, which now rule the community’s hash energy. It is a clear shift away from older fashions just like the Antminer S9, which had been principally retired by 2020. Andrade stresses that miners must preserve their gear up-to-date to remain within the recreation on this ever-evolving mining enviornment. Trying ahead, Coin Metrics’ report stresses the significance of miners adapting to bitcoin’s dwindling provide, fine-tuning operations, and tapping into low cost vitality sources.

Andrade factors out that staying revolutionary and environment friendly is essential for long-term survival as competitors heats up. The conclusion of the most recent Coin Metrics’ This autumn 2024 mining report paints an image of a bitcoin mining trade wrestling with income dips as a result of halving, whereas juggling {hardware} upgrades and a rollercoaster market. As bitcoin’s value makes a comeback, the highlight is on operational toughness and tech savvy to lock in income.