Ethereum is getting ready to reclaiming its all-time excessive, after setting a recent multi-year peak at $4,792. Bulls stay firmly in management, driving momentum as Bitcoin pauses in a consolidation vary. This stall in BTC’s advance has created room for altcoins to shine, igniting a broad bullish part throughout the market.

Institutional demand continues to play a pivotal position in Ethereum’s rally. On-chain knowledge exhibits a gradual accumulation by massive traders, with wallets linked to main establishments and funds constantly including to their holdings. This shopping for stress is strengthened by a tightening provide dynamic — ETH balances on exchanges and over-the-counter (OTC) desks are quickly declining, decreasing the quantity of cash available on the market.

The mixture of shrinking provide, sturdy investor confidence, and a good macro backdrop has put Ethereum in a primary place to problem its earlier highs. Market members are carefully watching the $4,800–$4,900 vary as a important resistance zone. A breakout above this degree might set the stage for brand spanking new value discovery and speed up the altcoin market’s bullish momentum.

Ethereum Whale Exercise Indicators Confidence Forward of Potential Altseason

Based on blockchain intelligence agency Arkham Intelligence, Ethereum has simply witnessed considered one of its largest single whale transactions of the yr. A newly created pockets withdrew 60,000 ETH — valued at roughly $284.76 million — from Coinbase Prime final night time. The whole sum is now being staked, signaling a robust long-term dedication to holding and securing the community.

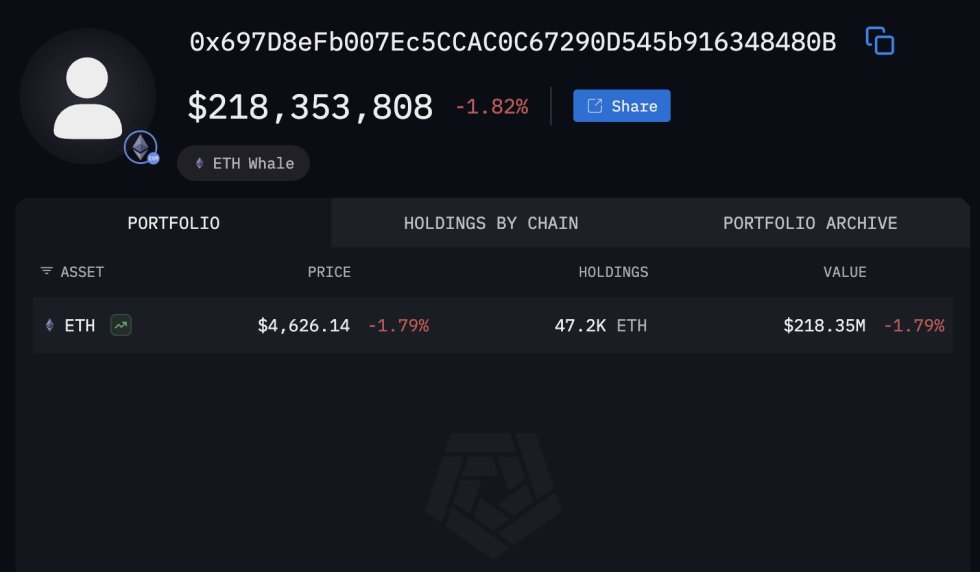

Additional evaluation exhibits that the whale has already moved 3,200 ETH (price $14.75 million) into 4 separate wallets. Notably, considered one of these wallets has deposited its share immediately into Coinbase Staking, confirming that this isn’t a speculative short-term commerce however relatively a deliberate accumulation and yield-generation technique. The pockets handle, 0x697D8eFb007Ec5CCAC0C67290D545b916348480B, is now on the radar of market watchers.

Analysts counsel that such large-scale staking exercise is a bullish sign for Ethereum’s value trajectory. By locking up a considerable quantity of ETH, this whale successfully removes important liquidity from the market, doubtlessly tightening provide throughout a interval of sturdy institutional demand.

Some market consultants imagine Ethereum might turn into the first catalyst for a broader altseason within the coming weeks. With Bitcoin consolidating close to file highs, capital rotation into high-quality altcoins — led by ETH — might ignite a recent wave of market enthusiasm, pushing the sector right into a extra aggressive bullish part.

Value Motion Particulars: Weekly Chart Evaluation

Ethereum (ETH) continues its spectacular rally, closing the week with a robust acquire and pushing to a multi-year excessive close to $4,792, simply shy of its all-time excessive. The weekly chart exhibits a steep upward trajectory over the previous month, with ETH breaking by means of key resistance ranges at $3,200 and $4,000 with little hesitation.

The 50-week transferring common (blue) has crossed decisively above the 100-week MA (inexperienced), signaling sturdy bullish momentum. Value motion stays effectively above the 200-week MA (pink) at round $2,443, underlining the energy of the present uptrend. Quantity has additionally spiked notably throughout this rally, indicating that purchasing stress is supported by strong market participation relatively than skinny liquidity.

Nonetheless, the sharp vertical transfer suggests overextended short-term situations, elevating the chance of a pullback or consolidation earlier than the following leg increased. So long as ETH holds above the $4,200–$4,300 help zone, the bullish construction stays intact, with merchants eyeing a possible breakout into uncharted territory.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.