Newmarket Capital CEO Andrew Hohns suggests incorporating Bitcoin into authorities bonds as a strategy to scale back nationwide debt and buy Bitcoin for the U.S. strategic reserve.

On the Bitcoin (BTC) Coverage Institute’s Bitcoin for America on March 11, Hohns proposes the thought of “Bit Bonds,” a novel kind of U.S. Treasury bond that includes Bitcoin into authorities financing. The concept is to make use of bond issuance to cut back authorities borrowing prices and construct a strategic Bitcoin reserve, whereas providing American households a tax-free funding car.

Hohn urged the U.S. authorities concern round $2 trillion Bit Bonds, with 90% of the funds allotted for presidency buy and 10% of the proceeds could be used to purchase Bitcoin. Which means for each $100, round $10 would go to BTC.

“If it’s a $2 trillion issuance proper off the bat, that may imply $200 billion price of Bitcoin if bought at $90,000 per BTC. That’s 2.22 million Bitcoin. After all, the value will fluctuate and sure we’ll purchase a special quantity than that,” stated Hahn throughout his presentation.

In response to the Newmarket Capital CEO, the bonds would allow the US federal authorities would have the ability to purchase $200 billion price of Bitcoin whereas saving the federal government $554 billion in 10-year rates of interest on the identical time.

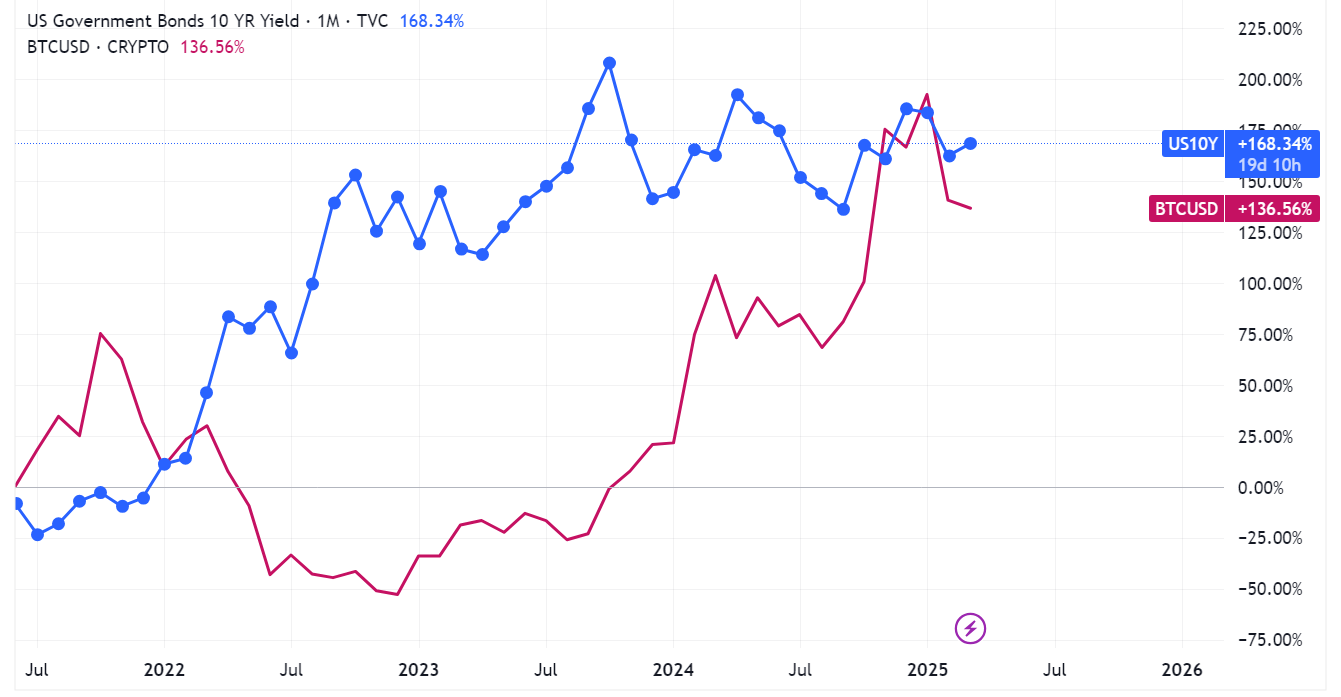

It is because Bit Bonds supply a a lot decrease fee of 1% per yr in comparison with the 4.5% rate of interest of U.S. Treasuries. Thus, it may considerably minimize curiosity bills.

A chart evaluating Bitcoin’s development to the U.S. Treasuries 10-year yields, March 12, 2025 | Supply: TradingView

You may also like: Bitcoin Strategic Reserve: Analyst outlines methods for the U.S. to purchase extra Bitcoin

Furthermore, he stated Bit Bonds would change into a pretty funding for international buyers, as a result of they will function eligible collateral for vary of various swap and by-product preparations. In response to Hahn, buyers stand an opportunity to obtain a 4.5% compound annual development fee on a senior foundation, which aligns with the present Treasury yields.

After incomes this mounted return, buyers obtain a 50% share from the upside of the Bitcoin buy, whereas the U.S. authorities receives the remaining 50%. Relying on Bitcoin’s efficiency, the full returns for buyers may be fairly engaging, starting from almost 7% to as excessive as 17% yearly on a tax-free foundation.

“It produces a authorities entitlement of Bitcoin that’s barely better than $50.8 trillion which is the anticipated dimension of the funded federal debt within the yr 2045. In different phrases, with this plan, we’re ready to defease the federal debt,” defined Hahn.

As well as, he additionally urged Bit Bonds change into out there for Americans as it’s a ” highly effective device to defend in opposition to inflation.” As a financial savings instrument, Hahn stated the bonds needs to be freed from earnings tax and capital positive aspects tax for the American individuals.

He claimed a household may make investments $2,900 and obtain a yield of seven% to 17% over a 10-year interval, relying on Bitcoin’s efficiency all through the years.

You may also like: Max Keiser sarcastically suggests promoting U.S. states to fund BTC strategic reserve, what different methods are there?