Social media buzzed this week after Bitcoin blocks 932129 and 932167 had been mined with out an instantly seen pool tag, prompting hypothesis {that a} solo miner had struck it wealthy, a well-known “Bitcoin lottery” narrative that briefly captured the market’s consideration.

The thrill, nonetheless, had much less to do with the blocks themselves than with what their obvious mislabeling revealed about how Bitcoin mining attribution works. It additionally revealed how rapidly assumptions can take maintain.

Supply: Bitcoin Archive

Amid the hypothesis, NiceHash emerged because the miner behind each blocks. NiceHash operates a hashrate market that connects miners with consumers of computing energy, moderately than working a standard mining pool.

As a result of the blocks initially appeared untagged on mempool explorers, many observers assumed that they had been mined independently by a solo miner. In actuality, each blocks had been mined by NiceHash as a part of inside testing for a forthcoming product, the corporate confirmed.

In unique feedback to Cointelegraph, Sasa Coh, CEO of NiceHash AG, mentioned the misunderstanding stemmed from how block metadata was displayed moderately than from any try and obscure attribution.

“The misperception right here is just that the blocks weren’t labeled by mempool, although they had been tagged with NiceHashMining,” Coh mentioned. “We didn’t need to fire up any hypothesis.”

Coh confirmed that the blocks had been mined throughout inside testing tied to a brand new product, although he declined to share technical particulars forward of its launch.

“We can’t disclose any particulars but, however we’re engaged on a brand new set of merchandise which are going to offer a full suite of functionalities on prime of the prevailing market,” he mentioned.

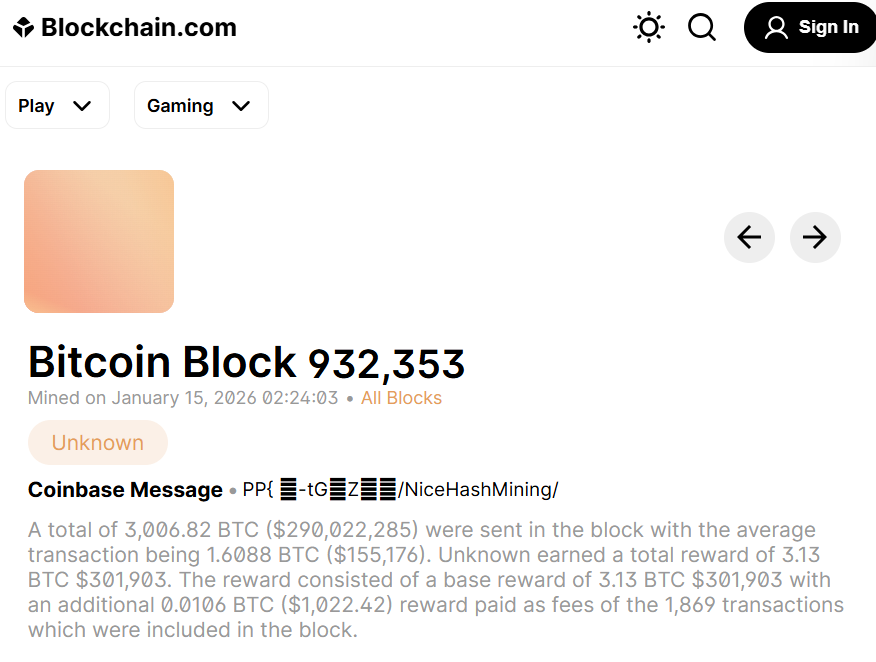

NiceHash mined two extra blocks on Thursday. Supply: Blockchain.com

Block tags are metadata, not protocol ensures. When a well-known tag doesn’t seem, the market can rapidly soar to incorrect conclusions. This episode underscores how a lot Bitcoin narrative formation nonetheless will depend on assumptions moderately than verifiable onchain indicators.

Associated: Bitcoin mining’s 2026 reckoning: AI pivots, margin strain and a battle to outlive

Solo mining continues to be potential, however not typical

The transient “fortunate miner” narrative additionally reignited dialogue round solo mining, a setup through which a person miner works independently moderately than contributing hashpower to a pool. Whereas solo miners obtain the complete block reward if profitable, payouts are extremely unpredictable as a result of probabilistic nature of mining.

“Solo mining is feasible, and it gives a whole lot of enjoyable,” Coh mentioned. “Straightforward Mining at Nicehash was concerned in 17 out of the overall 36 mined solo blocks in 2025.”

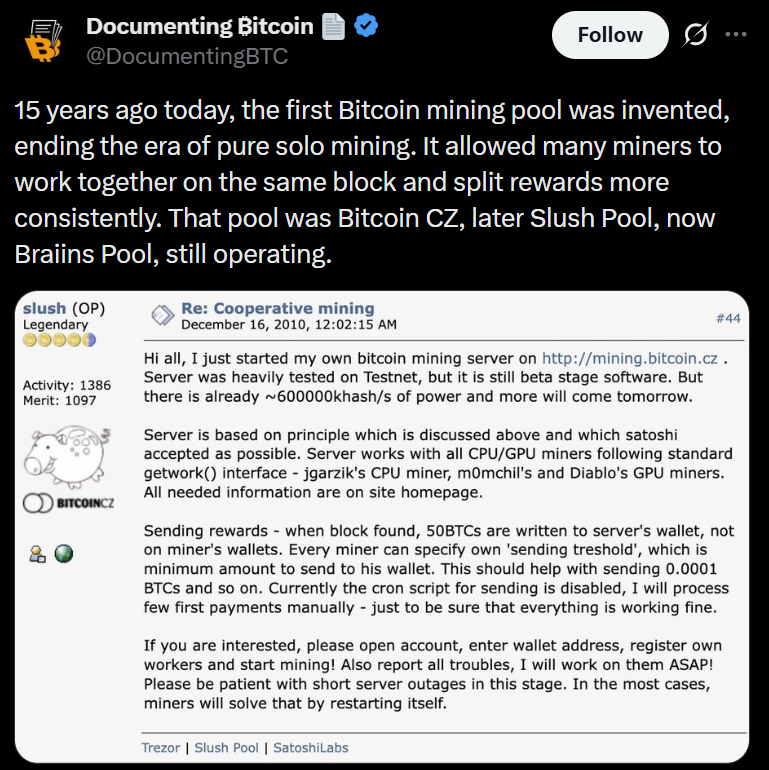

Supply: Documenting Bitcoin

Institutional mining operations, nonetheless, can’t depend on likelihood, he added. These firms usually function large-scale infrastructure and make use of superior methods designed to cut back variance and generate extra predictable income streams.

Institutional Bitcoin mining has grow to be more and more difficult with every halving cycle, squeezing margins and pressuring profitability, whereas pushing operators to diversify income streams into areas equivalent to synthetic intelligence and high-performance computing.

Associated: Bitcoin is now 56.7% inexperienced: Right here’s the way it may get even cleaner