Almost 200 firms now maintain billions in Bitcoin, however a brand new report cautions that just a few can keep away from the hazards of a possible dying spiral.

Bitcoin’s (BTC) company adoption is accelerating quick, with almost 200 entities now holding over 3 million BTC on their steadiness sheets. However as new gamers appear to hurry in, solely those that can skillfully develop their Bitcoin holdings per share usually tend to survive the dangers forward.

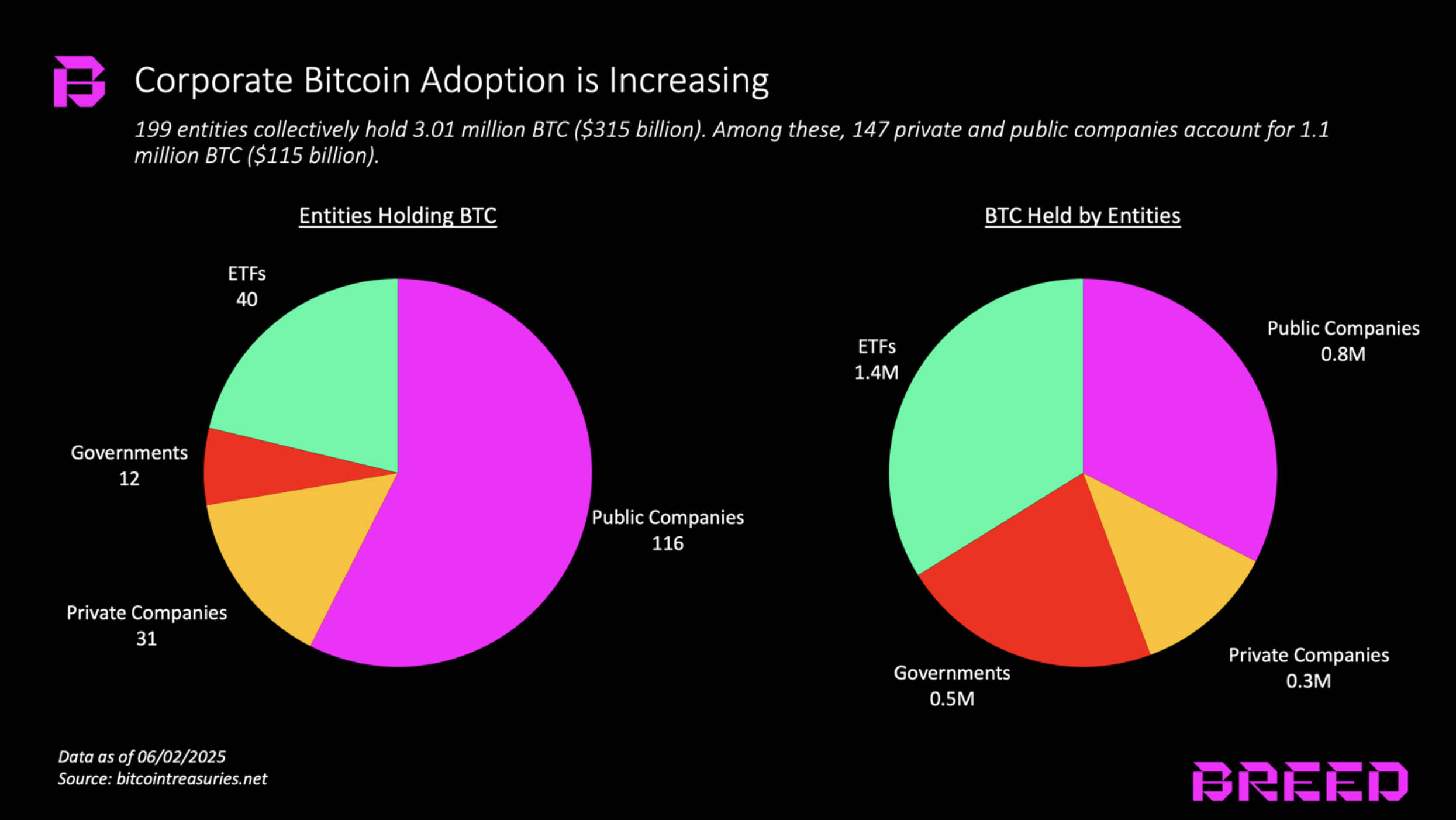

As of Could 2025, about 199 entities reportedly maintain 3.01 million BTC, roughly $315 billion at present costs. Amongst these, 147 firms — each personal and public — maintain round 1.1 million BTC, valued at $115 billion. And this isn’t static. Since early 2024, Bitcoin held by such entities has greater than doubled.

Company Bitcoin adoption amongst totally different entities | Supply: Breed.VC

The story right here isn’t nearly accumulation, however about how firms whose major function is to carry Bitcoin are being valued in another way, say analysts at Breed.VC. Consider these as Bitcoin holding firms — Technique is the poster little one. A brand new report highlights that for these companies, survival and success depend upon commanding what’s known as the A number of on Web Asset Worth, or shortly MNAV. Primarily, this can be a premium buyers pay above the Bitcoin worth on the books.

Wait and see

However this premium, the report explains, “hinges on belief in and execution by the core staff.” It’s not nearly proudly owning Bitcoin; buyers need to see these companies execute a playbook that grows Bitcoin holdings per share sooner than anybody may by merely holding Bitcoin on their very own.

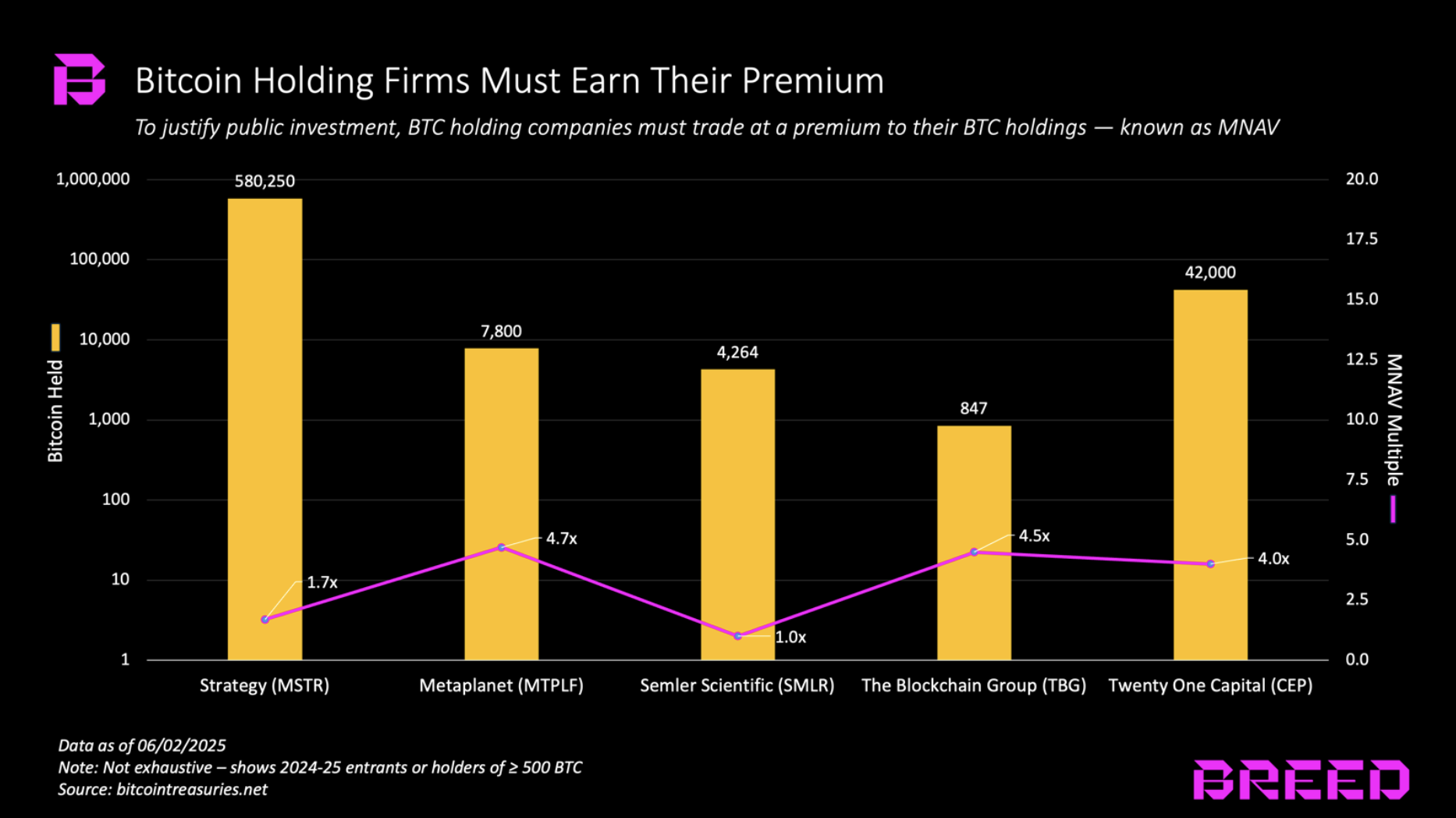

Bitcoin holdings and MNAV | Supply: Breed.VC

Technique at present dominates with about 580,000 BTC, over half of all corporate-held Bitcoin, valued round $60 billion. But its market capitalization sits at $104 billion, giving it an MNAV of about 1.7 instances. Traditionally, Technique’s 2x MNAV has been the gold customary. The report outlines three major levers Technique has used since 2020:

- Issuing convertible debt with low coupons, which converts to fairness provided that the share worth jumps considerably, defending shareholders from dilution until efficiency warrants it.

- Operating at-the-market inventory issuance packages, permitting them to promote new shares when the worth exceeds MNAV after which dollar-cost common into extra Bitcoin.

- Reinvesting all free money movement from legacy companies into shopping for spot Bitcoin.

Others are watching and studying. New entrants are adopting and tweaking this strategy, some even enabling Bitcoin holders to swap cash for shares with out triggering capital good points, or buying undervalued companies and turning that worth into Bitcoin. Others pursue distressed Bitcoin litigation claims or elevate capital through PIPE offers, apparently navigating regulatory gray areas to their benefit.

You may also like: Technique joins Russell High 200 Worth Index with $64b BTC on the books

The roster of Bitcoin treasury gamers is rising quick. Over 40 firms have introduced Bitcoin treasury methods within the first half of 2025 alone, elevating tens of billions to again these strikes. These companies come from throughout: Metaplanet from Japan is capitalizing on low rates of interest there, Semler Scientific and GameStop within the U.S. have pivoted their treasuries, and pure-play companies like Twenty One Capital — backed by Tether and Cantor — are additionally within the combine.

Contagion threat

But, regardless of all of the optimism, the report cautions that “nothing in finance is bulletproof,” particularly on this house. Technique itself confronted a brutal stress check in the course of the 2022–23 bear market. Bitcoin’s worth plummeted 80%, the MNAV premium collapsed, and capital dried up. Although the corporate survived, the menace is evident.

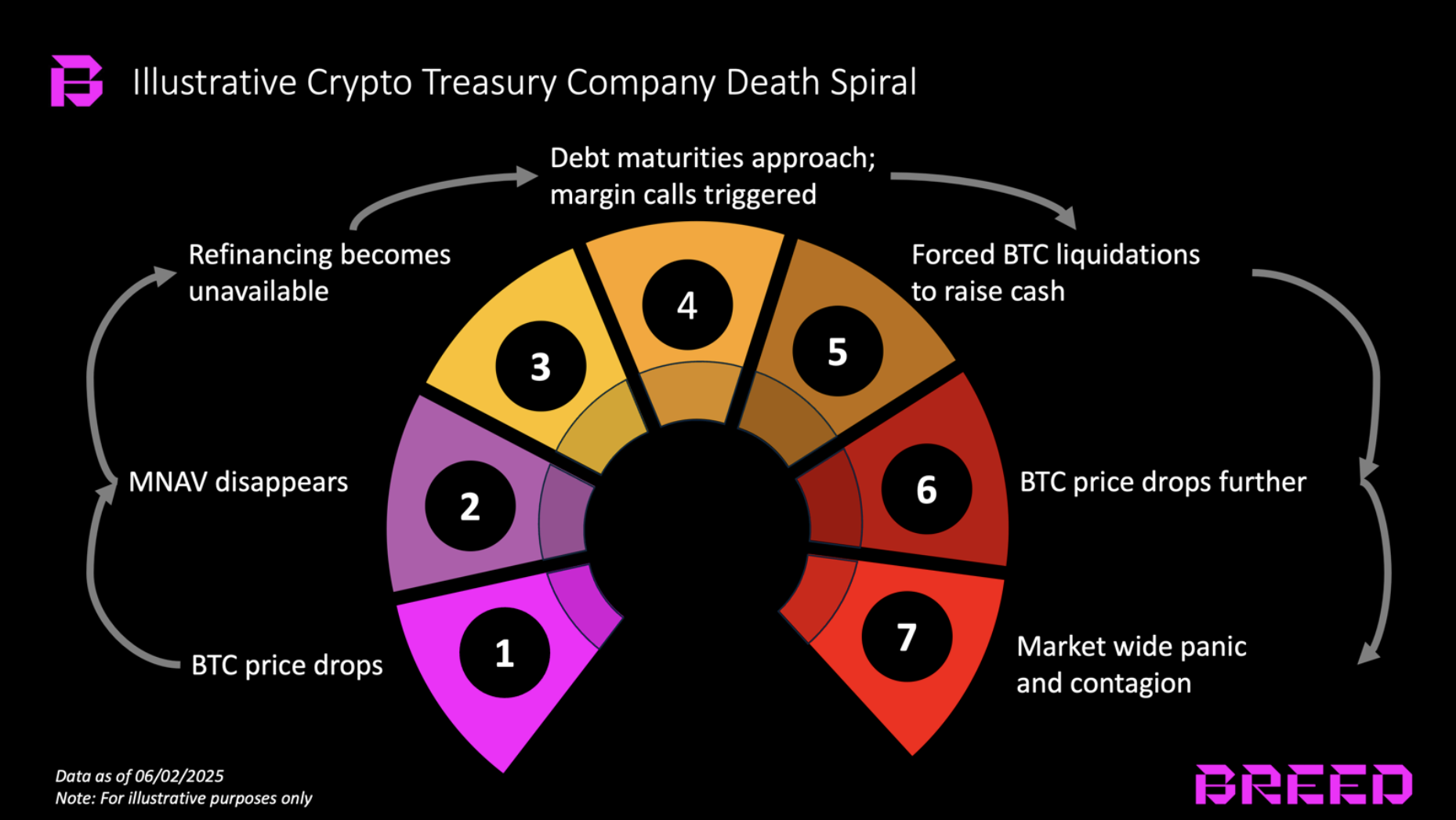

Crypto treasury firm dying spiral | Supply: Breed.VC

An prolonged bear market mixed with looming debt maturities may pressure companies to promote Bitcoin to fulfill obligations, probably triggering a vicious cycle of worth drops and compelled gross sales. This threat is alleged to be significantly acute for newer firms missing Technique’s scale and popularity. They typically elevate capital on harder phrases with increased leverage, which in downturns may speed up margin calls and distressed promoting, amplifying market stress.

The report predicts that “when failures inevitably hit, the strongest gamers are prone to purchase distressed firms and consolidate the business.”

“Luckily, contagion threat is muted as a result of most financing is equity-based; nonetheless, firms that rely closely on debt pose a better systemic menace.”

Breed.VC

Trying forward, the Bitcoin treasury firm mannequin seems to be simply getting began, and never just for Bitcoin. The playbook is already spreading to different crypto property. For instance, Solana has DeFi Growth Corp, which holds over 420,000 SOL and is valued round $100 million, and Ethereum has SharpLink Gaming, which raised $425 million in a spherical led by Consensys.

The report expects this pattern to develop globally, with extra firms chasing increased leverage to amplify success. Nonetheless, it additionally foresees that “most will fail.” In that shakeout, solely a handful will keep an enduring MNAV premium by way of “sturdy management, disciplined execution, savvy advertising, and distinctive methods.”

Briefly, the sport is evolving. Bitcoin treasury companies aren’t simply holders anymore as they’re turning into their very own breed of firms, entities that should show ability and self-discipline to outperform the market they spend money on.

Learn extra: GameStop’s Bitcoin push echoes Technique, however with out the cushion