DDC Enterprise, often known as DayDayCook, a publicly traded client model targeted on wellness-driven meal options, mentioned Tuesday it is going to safe as much as $528 million in gross proceeds to increase its Bitcoin holdings.

The capital might be sourced via a mixture of fairness investments, convertible notes, and an fairness line of credit score.

The NYSE-listed firm’s funding package deal features a $26 million fairness PIPE funding from buyers corresponding to Animoca Manufacturers, Kenetic Capital, QCP Capital, Jack Liu, and Matthew Liu, the co-founder of Origin Protocol.

The second part is a $300 million convertible secured observe facility, mixed with a $2 million personal fairness placement, each led by institutional funding agency Anson Funds.

DDC Enterprise additionally secured a $200 million fairness line of credit score with Anson Funds for Bitcoin purchases. DDC plans to make use of considerably all proceeds from these financings to amass Bitcoin.

“At the moment is a defining second for DDC Enterprise and our shareholders. This capital dedication of as much as $528 million, backed by revered establishments from each conventional finance and the digital asset frontier, represents a powerful mandate to execute an formidable company Bitcoin accumulation technique globally,” mentioned Norma Chu, Founder, Chairwoman & CEO of DDC Enterprise.

The multi-brand Asian meals firm made its first Bitcoin buy late final month, buying 21 BTC. Since then, its Bitcoin treasury has grown to 138 BTC, presently valued at round $14 million based mostly on market costs.

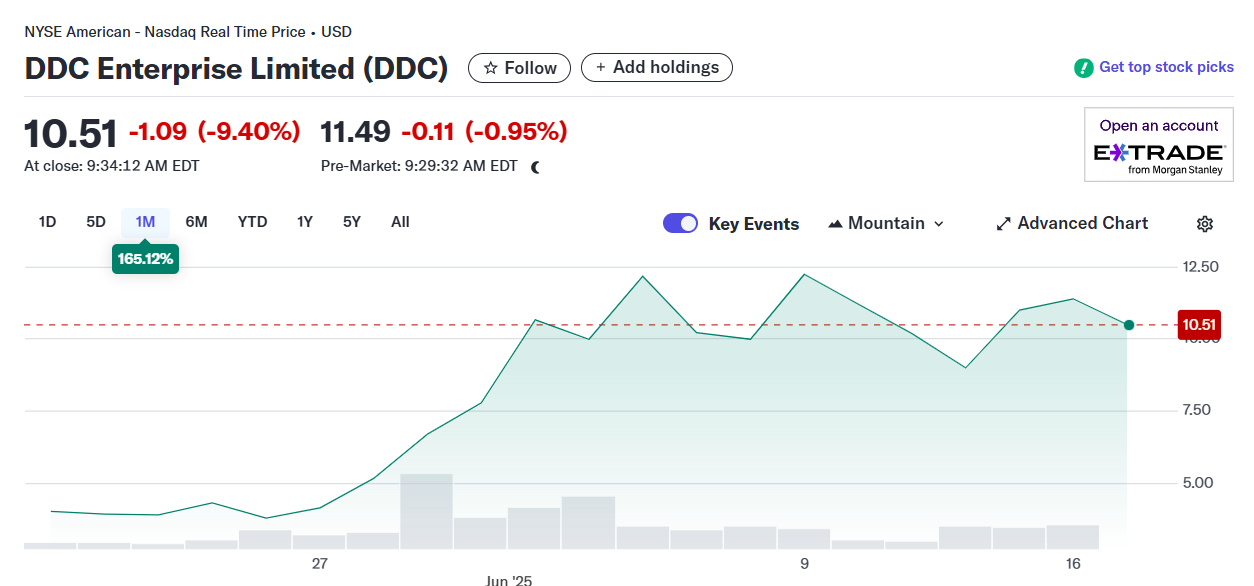

Shares of DDC Enterprise have surged roughly 165% over the previous 30 days, in line with Yahoo Finance information. Nevertheless, the inventory stays down by about 95% from its preliminary buying and selling ranges following its New York debut.