Ethereum Information: Can ETH Worth Surge Previous $3K Subsequent?

1- NYSE Proposes Rule Change for Grayscale’s Spot Ether ETF Staking

The New York Inventory Trade (NYSE) has filed a proposal with america Securities and Trade Fee (SEC) to permit Ethereum staking in Grayscale’s upcoming Spot Ether ETF. This transfer may considerably influence Ethereum’s market dynamics by enabling the ETF to take part in Ethereum’s proof-of-stake community, doubtlessly producing staking rewards for traders.

The proposal outlines the operational mechanics of the staking course of, emphasizing that rewards could be accrued however indirectly distributed as dividends. As an alternative, these rewards could be mirrored within the internet asset worth (NAV) of the ETF shares. If authorised, this growth may improve institutional curiosity in Ethereum, additional solidifying its function within the decentralized finance (DeFi) ecosystem.

Key Factors:

→ Staking Proposal: NYSE requests permission to permit staking in Grayscale’s Spot Ether ETF.

→ Reward Allocation: Rewards mirrored in NAV with out direct payouts.

→ Market Impression: Elevated institutional participation anticipated if authorised.

2- Pectra Set to Launch on Ethereum Sepolia Testnet in March 2025

Ethereum’s ecosystem continues to increase with the upcoming launch of Pectra on the Sepolia testnet, scheduled for March 5, 2025. Pectra goals to boost Ethereum’s scalability and person expertise, aligning with ongoing community upgrades like Ethereum 2.0.

The Sepolia testnet serves as an important setting for testing new options earlier than mainnet deployment. Pectra’s integration is anticipated to optimize transaction processing and help broader adoption of Ethereum-based purposes.

Launch Highlights:

◆ Date: March 5, 2025.

◆ Community: Sepolia Testnet.

◆ Focus: Scalability and efficiency enhancements.

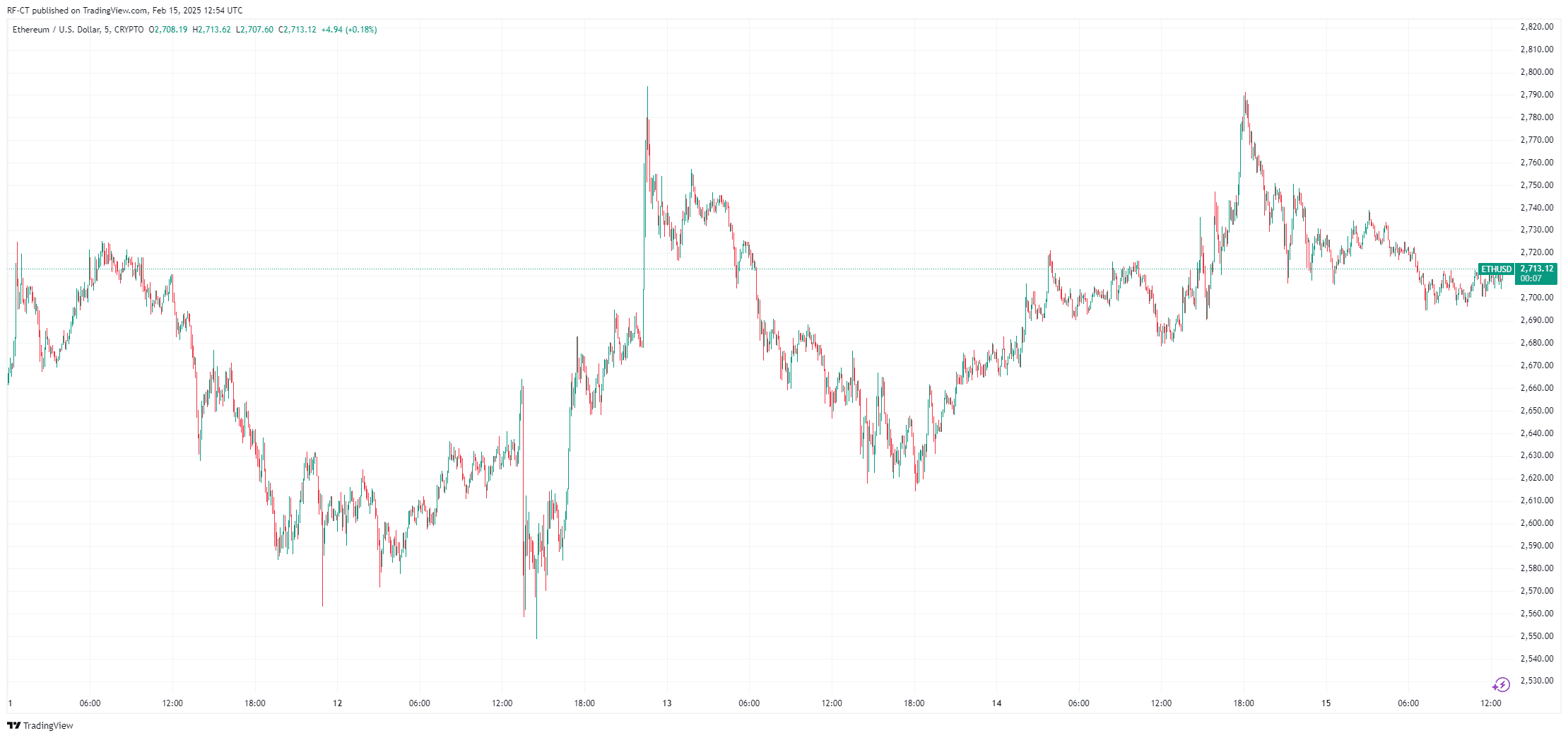

3- Ethereum Defends Vital Demand Zone Amid Market Uncertainty

Ethereum just lately examined a vital help zone close to $2,200 however demonstrated resilience, sustaining its place above this stage. Technical evaluation signifies robust shopping for strain round this demand zone, suggesting bullish sentiment regardless of broader market volatility.

Analysts are eyeing a possible rally towards the $3,000 mark if Ethereum maintains its present momentum. On-chain metrics reveal a gentle influx of ETH into wallets, indicating accumulation by long-term holders.

Market Insights:

- Help Zone: Sturdy protection on the $2,200 stage.

- Potential Rally: Eyes on $3,000 if momentum persists.

- Investor Conduct: Elevated accumulation by long-term holders.

By TradingView – ETHUSD_2025-02-15 (5D)

Ethereum’s Future Appears Promising

Ethereum stays on the forefront of blockchain innovation, with regulatory developments, robust worth help, and ongoing technological upgrades driving its development. The NYSE’s staking proposal may open new avenues for institutional traders, whereas the upcoming Pectra launch indicators Ethereum’s continued dedication to scalability.

All whereas the ETH worth defends its key zone, all appears promising, but the market volatility is taking its toll on all main cryptos regardless of final month’s highs. The quick time period could seem extremely unsure, however the lengthy one appeals extra promising.